North America has one of the largest armed forces in the world. In North America, most ammunition is produced by government-owned contractor-operated manufacturing plants that are owned by the US government but allocated to and operated by a private company for a definite period. This allows both entities to look after their interests, while performing duties for which they are best suited. The government establishes requirements and retains its ammunition supply base for use in case of a national emergency. The contractors have to compete for the initial deal and then manage the facilities to implement ammunition production. Resultantly, the ammunition industry in the region witnesses a great profit. The market growth in the region is majorly driven by the rising investment in research and development for military modernization plans for procuring the latest ammunition assets to replace the existing ammunition assets. Increasing defense budget in the region and long-term competitive strategy of the US Department of Defense for developing advanced technologies and new concepts of warfare is anticipated to drive the demand for small caliber ammunition. In addition, strong presence of several established market players in the region such as Northrop Grumman Corporation and General Dynamics Corporation contribute to the demand and supply of small caliber ammunition in the region. Furthermore, US the army is deployed in more than 150 countries of the world. Growing investments by homeland security and law enforcement departments and rising need of modernizing military operations with rapid changes in warfare are the major factor driving the growth of the North America small caliber ammunition market.

In case of COVID-19, North America is highly affected specially the US. The COVID-19 pandemic has had no impact on ammunition demand in the defense sector in the United States. The US Department of Defense (DoD) has asked manufacturers to continue with ammunition-related product activities. However, demand for ammunition in civil and commercial applications has shifted, particularly in sporting and hunting activities. The demand for ammunition for self-defense purposes has increased significantly. “About 2 Million Guns Were Sold in the US as Virus Fears Spread,” according to the New York Times, which highlights the increased ammunition demand for self-defense applications in April 2020.

Strategic insights for the North America Small Caliber Ammunition provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

