North America includes economies such as the US, Canada, and Mexico. The increasing consumer demand for healthy fibrous food products is the major driver for soluble dietary fibers market in North America. Many people from the North America rely heavily on whole-grain foods as a source of fiber. There is a growing consumer awareness about the health benefits of different types of soluble dietary fibers including inulin, pectin, polydextrose, and beta-glucan, and their significance in controlling blood sugar level, providing digestive support, and enhancing immunity. As a result of the region's growing urban population and changing lifestyle, dietary preferences have evolved considerably. Rising daily intake of fiber content and promising trend in functional food production are among other drivers for the soluble dietary fibers market in North America. As the worldwide pandemic continues, consumers are placing an even greater emphasis on preventative health when it comes to food choices. The consumers are giving more importance to the health profile of products in the times of COVID-19.

North America is one of the worst affected economies due to the COVID-19 pandemic. The US has the highest number of confirmed cases of COVID-19, compared to Mexico and Canada. The unprecedented rise in number of COVID-19 cases across the US and Canada and the subsequent lockdown of numerous manufacturing facilities in the countries have negatively influenced the growth of the various markets. The significant disruption in manufacturing facilities, along with raw material sourcing, has had a negative impact on the demand for soluble dietary fibers in the country. In the same way, the pandemic had an intense impact on the Canadian economy, causing it into a recession. However, the market is reviving on account of significant measures taken by the government such as vaccination drives. Further, as per an article published by the National Center for Biotechnology Information (NCBI) in 2020, the global public health bodies and governments have implemented several strategies as well as issued advisories to promote health and hygiene, social distancing strategies, and other such guidelines to prevent the spread of COVID-19 virus. With the state of economic recovery, several industrial sectors such as food & beverages, pharmaceuticals and nutraceuticals, and animal feed, are strategically focused on investing in advanced products to maximize revenue. This is expected to provide impetus for the market growth.

Strategic insights for the North America Soluble Dietary Fibers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

