Increasing Water Scarcity and Misuse of Water is Driving the Smart Water Metering Market

The world is facing a huge scarcity of water owing to practices such as illegal tapping, tampering of pipelines, and leakage, among others. Owing to this, water scarcity is rapidly increasing in the current scenario and the issue is anticipated to increase in the near future. According to WWF (World Wildlife Fund), approximately 1.1 billion people globally lack access to water, totaling to 2.7 billion find water scarce. In addition to this, another major problem faced by various regions is the misuse of water which has significantly raised the demand for advanced solutions to maintain the consumption pattern from the source to destination. The substantial demand for an advanced solution has led to development and implementation of smart water meters, which are capable of monitoring the consumption pattern along with supervising and recording the leakage, theft, and illegal tampering. The smart water meters are wired or wireless mechanisms, integrated with data management programs through which the user or operators are able to review/check the consumption pattern. The technological advancements in the field of water conservation are a major progress to fight water scarcity. Various governments of developed and developing regions across the globe are constantly increasing their interest in adopting these robust technologies to provide an adequate quantity of water to the mass. In addition, various private organizations are also striving hard to implement technologically enriched smart water management systems to cope up with water scarcity problems across the globe. Thus, water scarcity and demand for proper maintenance of water consumption pattern is increasing the adoption of smart water meters thereby bolstering the market for smart water meter and this trend is to foresee to continue in the future.

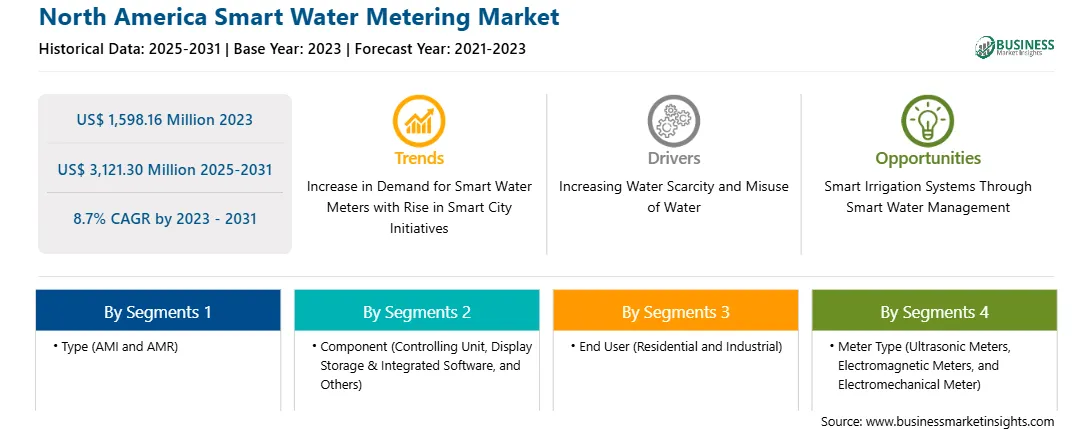

Smart Water Metering Market Overview

North America comprises the US, Canada, and Mexico. The US is a developed country in terms of modern technology, the standard of living, infrastructure, and many others. Also, affordability concerns regarding the development of water infrastructures have reached a critical stage. The US Environmental Protection Agency (EPA) manages two State Revolving Fund programs — the Clean Water State Revolving Fund (CWSRF) and the Drinking Water State Revolving Fund (DWSRF). In addition, DWSRF is co-funded by the federal and state government, with 80% and 20%, respectively. Furthermore, the water industry’s investors have focused on opportunistic upgrades—primarily to support smart-meter installation and data collection and visualization rather than full network optimization. Governments in the region continue to take measures to reduce unyielding water usage and undergo modernization and to replace older water meters with avant-garde smart water meters, which is becoming major trends in the region.

Strategic insights for the North America Smart Water Metering provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Smart Water Metering refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Smart Water Metering Strategic Insights

North America Smart Water Metering Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,400.59 Million

Market Size by 2028

US$ 2,528.28 Million

Global CAGR (2022 - 2028)

10.3%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Component

By Application

By Meter Type

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Smart Water Metering Regional Insights

North America Smart Water Metering Market Segmentation

The North America smart water metering market is segmented into type, component, application, and meter type, and country.

On the basis of type, the North America smart water metering market has been segmented into advanced metering infrastructure and automatic meter reader. The automatic meter reader segment registered the largest market share in 2022.

On the basis of component, the smart water metering market has been segmented into controlling units, display/storage and integrated software, and others. The display/storage and integrated software segment held a larger market share in 2022.

On the basis of application, the North America smart water metering market has been segmented into residential and industrial. The residential segment held the largest market share in 2022.

On the basis of meter type, the North America smart water metering market has been segmented into ultrasonic meters, electromagnetic meters, and electromechanical meters. Ultrasonic meters segment held the largest market share in 2022.

Based on country, the North America smart water metering market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

Arad Ltd; Badger Meter Inc; Bmeters SRL; Diehl Stiftung & Co KG; Itron Inc; Kamstrup AS; Mueller Water Products Inc; Neptune Technology Group Inc; Sensus USA Inc; WAVIoT Integrated Systems LLC are the leading companies operating in the North America smart water metering market.

The North America Smart Water Metering Market is valued at US$ 1,400.59 Million in 2022, it is projected to reach US$ 2,528.28 Million by 2028.

As per our report North America Smart Water Metering Market, the market size is valued at US$ 1,400.59 Million in 2022, projecting it to reach US$ 2,528.28 Million by 2028. This translates to a CAGR of approximately 10.3% during the forecast period.

The North America Smart Water Metering Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Smart Water Metering Market report:

The North America Smart Water Metering Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Smart Water Metering Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Smart Water Metering Market value chain can benefit from the information contained in a comprehensive market report.