North America Slip and Tier Sheets Market

No. of Pages: 128 | Report Code: BMIRE00027886 | Category: Chemicals and Materials

No. of Pages: 128 | Report Code: BMIRE00027886 | Category: Chemicals and Materials

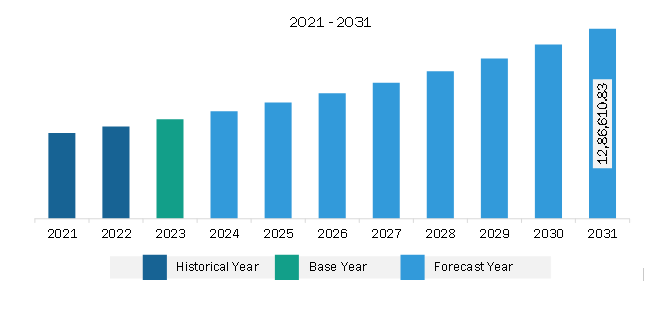

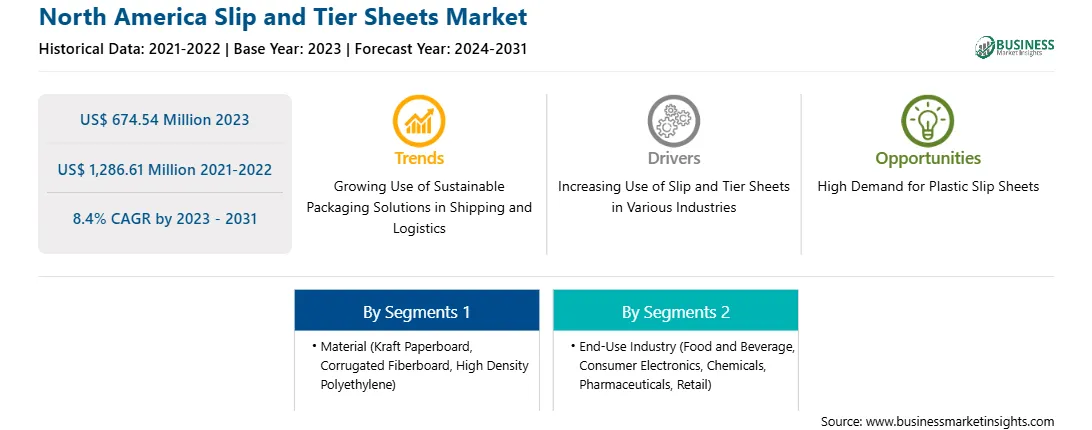

The North America slip and tier sheets market was valued at US$ 674.54 million in 2023 and is expected to reach US$ 1,286.61 million by 2031; it is estimated to register a CAGR of 8.4% from 2023 to 2031.

Slip sheets are recyclable and more environmentally friendly than traditional wooden pallets, which are discarded in landfills. Tier sheets are also recyclable and can be made from 100% recycled paper. Many companies are taking various actions to offer greener packaging solutions. Making logistics greener allows the companies to remain competitive in the market. Various companies and industries are increasingly focusing on using green and sustainable packaging solutions, such as slip and tier sheets, in their product's shipping and logistics to reduce carbon footprints. In addition, various rules, regulations, and initiatives are encouraging the use of sustainable packaging products across different regions.

As per the National Institute on Deafness and Other Communication Disorders, ~30 million people or 13% of the US population aged 12 years and above was experiencing hearing loss in one or both ears in 2021. As per the same source, ~28.8 million people in the US could benefit from the use of hearing aids. Country has presence of the leading global market players, which are focused on product development and launches. Furthermore, FDA approval for OTC hearing aids is expected to create ample opportunities in the market. In October 2023, Audien Hearing launched the world’s first FDA-compliant hearing aid sold over the counter (OTC)—ATOM ONE—for less than US$ 100. The ATOM ONE would allow millions of people suffering from hearing loss to walk in and purchase an economical device suiting their or their loved ones’ needs. In October 2023, ELEHEAR, a provider of AI-powered hearing aids and audio solutions, introduced its first OTC hearing aid devices—the ELEHEAR Alpha and ELEHEAR Alpha Pro. Therefore, increasing prevalence of hearing impairment among large populations, new product launches, and availability of OTC hearing aids at economical pricing favors the market growth in the US.

Strategic insights for the North America Slip and Tier Sheets provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 674.54 Million |

| Market Size by 2031 | US$ 1,286.61 Million |

| Global CAGR (2023 - 2031) | 8.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Slip and Tier Sheets refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America slip and tier sheets market is categorized into material, end-use industry, and country.

Based on material, the North America slip and tier sheets market is segmented into kraft paperboard, corrugated fiberboard, high density polyethylene (HDPE), and others. The kraft paperboard segment held the largest share of North America slip and tier sheets market share in 2023.

In terms of end-use industry, the North America slip and tier sheets market is segmented into food & beverage, consumer electronics, chemicals, pharmaceuticals, retail, and others. The food & beverage segment held the largest share of North America slip and tier sheets market in 2023.

By country, the North America slip and tier sheets market is segmented into the US, Canada, and Mexico. The US dominated the North America slip and tier sheets market share in 2023.

Fresh Pak Corp; International Paper Co; Georgia-Pacific LLC; Signode Industrial Group LLC; WestRock Co; Dura-Fibre, LLC; Smurfit Kappa Group Plc; Crown Paper Converting; Eltete TPM Oy; and Sonoco Products Co are some of the leading companies operating in the North America slip and tier sheets market.

The North America Slip and Tier Sheets Market is valued at US$ 674.54 Million in 2023, it is projected to reach US$ 1,286.61 Million by 2031.

As per our report North America Slip and Tier Sheets Market, the market size is valued at US$ 674.54 Million in 2023, projecting it to reach US$ 1,286.61 Million by 2031. This translates to a CAGR of approximately 8.4% during the forecast period.

The North America Slip and Tier Sheets Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Slip and Tier Sheets Market report:

The North America Slip and Tier Sheets Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Slip and Tier Sheets Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Slip and Tier Sheets Market value chain can benefit from the information contained in a comprehensive market report.