Countries falling under North America were highly impacted by Covid-19 in the initial stages, i.e., during the first wave, and impacted the U.S. SPECT equipment market. As per the Society of Nuclear Medicine and Molecular Imaging (SNMMI), nearly 80% of respondents saw declines of 50%-75% in nuclear medicine imaging procedures. In the U.S., due to an increasing number of infected patients and lethal Coronavirus variants, the diagnostic and imaging activities had come to an end for an extended period during the pandemic. Thus, overall diagnosis of chronic diseases with SPECT equipment got delayed and hampered the North American SPECT equipment market. Therefore, the COVID-19 has a potential economic impact on most sectors, including oncology procedures. The pandemic has hindered cancer diagnosis and surgeries and is likely to impact the market negatively. For instance, in 2020, Breastcancer.org conducted a survey in 534 patients in the U.S., which revealed that around 31.7% of people who had been diagnosed with breast cancer reported a delay in care; of these people, 22% reported delayed in screening, and 9.3% reported a delay in treatment due to COVID-19. As a result, more cases of advanced cancers are expected in coming years due to delayed diagnosis, such as preventative screening and postponed medical appointments, in the coming years. The SPECT Equipment market in the U.S. is expected to witness modest growth driven by an aging population, increases in health risk factors like poor lifestyle, and the adoption of new technology due to favorable regulatory changes. However, the overall market expansion will be hindered by a saturated installed base of large imaging systems and the consolidation of hospitals. Also, the pandemic has dramatically affected the activities in radio isotopes field globally. In many radio pharmacy labs, diagnostic imaging tests are quantitatively reduced, and certain imaging centers reduce their test procedures to a significant extent. Thus, the market for SPECT Equipment region is expected to witness negative growth for a certain period.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SPECT equipment market. The North America SPECT equipment is expected to grow at a good CAGR during the forecast period.

Strategic insights for the North America SPECT Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

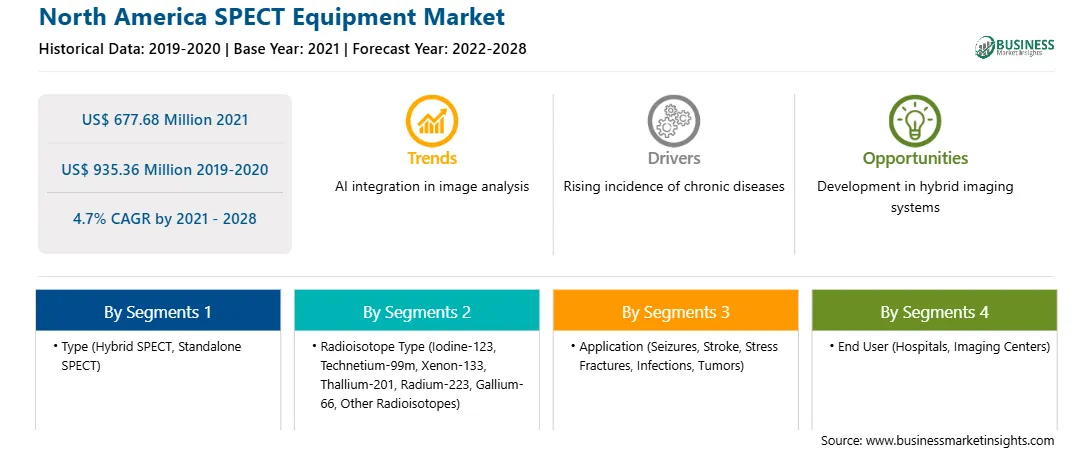

| Market size in 2021 | US$ 677.68 Million |

| Market Size by 2028 | US$ 935.36 Million |

| Global CAGR (2021 - 2028) | 4.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America SPECT Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America SPECT Equipment Market is valued at US$ 677.68 Million in 2021, it is projected to reach US$ 935.36 Million by 2028.

As per our report North America SPECT Equipment Market, the market size is valued at US$ 677.68 Million in 2021, projecting it to reach US$ 935.36 Million by 2028. This translates to a CAGR of approximately 4.7% during the forecast period.

The North America SPECT Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America SPECT Equipment Market report:

The North America SPECT Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America SPECT Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America SPECT Equipment Market value chain can benefit from the information contained in a comprehensive market report.