The US, Canada, and Mexico are the key countries in North America. Soil pollution or soil contamination is the condition when the soil contains certain substances or chemicals in concentrations greater than the normal specified levels. The contamination of soil will have adverse effect on the native environment including plants as well as humans. Common contaminants that can be found in North America include pesticides, radon, lead, asbestos, chromated copper arsenate, and creosote. These contaminants have a negative impact on the soil fertility and result in decreased soil yield. Fruits and vegetables grown on such soil would lack the essential nutrition and can contain certain poisonous substances, which can lead to serious health problems among consumers. Soil fertility tests play an important role in determining the fertility and growth potential of soil, as well as in protecting the environment from pollutants.

The US has the highest number of confirmed cases of COVID-19, as compared to Mexico and Canada. This is likely to impact the agriculture industry in the region as, due to COVID-19, overall production processes, research and development activities, and supply chain are likely to get affected. However, with the industry's revival, governments are resuming operations while taking safeguards that come at the expense of debt and budgetary imbalance. For instance, the US federal government has taken steps to implement the COVID-19 Food Assistance Program, with the goal of giving US$ 16 billion in direct payments to farmers, which will indirectly boost the demand for soil fertility testing as this testing will help farmers to grow nutrient rich crops.

Strategic insights for the North America Soil Fertility Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

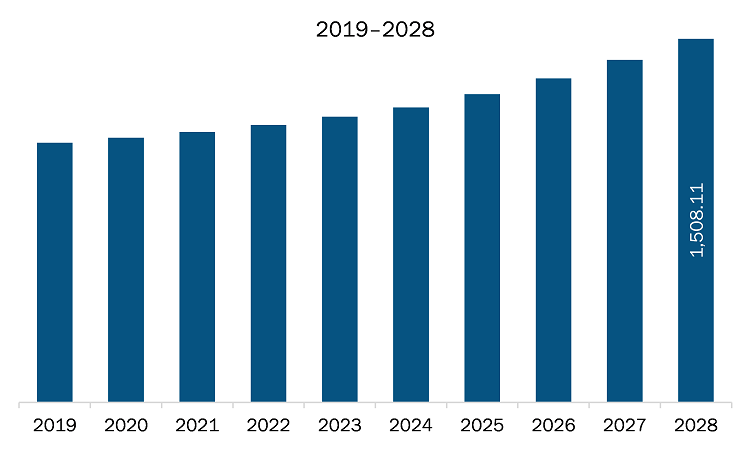

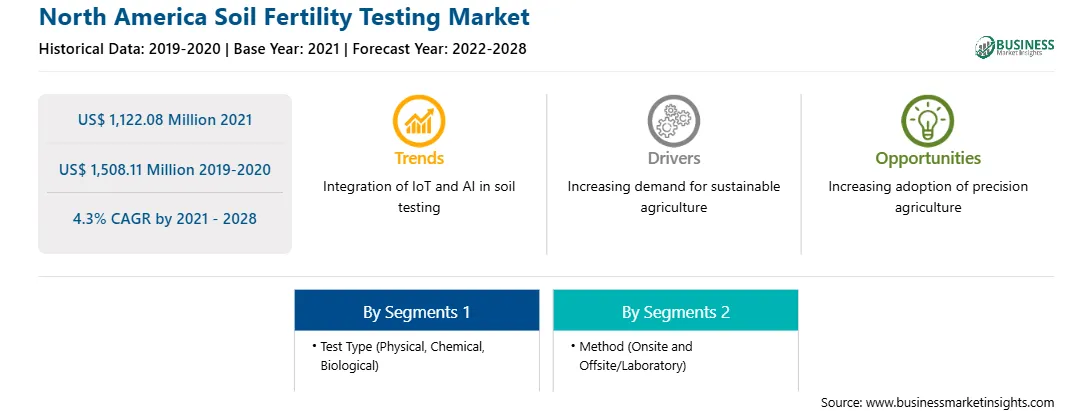

| Market size in 2021 | US$ 1,122.08 Million |

| Market Size by 2028 | US$ 1,508.11 Million |

| Global CAGR (2021 - 2028) | 4.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Test Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Soil Fertility Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The soil fertility testing market in North America is expected to grow from US$ 1,122.08 million in 2021 to US$ 1,508.11 million by 2028; it is estimated to grow at a CAGR of 4.3% from 2021 to 2028. Foodborne illnesses are infectious diseases caused by viruses, bacteria, pathogens, and toxins that enter the body through contaminated food. These organisms can cause severe diarrhea or debilitating infections such as meningitis. According to the WHO, ~600 million individuals—about 1 in 10 people—in the world fall sick after consuming contaminated food, while 420,000 die because of the same, resulting in the loss of 33 million healthy life years (DALYs). In addition, children under the age of five account for 40% of the foodborne disease burden, with 125,000 deaths each year. Therefore, foodborne diseases form a major public health concern for any economy. Diarrhea is the most frequent diseases caused by contaminated food, affecting 550 million people, and causing 230,000 deaths each year. Food can be contaminated at any stage along the farm-to-table chain. Soil pollution or soil contamination is characterized by the presence of substances or chemicals in higher than the normal concentrations; such high levels of these substances might exhibit adverse effects on the human health. As a result, interventions to reduce the risk of foodborne illness must be undertaken at every stage of food production, from farm to table. Moreover, the demand for healthy nutritious crops and food is increasing worldwide, and soil fertility testing would help farmers in farming effectively and efficiently, by analyzing as well as determining the inputs and resources necessary to supplement for optimum plant growth. In addition to the role of soil fertility testing in ensuring suitability of crop for safe consumption by humans and animals, the rise in number of laboratories and local testing facilities is expected to boost the soil fertility testing market in the coming years.

In terms of test type, the chemical segment accounted for the largest share of the North America soil fertility testing market in 2020. Further In term of method, the offsite/laboratory segment held a larger market share of the soil fertility testing market in 2020.

A few major primary and secondary sources referred to for preparing this report on the soil fertility testing market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are SGS SA; Eurofins Scientific; ALS; Water Agricultural Laboratories, Inc.; A&L Great Lakes; Agrocares; Water Agricultural Laboratories, Inc.; and Activation Laboratories Ltd., among others.

The North America Soil Fertility Testing Market is valued at US$ 1,122.08 Million in 2021, it is projected to reach US$ 1,508.11 Million by 2028.

As per our report North America Soil Fertility Testing Market, the market size is valued at US$ 1,122.08 Million in 2021, projecting it to reach US$ 1,508.11 Million by 2028. This translates to a CAGR of approximately 4.3% during the forecast period.

The North America Soil Fertility Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Soil Fertility Testing Market report:

The North America Soil Fertility Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Soil Fertility Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Soil Fertility Testing Market value chain can benefit from the information contained in a comprehensive market report.