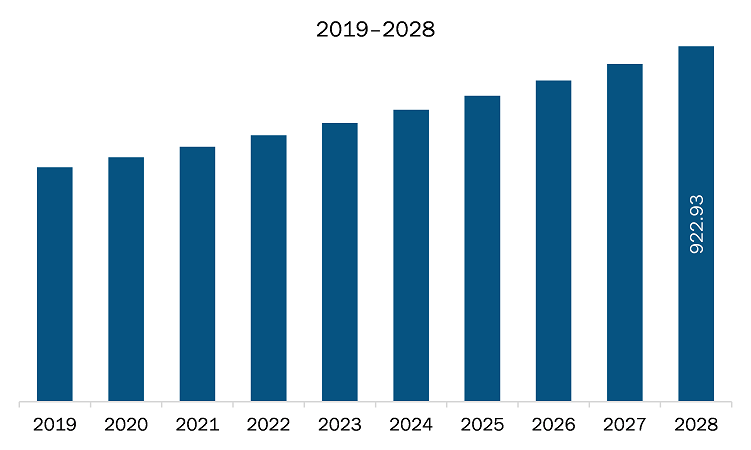

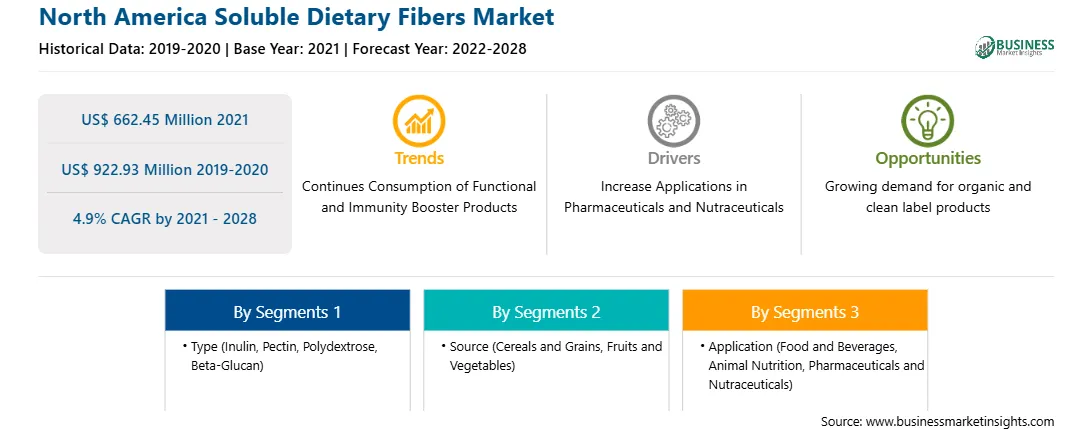

| Market size in 2021 | US$ 662.45 Million |

| Market Size by 2028 | US$ 922.93 Million |

| Global CAGR (2021 - 2028) | 4.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Soluble Dietary Fibers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The soluble dietary fibers market in North America is expected to grow from US$ 662.45 million in 2021 to US$ 922.93 million by 2028; it is estimated to grow at a CAGR of 4.9% from 2021 to 2028. Soluble fibers such as pectins, gums, and mucilage are significantly sourced from fruits and vegetables, oat bran, barley, seed husks, flaxseed, psyllium, dried beans, lentils, peas, and soy milk and soy products. Apart from the traditional sources of soluble dietary fibers, new sources of soluble dietary fibers have been identified. According to an article published by Multidisciplinary Digital Publishing Institute (MDPI) in 2020, the water-soluble fibers such as mucilage, can also be obtained from aquatic plants, cactus, aloe vera, and okra, as well as glycoproteins from food additives. For instance, an article published by NCBI justifies cactus being rich source of dietary fibers. The article represents that Mexico is one of the major producers of prickly pear cactus, which have high dietary fiber (DF, 40–60 g/100 g dry weight), along with phytochemicals ingredients and biofunctional activity, which makes the crop an indispensable prospect to be used in fortified foods products. The water-soluble dietary fiber (SDF) obtained from cactus (opuntia streptacantha) shows a potential to suppress the effect for elevation of postprandial blood glucose level. Similarly, seaweed extracts, such as carrageenan, are also considered one of the essential sources of soluble dietary fibers. Carrageenan is effective in maintaining the cholesterol content in foods, owing to its ability to mimic the texture and sensory qualities of fat, which helps to significantly reduce the total amount of fat in food. Similarly, several studies suggest that soluble dietary fibers can be extracted from brown algae. An article published by NCBI in June 2020 states that the soluble fiber content is comparatively higher in red algae (15–22% dry weight) as in Chondrus and Porphyra. In the wake of rising demand for soluble dietary fibers, several manufacturers are trying to invest and explore new sources of such fibers. For instance, Sobigel is involved in production of superior quality dietary agar possessing solubility of up to 85%, which can regulate intestinal flow, control cholesterol and sugar levels, and manage overweight. Owing to its capacity of absorbing water, it is considered as an ideal ingredient to be used in food supplements and cooking purposes. Hence, the soluble dietary fibers market is expected to flourish with the evolution of new sources.

In terms of type, the inulin segment accounted for the largest share of the North America soluble dietary fibers market in 2020. In terms of source, the cereals and grains segment accounted for the largest share. Further In term of application, the food and beverages held a larger market share of the soluble dietary fibers market in 2020.

A few major primary and secondary sources referred to for preparing this report on the soluble dietary fibers market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Cargill, Incorporated, Kerry Group, Ingredion Incorporated, Nexira, Roquette Frères, Tate & Lyle PLC, ADM, IFF Nutrition & Biosciences, and BENEO GmbH among others.

The North America Soluble Dietary Fibers Market is valued at US$ 662.45 Million in 2021, it is projected to reach US$ 922.93 Million by 2028.

As per our report North America Soluble Dietary Fibers Market, the market size is valued at US$ 662.45 Million in 2021, projecting it to reach US$ 922.93 Million by 2028. This translates to a CAGR of approximately 4.9% during the forecast period.

The North America Soluble Dietary Fibers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Soluble Dietary Fibers Market report:

The North America Soluble Dietary Fibers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Soluble Dietary Fibers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Soluble Dietary Fibers Market value chain can benefit from the information contained in a comprehensive market report.