The North America solvent evaporation market is segmented into the US, Canada, and Mexico. The US held the largest share of the North American solvent evaporation market in 2020. The United States Food and Drug Administration (USFDA) has drawn certain standards about the following parameters of microspheres for parenteral depot administration. These are: polymer/copolymer, organic solvents, copolymer-peptide complexes, sterilization, in vitro in vivo correlations, particle size and diluent-suspending vehicle. The first FDA approved system for controlled delivery of a peptide was an injectable poly(lactide-coglycolide) microsphere formulation of leuprolide acetate. Commercially it is available with brand name Lupron Depot. Likely, in July 2020, SP Industries entered into a partnership agreement with the leading U.S.-based manufacturer of rotary evaporators, Ecodyst, for the large-scale distribution of single sample evaporators. SP added Ecodyst’s next-generation single sample evaporation systems to its SP Genevac parallel centrifugal evaporators portfolio under the deal. According to the companies, the partnership aimed to produce more effective evaporation systems and advance the drug development process. In August 2020, the California-based CAPNA Systems introduced an innovative multi-solvent evaporation system, dubbed Alcohol Recovery Evaporator System - multi-solvent (ARES-ms). The new product can separate around three solvents in a single solution, enabling the user to reduce the processing costs and save time. Growing R&D expenditure in pharmaceutical industry and increasing product launches are the major factor driving the growth of the North America solvent evaporation market.

In case of COVID-19, North America is highly affected specially the US. The outbreak of the COVID-19 pandemic situation shown some favorable scenario for players operating in the solvent evaporations market. Various people across the North American region are affected with corona virus. The effect of the corona is mild in adults; however, it is adverse in older people. The infection of corona among older people has resulted in severe complications and has accounted for a good number of deaths in the country. But during the pandemic situation, life science companies engaged in development of novel drugs for the treatment of life threaten diseases. Therefore, solvent evaporation products is required in drug design and development. Furthermore, due to the high numbers of FDA approved drugs during 2020 has positive impact of the covid-19 on the solvent evaporation market. In 2020, FDA approved 53 novel drugs. Similarly, a product launched support the growth of the solvent evaporation during pandemic. In July 2020, BUCHI Labortechnik AG (Switzerland) launched SyncorePlus, fully automated solution for parallel evaporation.

Strategic insights for the North America Solvent Evaporation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 184.70 Million |

