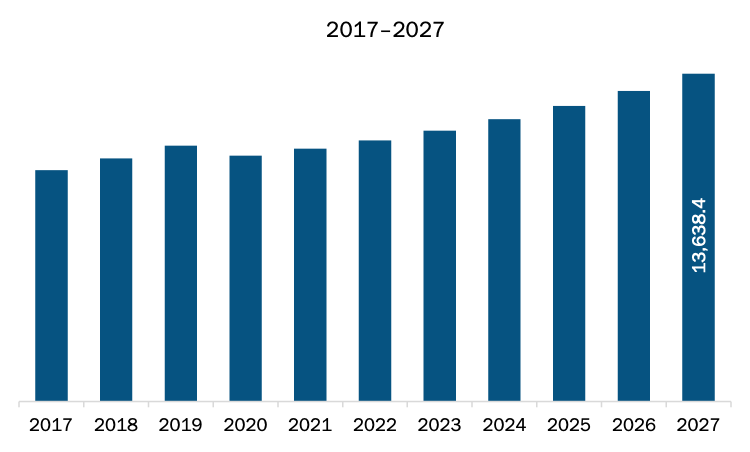

In terms of revenue, the North America semi-trailer market was valued at US$ 10,637.1 million in 2019 and it is expected to grow at a CAGR of 4.2% during the forecast period of 2020 to 2027 to reach US$ 13,638.4 million by 2027.

Technological advancements have enhanced the seafood packaging, processing, and storage processes during their shipping from one place to another. The retail sector in the US is altering the ways food is being made available across every retail shop, such as convenience stores and supermarkets. These changes in the food, pharmaceuticals, and retail industries—boosting the demand for cold chain—are supporting the growth of the semi-trailer market in North America. The developments in cold chains help in retaining the quality of the perishable food and temperature-sensitive medical products, thereby assuring reliable and efficient shipping of these products. The shipment of frozen foods in refrigerator semi-trailers facilitates the preservation of their nutritive values and quality for a longer period. The cold chain operators in North America are constantly focusing on advancements in the existing technologies associated with the transportation of products, while ensuring efficiency, integrity, and safety. Several market players present in the region are focusing on the development of a variety of semi-trailers. For instance, in 2020, Fontaine introduced Fontaine Magnitude 60LCC, a lowbed trailer intended for customers working in regions where spread-axle configurations are not required to maximize their trailer loads. Similarly, in 2019, East Manufacturing introduced its aluminum air tank as a standard on all trailer types and models, which is a lightweight trailer and rising its life span and recycling value by implementing anti-corrosive material and coating. Thus, such developments in the US, Canada, and Mexico, are accelerating the growth of the North America semi-trailer market.

North America is an early adopter of several advanced technologies. Companies present in this region are continuously focusing on enhancing the overall business processes to meet customer requirements by offering high-quality products and services in the best possible way. The supply chain industry in the region has been undergoing a constant transformation, thereby substantially impacting warehousing and distribution fundamentals. Emerging technologies play a significant role in this development by filling a gap between supply chain operations and customers. The escalating adoption of semi-trailers in the US is mainly attributed to the boom in the automotive and e-commerce sectors and increased demand for perishable foods by the retailers. The mode of transportation for perishable goods depends on the type of goods, distance over which the product needs to be transported, and conditions under which the product must be shipped. Depending on the mode of transportation, the perishable goods are transported through sea, air, rail, and roadways. Road transportation is highly preferred to transport goods across the borders. Thus, the demand for refrigerated semi-trailers is growing across the region. On other hand, due to the COVID-19 outbreak, majority of the manufacturing plants are shut down, municipalities are functioning slowly as compared to past, and the automotive, manufacturing, and semiconductor industries are at a halt, which is negatively impacting the semi-trailer market. In terms of patient count and death toll, Canada and Mexico are still at a nascent stage compared to the US, which is the worst affected country due to the COVID-19 outbreak. The huge increase in number of confirmed cases in the US and rise in reported deaths in the country have affected the logistics industry. As per Geotab Inc.'s study, a significant drop has been witnessed in commercial transportation activity in the US and Canada, wherein the US, the impact is more significant. With a decline in commercial transportation activity, the growth of semi-trailer market in the region has been impacted in a negative manner.

Strategic insights for the North America Semi-Trailer provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 10,637.1 Million |

| Market Size by 2027 | US$ 13,638.4 Million |

| Global CAGR (2019 - 2027) | 4.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Semi-Trailer refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Semi-Trailer Market Segmentation

North America Semi-Trailer Market – by Type

North America Semi-Trailer Market – by

Number of Axles

North America Semi-Trailer Market – by Tonnage

North America Semi-Trailer Market

– by

Country

North America Semi-Trailer Market - Companies Mentioned

The List of Companies - North America Semi-Trailer Market

The North America Semi-Trailer Market is valued at US$ 10,637.1 Million in 2019, it is projected to reach US$ 13,638.4 Million by 2027.

As per our report North America Semi-Trailer Market, the market size is valued at US$ 10,637.1 Million in 2019, projecting it to reach US$ 13,638.4 Million by 2027. This translates to a CAGR of approximately 4.2% during the forecast period.

The North America Semi-Trailer Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Semi-Trailer Market report:

The North America Semi-Trailer Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Semi-Trailer Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Semi-Trailer Market value chain can benefit from the information contained in a comprehensive market report.