Security inspection systems are electronic devices or manual or visual inspection of baggage, person, vehicle, and others to detect possession of prohibited, illegal, and other dangerous items into a secure area. Security inspections assist in threat recognition to safeguard public places, airports, borders, and other places against terrorism. The various technologies used for security inspection are biometric technologies, X-rays, explosive trace detectors, electromagnetic detectors, and others. The advancements in technology are creating a lucrative opportunity for companies offering security inspection system. Companies are developing new applications such as Nuclear Quadrapole Resonance (NQR). This technology can detect explosives embedded in electronics, which are hidden under layers of shoes or clothes. This technology is currently deployed in international airports of America. The recent Rising acceptance of vehicle inspection system at border checkpoints is expected to create a significant demand for security inspection in the coming years, which is further anticipated to drive the North America security inspection market. Furthermore, COVID-19 is having a very devastating impact over the North America region.

Strategic insights for the North America Security Inspection provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

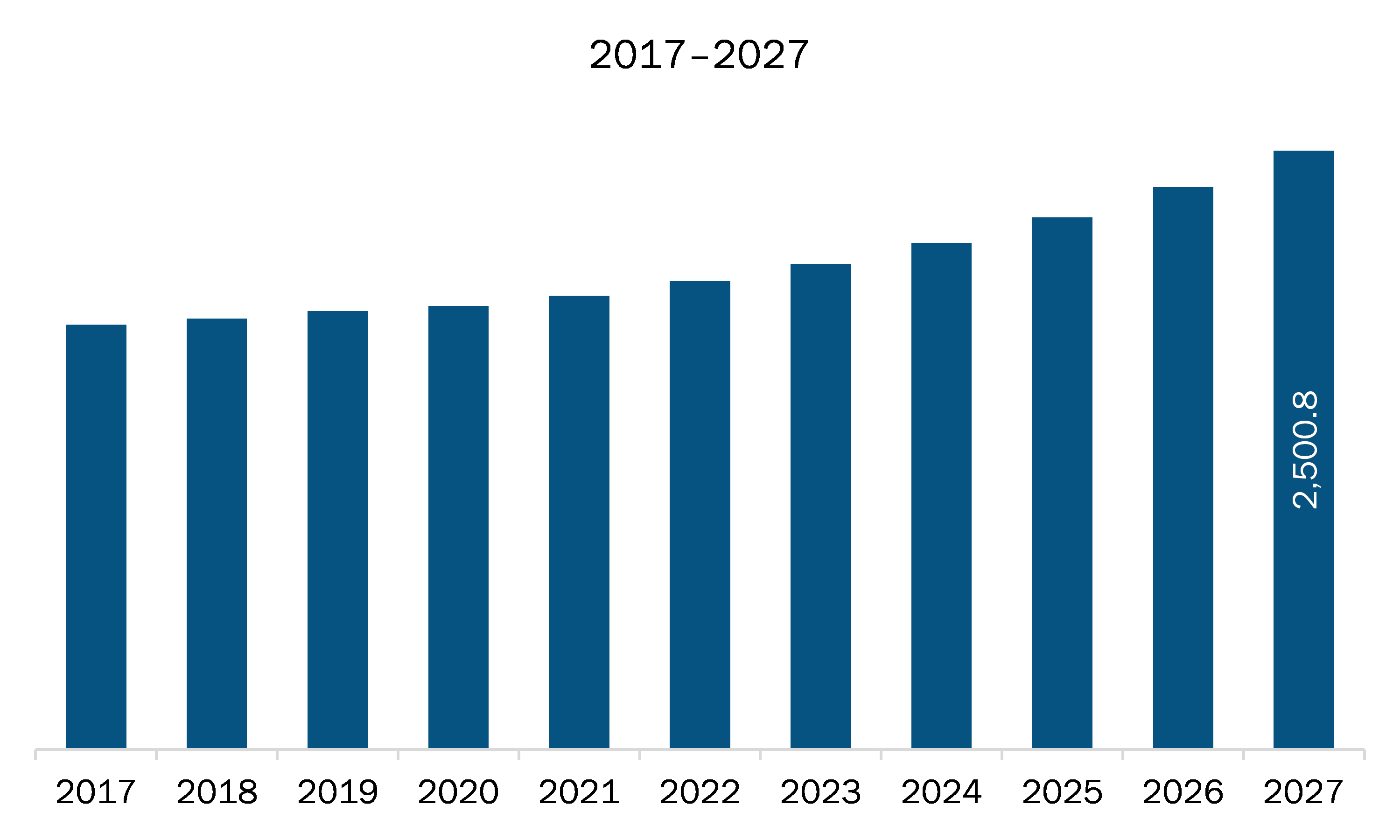

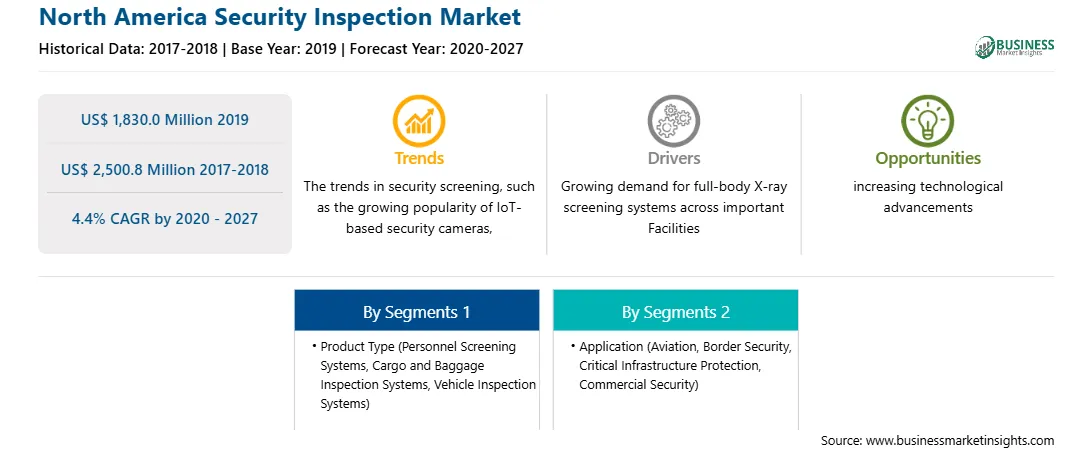

| Market size in 2019 | US$ 1,830.0 Million |

| Market Size by 2027 | US$ 2,500.8 Million |

| Global CAGR (2020 - 2027) | 4.4% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Security Inspection refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The security inspection market in North America is expected to grow from US$ 1,830.0 million in 2019 to US$ 2,500.8 million by 2027; it is estimated to grow at a CAGR of 4.4% from 2020 