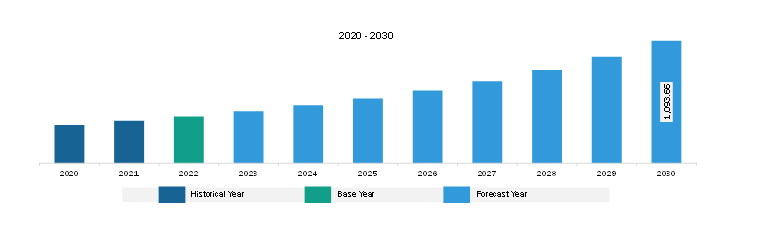

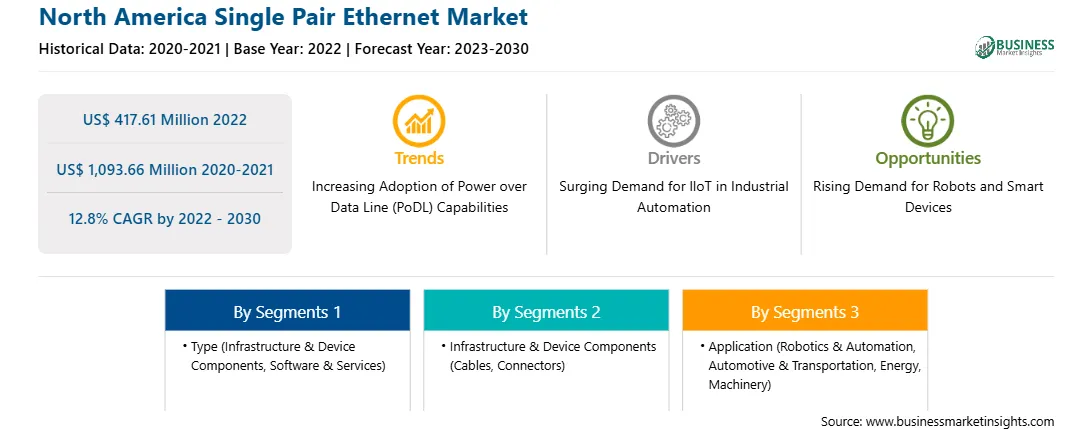

The North America single pair ethernet market was valued at US$ 417.61 million in 2022 and is expected to reach US$ 1,093.66 million by 2030; it is estimated to record a CAGR of 12.8% from 2022 to 2030. Surging Demand for IIoT in Industrial Automation Fuels North America Single Pair Ethernet Market

Single Pair Ethernet (SPE) is an end-to-end industrial Ethernet technology that is taking over the old legacy of Fieldbus networks and traditional Ethernet and smart manufacturing, creating a path for IIoT and Industry 4.0. With industrial communication technology getting advanced the demand for SPE is increasing in the market. It has been witnessed that there is a higher demand for solutions that would adapt to long-lasting strategies in smart manufacturing. The SPE is gaining high acceptance in industrial applications such as process automation and condition-based monitoring. The 10Base-T1 standard of the Institute of Electrical and Electronics Engineers (IEEE) permitted SPE to be utilized for faster connectivity, higher quality health insights, and higher performance in the smart manufacturing setting. As technology gets more sophisticated, manufacturers worldwide focus on staying ahead of competitors by revolutionizing business strategies to fulfill initiatives around machine learning, smart manufacturing, and industrial automation.

SPE is receiving acceptance in the process, automotive, transportation, industrial automation, robotics, and advanced manufacturing industries. The IEEE certified a new standard for single pair ethernet protocol - the IEEE 802.3cg standard (also depicted as the 10Base-T1). The 10Base-T1S "Short Range" is ideal for automotive, computing, and industrial applications within a range of 25 m. The 10Base-T1L "Long Range" is appropriate for IoT, Industrial areas (including factories, large warehouses, and many more) where the range is 1,000 m.

As more and more industrial components become smarter, the connections are no longer restricted to internal company networks. This factor has made the devices a part of the Internet. With increased collection and use of data, the need for more concentrated infrastructure is also increasing. At the same time, the advanced infrastructure of transforming industries is projected to take up less space and fewer resources and is promoting the use of more sensors and high network bandwidth. Thus, surging demand for IIOT in industrial automation is increasing the demand for SPE in the market.North America Single Pair Ethernet Market Overview