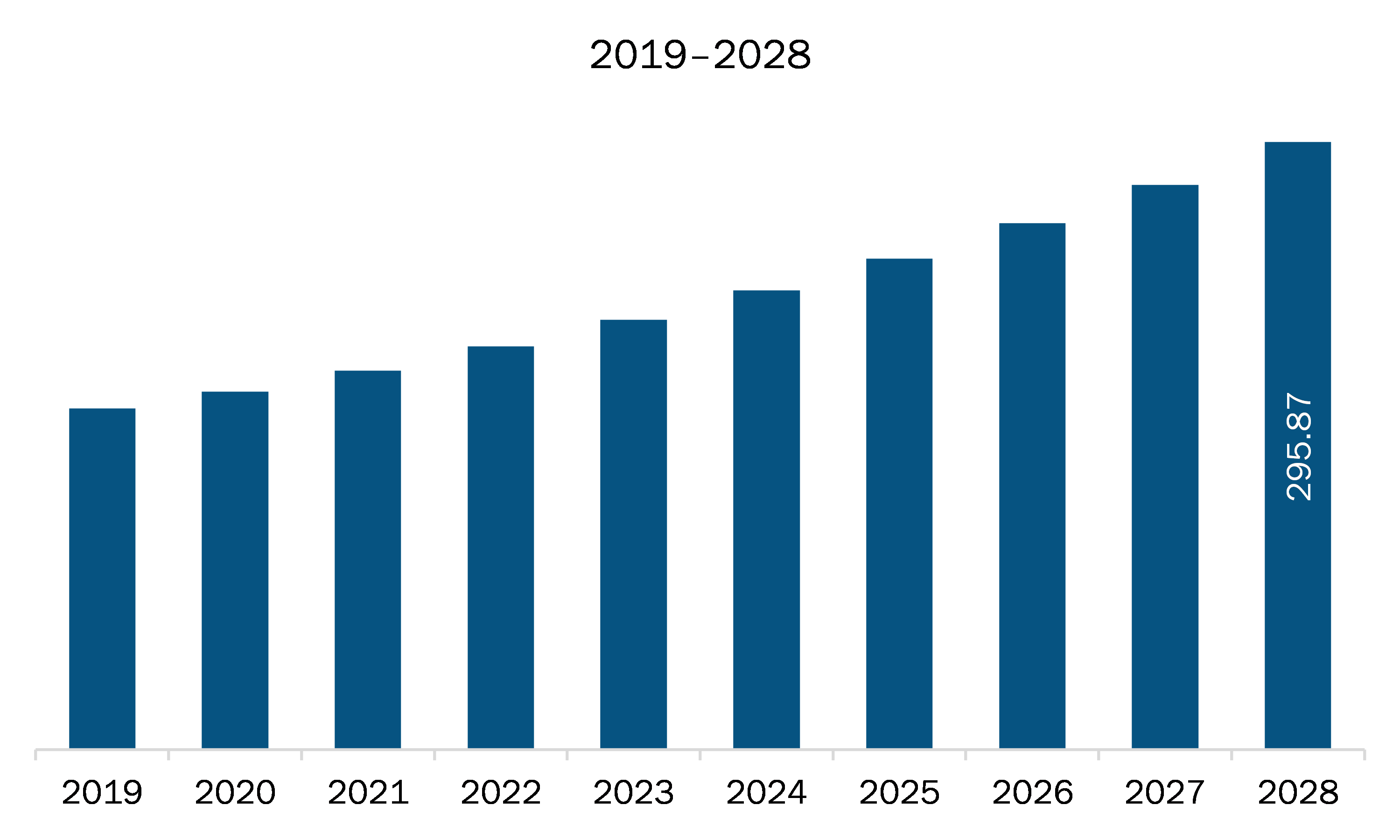

| Market Size by 2028 | US$ 295.87 Million |

| Global CAGR (2021 - 2028) | 7.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Solvent Evaporation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America solvent evaporation market is expected to grow from US$ 184.70 million in 2021 to US$ 295.87 million by 2028; it is estimated to grow at a CAGR of 7.0% from 2021 to 2028. The biotechnology and pharmaceuticals industries in countries such as Mexico are growing significantly. The governments of countries in this region are taking various initiatives through funding, programs, and conferences to support these industries. Moreover, economic, and demographic development, rising healthcare expenditure, surging pharmaceutical R&D activities, and improving public–private healthcare collaborations and funding conditions are driving the growth of these industries. An increasing number of companies are aiding in the production of drugs and active pharmaceutical ingredient (API) through contract manufacturing services. Countries like Canada have large biotech hubs in different cities and provinces. Several economies are further seeking help from developed nations such as the US for innovative technologies and novel procedures. In response, well-established players are shifting their focus on these economies for their expansion, thus leveraging enormous potentials offered by these countries. Thus, countries like Mexico are creating growth opportunities for future growth of the North America solvent evaporation market.

In terms of type, the rotary evaporators segment accounted for the largest share of the North America solvent evaporation market in 2020. In terms of end user, the pharmaceutical and biopharmaceutical industry segment held a larger market share of the North America solvent evaporation market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America solvent evaporation market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Apricot Designs, Inc.; Biotage AB; Büchi Labortechnik AG; Heidolph Instruments GmbH & CO. KG; IKA Werke GmbH & CO. KG; KNF NEUBERGER, INC.; Labconco Corporation; LabTech S.r.l.; Organomation Associates, Inc.; Porvair plc; Raykol; SCINCO CO.,LTD.; and Yamato Scientific co., ltd.

The North America Solvent Evaporation Market is valued at US$ 184.70 Million in 2021, it is projected to reach US$ 295.87 Million by 2028.

As per our report North America Solvent Evaporation Market, the market size is valued at US$ 184.70 Million in 2021, projecting it to reach US$ 295.87 Million by 2028. This translates to a CAGR of approximately 7.0% during the forecast period.

The North America Solvent Evaporation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Solvent Evaporation Market report:

The North America Solvent Evaporation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Solvent Evaporation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Solvent Evaporation Market value chain can benefit from the information contained in a comprehensive market report.