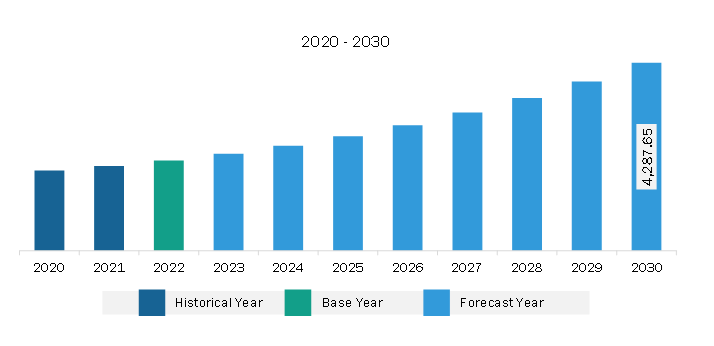

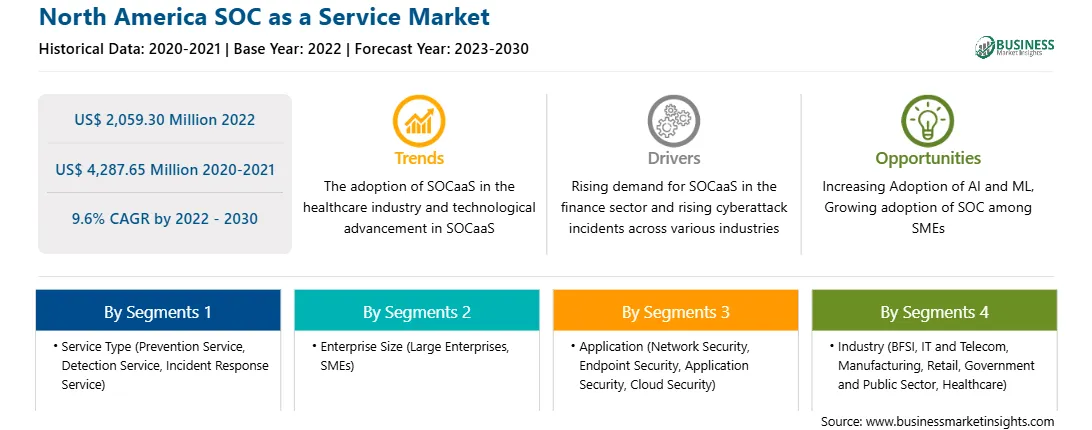

The North America SOC as a service market is expected to grow from US$ 2,059.30 million in 2022 to US$ 4,287.65 million by 2030. It is estimated to register a CAGR of 9.6% from 2022 to 2030.

In recent years, several organizations across various industries have faced several cyberattacks. According to AAG IT Services, ~236.1 million ransomware attacks took place globally in the first half of 2022. Such growing cyberattacks are affecting various organizations' brand value, which is compelling various large organizations and small & medium enterprises to opt for SOC as a service (SOCaaS) to protect consumer information and improve organization security. This factor is helping the players operating in the SOC as a service market to capitalize their customer base and revenues. A few of the data breach incidents that occurred in recent years are mentioned below:

Such a growing number of cyberattack incidents in various industries is raising the need for SOCaaS as it helps in faster threat detection and more efficient remediation to streamline security events, driving the growth of the SOC as a service market.

The US, Canada, and Mexico are among the major economies in North America. North America SOC as a service market is witnessing growth owing to the wide presence of key market players such as Fortinet, Inc.; Verizon; AT&T; Arctic Wolf Networks Inc.; and Cloudflare, Inc. These players continuously develop and expand their service portfolio to attract new customers. For instance, in April 2023, Fortinet, Inc. launched FortiOS 7.4 to support organizations in building cybersecurity platforms across endpoint security, SOC automation, application security, identity and access, and threat intelligence. FortiOS 7.4 has new real-time response and automation capabilities that help the user increase effectiveness, improve efficacy, and accelerate time to resolve sophisticated attacks. In addition, Fortinet, Inc. expands Fortinet Security Fabric by adding new and enhanced products and capabilities that allow its users to advance threat prevention and coordinate response for a self-defending ecosystem across networks, clouds, and endpoints. Moreover, implementing IoT in business operations makes hyperconnectivity affordable to enterprises, which increases the demand for IoT among enterprises. According to Cisco, the US is expected to register 13.6 billion per capita IoT devices and connections by the end of 2023. The adoption of IoT devices and connections adds complexity for the SOC team to detect cyberattacks. The security team is already dealing with the ever-changing cybersecurity industry, implementing IoT in business operations, and creating challenges for the SOC team to understand patterns of cyberattacks.

Increasing government investment in advanced innovations in the technologies is driving the market. For instance, in December 2022, the Government of the US plans to turn the Middle American metro area into a hub for tech innovation. The government invested US$ 500 million in the Regional Technology and Innovation Hub program to convert countries of Middle America into essential centers of innovation. These centers are focused on research and development of new technologies such as IoT, AI, and ML to promote automation in the business. These technologies are highly vulnerable to cyberattacks and data breaches, which increases the demand for SOC as a Service among users to protect their data.

Strategic insights for the North America SOC as a Service provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,059.30 Million |

| Market Size by 2030 | US$ 4,287.65 Million |

| Global CAGR (2022 - 2030) | 9.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America SOC as a Service refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America SOC as a service market is segmented into service type, enterprise size, application, industry, and country.

Based on service type, the North America SOC as a service market is segmented into prevention service, detection service, and incident response service. The prevention service segment held the largest share of the North America SOC as a service market in 2022.

In terms of enterprise size, the North America SOC as a service market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger share of the North America SOC as a service market in 2022.

By application, the North America SOC as a service market is segmented into network security, endpoint security, application security, and cloud security. The endpoint security segment held the largest share of the North America SOC as a service market in 2022.

In terms of industry, the North America SOC as a service market is segmented into BFSI, IT and telecom, manufacturing, retail, government and public sector, healthcare, and others. The BFSI segment held the largest share of the North America SOC as a service market in 2022.

Based on country, the North America SOC as a service market is segmented into the US, Canada, and Mexico. The US dominated the North America SOC as a service market in 2022.

Arctic Wolf Networks Inc, AT&T Inc, Atos SE, Cloudflare Inc, Fortinet Inc, NTT Data Corp, Thales SA, and Verizon Communications Inc are some of the leading companies operating in the North America SOC as a service market.

1. Arctic Wolf Networks Inc

2. AT&T Inc

3. Atos SE

4. Cloudflare Inc

5. Fortinet Inc

6. NTT Data Corp

7. Thales SA

8. Verizon Communications Inc

The North America SOC as a Service Market is valued at US$ 2,059.30 Million in 2022, it is projected to reach US$ 4,287.65 Million by 2030.

As per our report North America SOC as a Service Market, the market size is valued at US$ 2,059.30 Million in 2022, projecting it to reach US$ 4,287.65 Million by 2030. This translates to a CAGR of approximately 9.6% during the forecast period.

The North America SOC as a Service Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America SOC as a Service Market report:

The North America SOC as a Service Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America SOC as a Service Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America SOC as a Service Market value chain can benefit from the information contained in a comprehensive market report.