The single pair ethernet market in North America is segmented into the US, Canada, and Mexico. The region is characterized by the presence of developed economies with high GDP per capita, large-scale industrialization and infrastructure, favorable economic policies, a positive outlook toward adopting modern technology, and a high inclination for automation across industrial and commercial sectors. Most Fortune 500 manufacturing companies have a strong presence in North America, especially in the US. The US is the largest user of industrial robotics in North America, with more than 75% share, followed by Mexico and Canada. Factors such as increased emphasis on improving production efficiency and high labor costs contribute to the adoption of Industry 4.0 practices at a higher rate. According to the Association for Advancing Automation, North America witnessed a 28% higher rate of robotics procurement in 2021 than in 2020. Also, 48% of robotics procurement was from automotive manufacturers, followed by metal, food, consumer goods, semiconductors and electronics/photonics, plastics and rubber, and life sciences/pharma/biomed manufacturers. Thus, the high inclination toward automation in the region is expected to drive the single pair ethernet market in the region in the coming years.

North America has one of the largest automotive markets, with the US being the second-largest market globally. Companies such as General Motors, Ford, Chevrolet, VW, Tesla, Dodge, Toyota, Honda, Hyundai, and Renault have many manufacturing facilities in North America. Further, the US and Canadian governments are announcing the phase-out of gas-powered vehicles by 2035, boosting the production of electric vehicles (EVs). This is projected to drive the single pair ethernet market in North America during the forecast period. To curtail carbon emissions, governments in North America are emphasizing clean energy. For instance, in 2021, the US and Canada announced that they would be carbon neutral by 2050. Due to such initiatives, the development of solar and wind power projects is increasing across the region. For instance, in December 2021, the US government approved two solar projects in Riverside County, California, which will generate up to 465 MW of electricity, enough to power ~132,000 homes. Thus, the rising deployment of wind and solar farms is anticipated to propel the single pair ethernet utilization in the future. North America has a significant number of smart grids, smart cities, and smart farms, which also contributes to the growth of the single pair ethernet market in North America. Microchip Technology Inc., Vericom Global Solutions, Telebyte Inc., Molex, and UL LLC are among the regional members of the Single Pair Ethernet System Alliance, an alliance formed to promote single pair ethernet technology.

North America Single Pair Ethernet Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Single Pair Ethernet provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Single Pair Ethernet refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Single Pair Ethernet Strategic Insights

North America Single Pair Ethernet Report Scope

Report Attribute

Details

Market size in 2022

US$ 417.61 Million

Market Size by 2030

US$ 1,093.66 Million

Global CAGR (2022 - 2030)

12.8%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Type

By Infrastructure & Device Components

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Single Pair Ethernet Regional Insights

North America Single Pair Ethernet Market Segmentation

The North America single pair ethernet market is categorized into type, application, and country.

Based on type, the North America single pair ethernet market is bifurcated into infrastructure & device components and software & services. The infrastructure & device components segment held a larger market share in 2022. Further, infrastructure & device components segment is sub segmented into cables, connectors, and others. Also, the cables segment is divided into 10Base-T1, 100Base-T1, and 1000Base-T1.

In terms of application, the North America single pair ethernet market is categorized into robotics & automation, automotive & transportation, energy, machinery, and others. The robotics & automation segment held the largest market share in 2022.

By country, the North America single pair ethernet market is segmented into the US, Canada, and Mexico. The US dominated the North America single pair ethernet market share in 2022.

The Siemon Co, Würth Elektronik GmbH & Co KG, TE Connectivity Ltd, LEONI AG, Analog Devices Inc, HARTING Applied Technologies GmbH, Weidmuller Interface GmbH & Co KG, PHOENIX CONTACT GmbH & Co. KG, Lapp Holding SE, and Belden Inc are some of the leading companies operating in the North America single pair ethernet market.

1. Belden Inc

2. Lapp Holding SE

3. Phoenix Contact GmbH & Co.KG

4. Weidmuller Interface GmbH & Co KG

5. Harting Applied Technologies GmbH

6. Analog Devices Inc

7. Leoni Ag

8. TE Connectivity Ltd

9. Wurth Elektronik GmbH & Co KG

10. The Siemens Co

The North America Single Pair Ethernet Market is valued at US$ 417.61 Million in 2022, it is projected to reach US$ 1,093.66 Million by 2030.

As per our report North America Single Pair Ethernet Market, the market size is valued at US$ 417.61 Million in 2022, projecting it to reach US$ 1,093.66 Million by 2030. This translates to a CAGR of approximately 12.8% during the forecast period.

The North America Single Pair Ethernet Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Single Pair Ethernet Market report:

The North America Single Pair Ethernet Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Single Pair Ethernet Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Single Pair Ethernet Market value chain can benefit from the information contained in a comprehensive market report.