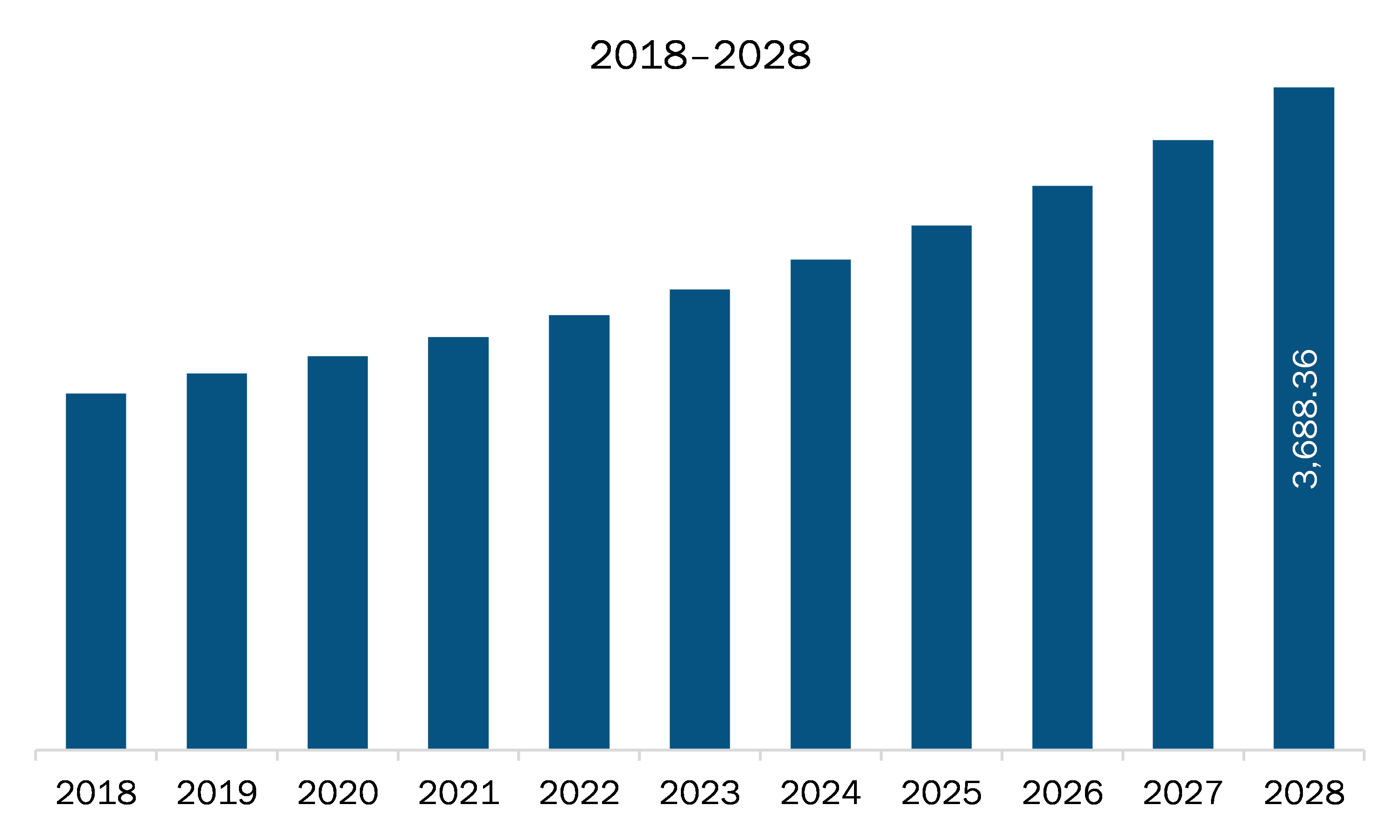

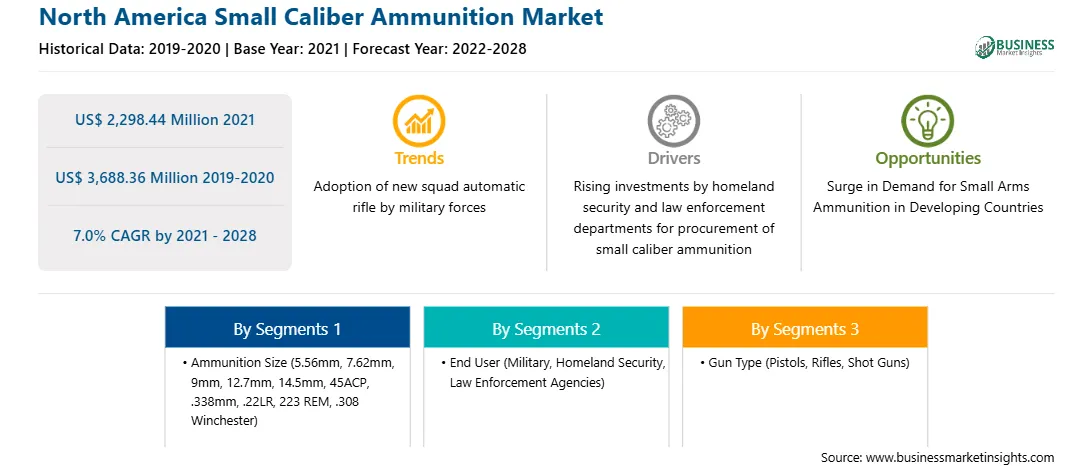

| Market size in 2021 | US$ 2,298.44 Million |

| Market Size by 2028 | US$ 3,688.36 Million |

| Global CAGR (2021 - 2028) | 7.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Ammunition Size

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Small Caliber Ammunition refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America small caliber ammunition market is expected to grow from US$ 2,298.44 million in 2021 to US$ 3,688.36 million by 2028; it is estimated to grow at a CAGR of 7.0% from 2021 to 2028. Growing demand for small arms ammunition is expected to escalate the North America small caliber ammunition market. A rise in demand for small arms ammunition in North American countries like Mexico is creating opportunities for the growth of small caliber ammunition players providing products for different segments, such as homeland security, law enforcement, and military. The ongoing political turmoil in North American countries have driven the demand for sophisticated weapons and ammunition in the North America. Moreover, increasing threats due to terrorism and territorial conflicts have compelled the countries to adopt and procure artillery and mortar systems to secure and safeguard their borders against illegal trespassing and several forms of trafficking. Rampant illegal activities such as smuggling, poaching, and unlicensed mining in North American countries have increased the procurement of advanced weaponry by the government authorities to strengthen their law enforcement and military forces, which will drive the North America small caliber ammunition market.

In terms of ammunition size, the 9mm segment accounted for the largest share of the North America small caliber ammunition market in 2020. In terms of end user, the military segment held a larger market share of the North America small caliber ammunition market in 2020. Further, the pistols segment held a larger share of the North America small caliber ammunition market based on gun type in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America small caliber ammunition market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BAE Systems Plc, CBC Global Ammunition, Denel PMP, Elbit Systems Ltd., FN HERSTAL, General Dynamics Ordnance and Tactical Systems, NAMMO AS, Northrop Grumman Corporation, Remington Ammunition, and Winchester Ammunition.

The North America Small Caliber Ammunition Market is valued at US$ 2,298.44 Million in 2021, it is projected to reach US$ 3,688.36 Million by 2028.

As per our report North America Small Caliber Ammunition Market, the market size is valued at US$ 2,298.44 Million in 2021, projecting it to reach US$ 3,688.36 Million by 2028. This translates to a CAGR of approximately 7.0% during the forecast period.

The North America Small Caliber Ammunition Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Small Caliber Ammunition Market report:

The North America Small Caliber Ammunition Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Small Caliber Ammunition Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Small Caliber Ammunition Market value chain can benefit from the information contained in a comprehensive market report.