The spine device companies widely adopted innovation, spinoffs, and merger and acquisition developments or strategies. The strategies have helped mark an exponential growth of the North America spinal fusion devices market in 2022. Below are a few instances of developments made by the companies in 2022.

• In August 2022, Kleiner Device Labs announced the completion of its first successful surgery using its new KG2 Surge flow-thru interbody system. On July 19, 2022, the single level transforaminal lumbar interbody fusion (TLIF) surgery was performed at the Brooklyn Hospital Center, New York, US. Kleiner Device Labs claims that the new KG2 Surge flow-thru interbody system provided the amount of bone-grafting material three times more than the traditional spinal surgery approaches. The company also claims that their KG2 Surge flow-thru interbody system is a single-patient-use bone graft delivery tool combined with a 3D-printed titanium I-Beam fusion implant. Further, the KG2 Surge flow-thru interbody system will reduce multi-step, multi-instrument pass practice to a single insertion process of current spinal fusion procedures.

• In March 2022, Zimmer Biomet Holdings, Inc. announced a complete spinoff of ZimVie. ZimVie will continue to focus on key growth strategies for the spine and dental markets. The company will develop products, including spinal fusion implants, surgical tools, bone grafts, implants, non-fusion alternatives, and digital care technologies. Due to the spinoff, ZimVie will operate as an independent entity registered on the Nasdaq with the symbol ‘ZIMV.’ Thus, it is expected that ZimVie will significantly enhance the market by holding a good market share.

• In October 2022, Spineart launched its new minimally invasive spine surgery (MISS) system, PERLA TL MIS. The company’s MISS system is a thoracolumbar posterior fixation system available worldwide. The launch of PERLA TL MIS is anticipated to demonstrate the company’s commitment to transforming spine surgery to benefit its end users: surgeons, patients, and hospitals. Such product launches are likely to drive market growth in the coming future.

The trend of developments in the spine industry has continued and witnessed strategic improvements that have fueled the growth of the North America spinal fusion devices market.

• In July 2023, Xtant Medical Holdings, Inc. announced that it won certain assets and liabilities of Surgalign Holdings, Inc. related to spinal fixation and domestic and international biologics. Xtant Medical Holdings, Inc. is dedicated to developing spinal implant systems that facilitate spinal fusion in complex spinal deformity degenerative processes. Thus, such developments in spinal technology by spine device companies are catalyzing the market growth.

DePuy Synthes, Stryker, Aurora Spine, and Alevio Spine are among the major players operating in the North America spinal fusion devices market in the US. Product developments and launches driven by these players favor the market growth. Technologically advanced spinal fusion devices approved by the Food and Drug Administration (FDA) are widely adopted in the US. Following is the list of spinal fusion devices recently approved by the FDA:

• In May 2023, CTL Amedica received FDA 510(k) clearance for the commercialization of the NITRO Interbody Fusion Cage System, which is exclusively made by the fusion of biomaterial silicon nitride. Silicon nitride material is compatible with all imaging modalities; it exhibits unique bacteriostatic properties and provides artifact-free imaging.

• In January 2023, Alevio Spine received 510 (K) clearance of additional indications for the SI-Cure SI Joint Fusion System. The expanded indication includes sacroiliac fusion for skeletally mature patients undergoing sacropelvic fixation as part of a lumbar or thoracolumbar fusion.

• In June 2022, the US FDA granted 510K clearance for Aurora Spine’s DEXA SOLO-L anterior lumbar interbody fusion device (ALIF). Based on DEXA Technology Platform, a 3D printed standalone device was designed for anterior and lateral lumbar interbody fusion (ALIF & LLIF) procedures.

Age-related wear-and-tear triggers the prevalence of lower back pain (LBP) among the geriatric population in the US, in turn, fuels the demand for spinal fusion devices. According to National Health Services in 2022, lifetime incidence of LBP in the US is reported to be 60–90%, with annual incidence of 5%. The source also states that 14.3% of new patients visit physicians each year because of LBP, and ~13 million people visit physician due to chronic LBP.

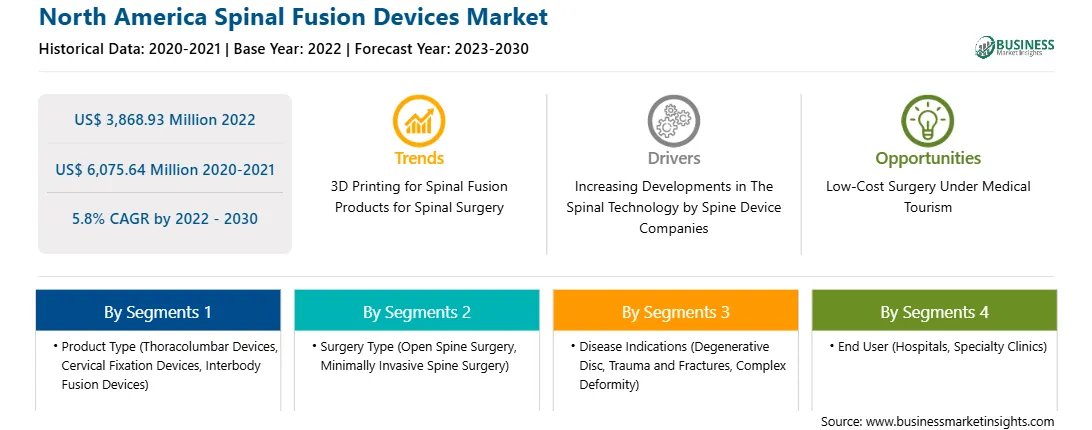

The North America spinal fusion devices market is segmented based on product type, surgery type, disease indications, end user, and country.

Based on product type, the North America spinal fusion devices market is segmented into thoracolumbar devices, cervical fixation devices, and interbody fusion devices. The thoracolumbar devices segment held the largest share in 2022.

By surgery type, the North America spinal fusion devices market is bifurcated into open spine surgery and minimally invasive spine surgery. The open spine surgery segment held the largest share in 2022.

By disease indications, the North America spinal fusion devices market is segmented into degenerative disc, trauma and fractures, complex deformity, and others. The degenerative disc segment held the largest share in 2022.

In terms of end users, the North America spinal fusion devices market is categorized into hospitals, specialty clinics, and others. The hospitals segment held the largest share in 2022.

Based on country, the North America spinal fusion devices market is segmented into the US, Canada, and Mexico. The US dominated the North America spinal fusion devices market in 2022.

ATEC Spine Inc, B. Braun SE, Centinel Spine LLC, DePuy Synthes Inc, Globus Medical Inc, Medtronic Plc, NuVasive Inc, Orthofix Medical Inc, Stryker Corp, and ZimVie Inc are some of the leading companies operating in the North America spinal fusion devices market.

Strategic insights for the North America Spinal Fusion Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3,868.93 Million |

| Market Size by 2030 | US$ 6,075.64 Million |

| Global CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Spinal Fusion Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Spinal Fusion Devices Market is valued at US$ 3,868.93 Million in 2022, it is projected to reach US$ 6,075.64 Million by 2030.

As per our report North America Spinal Fusion Devices Market, the market size is valued at US$ 3,868.93 Million in 2022, projecting it to reach US$ 6,075.64 Million by 2030. This translates to a CAGR of approximately 5.8% during the forecast period.

The North America Spinal Fusion Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Spinal Fusion Devices Market report:

The North America Spinal Fusion Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Spinal Fusion Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Spinal Fusion Devices Market value chain can benefit from the information contained in a comprehensive market report.