Healthcare facilities are primarily responsible for collecting, separating, and disposing of the medical, infectious, and hazardous waste they generate. Increasing prevalence of infectious diseases, rising number of hospital visits and admissions, and growing demand for diagnostic and clinical testing contribute to the generation of large amounts of single-use waste. The resulting medical waste is excluded from general waste disposal and must be disposed of effectively. According to the World Health Organization, 16 million injections are used worldwide each year, but there need to be proper disposal options. In the US, with its advanced healthcare facilities, exposure to bloodborne pathogens from needles and other sharp objects is a serious problem, resulting in 385,000 incidents yearly. 85% of all medical waste generated is general non-hazardous waste, and the remaining 15% is hazardous waste containing harmful microorganisms. Therefore, medical waste disposal is the need of the hour, which is increasing the demand for sharps containers worldwide.

In addition, large-scale vaccination programs are being carried out in different parts of the world to counteract the further emergence and spread of the pandemic, which is expected to have a significant impact on the market under study. For example, according to the World Health Organization's Coronavirus Dashboard, ~12.5 billion vaccines were administered worldwide by the end of August 2022, which generated a significant number of syringes as waste. Therefore, the COVID-19 pandemic impacted the North America sharps container market significantly.

The generation of a large amount of medical waste is increasing the demand for sharps containers for the proper disposal of these medical wastes, thereby boosting the market growth.

The North America sharps containers market is segmented into the US, Canada, and Mexico. The region holds a significant share of the North America sharps containers market. The North America sharps containers market is expected to witness significant growth during the forecast period due to the rising prevalence of chronic diseases such as diabetes and cardiac diseases. Moreover, a rise in hospitalization and surgeries is likely to offer growth opportunities to the market during the forecast period. In the US, there is a standard practice for patients to deposit their needles, syringes, and other medical waste products with their curbside trash. Medical waste from hospitals and healthcare organizations is highly regulated in the US. Medical waste is collected only by certified medical waste hauling and disposal companies; the waste is then autoclaved and placed in a landfill.

According to an article titled "Summary of Information on The Safety and Effectiveness of Syringe Services Programs (SSPs)," published in the Centers for Disease Control and Prevention (CDC)—the US has seen an increase in injection drug use, primarily the injection of opioids. Outbreaks of hepatitis C, hepatitis B, and HIV infections have been correlated with these injection patterns and trends. The majority of new hepatitis C virus (HCV) infections are due to injection drug use, and the nation has witnessed an exponential increase in reported cases of HCV from 2010 to 2019. Furthermore, the incidences of 5 new HCV virus infections are increasing rapidly among young people, with the majority of cases being among individuals aged 20–39 years.

Moreover, the prevalence of chronic illnesses such as Crohn's disease and diabetes, which can be treated with self-injectable medication, is rising across the US. Major corporations such as BD and Smiths Medical are also making syringes, such as BD's Hypak SCF PRTC glass pre-fillable syringe, specifically for the treatment of chronic diseases to strengthen their market positions. Additionally, in May 2021, BD stated that it plans to expand its Diabetes Care division into a distinct, publicly traded company. BD Diabetes Care, which supports ~30 million patients annually and produces approximately 8 billion injection devices, has been a significant driver of the adoption of insulin syringes and other products in the country.

Therefore, the rising cases of diabetes and needlestick injuries and growing government initiatives are expected to boost the North America sharps containers market growth in the US during the forecast period.

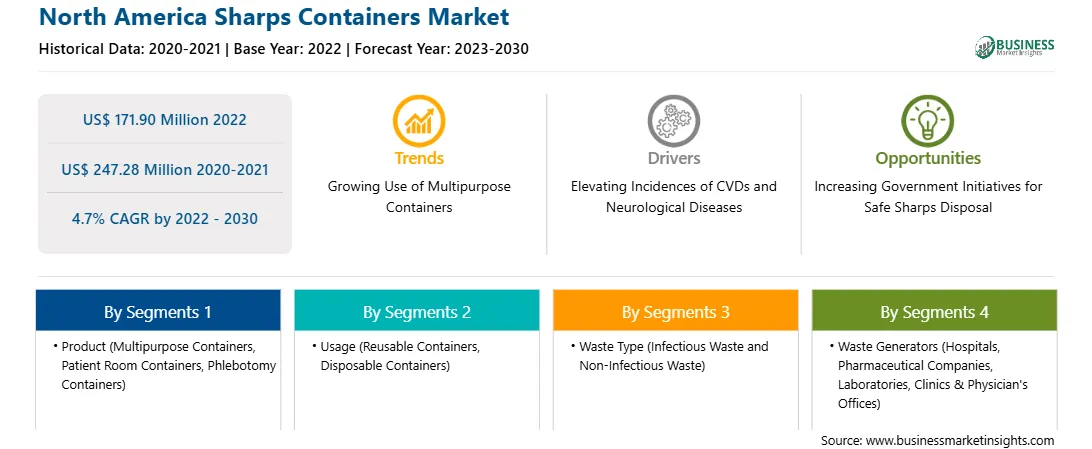

The North America sharps containers market is segmented into product, usage, waste type, waste generators, container size, distribution channel, and country.

Based on product, the North America sharps containers market is segmented into multipurpose containers, patient room containers, and phlebotomy containers. The multipurpose containers segment held the largest share of the North America sharps containers market in 2022.

Based on usage, the North America sharps containers market is segmented into reusable containers and disposable containers. The reusable containers segment held a larger share of the North America sharps containers market in 2022.

Based on waste type, the North America sharps containers market is segmented into infectious waste and non-infectious waste. The infectious waste held a larger share of the North America sharps containers market in 2022.

Based on waste generators, the North America sharps containers market is segmented into hospitals, pharmaceutical companies, laboratories, clinics & physician’s offices, and others. The hospitals held the largest share of the North America sharps containers market in 2022.

Based on container size, the North America sharps containers market is segmented into 1-3 gallons, 4-6 gallons, 7-8 gallons, and others. The 1-3 gallons held the largest share of the North America sharps containers market in 2022.

Based on distribution channel, the North America sharps containers market is segmented into medical supply companies, pharmacies, online sale, and others. The medical supply companies held the largest share of the North America sharps containers market in 2022.

Based on country, the North America sharps containers market is segmented into the US, Canada, and Mexico. The US dominated the North America sharps containers market in 2022.

Becton Dickinson and Co, Bemis Co Inc, Bondtech Corp, EnviroTain LLC, GPC Medical Ltd, Mauser Group NV, Stericycle Inc, and The Harloff Co are some of the leading companies operating in the North America sharps containers market.

Strategic insights for the North America Sharps Containers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 171.90 Million |

| Market Size by 2030 | US$ 247.28 Million |

| Global CAGR (2022 - 2030) | 4.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Sharps Containers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Sharps Containers Market is valued at US$ 171.90 Million in 2022, it is projected to reach US$ 247.28 Million by 2030.

As per our report North America Sharps Containers Market, the market size is valued at US$ 171.90 Million in 2022, projecting it to reach US$ 247.28 Million by 2030. This translates to a CAGR of approximately 4.7% during the forecast period.

The North America Sharps Containers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Sharps Containers Market report:

The North America Sharps Containers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Sharps Containers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Sharps Containers Market value chain can benefit from the information contained in a comprehensive market report.