to 2027. Lack of skilled security personnel coupled with rising integration of automation technologies in security systems is influencing the surge in demand for automated security scanning systems. These automated systems enable computer-based security operations with predefined rules. Moreover, these systems are enabling to speed up the security checking processes in a systematic manner; thereby, reducing the risk of any human errors. The automated systems reduce the burden of repetitive tasks; thus, offering more time for the security personnel to focus on other critical security operations. Thus, the added benefits of automated security systems are contributing to the growth of the North America security inspection market.

In terms of product type, the personnel screening systems segment accounted for the largest share of the North America security inspection market in 2019. In terms of application, the aviation segment held a larger market share of the North America security inspection market in 2019.

A few major primary and secondary sources referred to for preparing this report on the security inspection market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ADANI; Analogic Corporation; C.E.I.A. SpA; Leidos; Nuctech Company Limited; OSI Systems, Inc.; Smiths Group plc.

Some of the leading companies are:

The North America Security Inspection Market is valued at US$ 1,830.0 Million in 2019, it is projected to reach US$ 2,500.8 Million by 2027.

As per our report North America Security Inspection Market, the market size is valued at US$ 1,830.0 Million in 2019, projecting it to reach US$ 2,500.8 Million by 2027. This translates to a CAGR of approximately 4.4% during the forecast period.

The North America Security Inspection Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Security Inspection Market report:

The North America Security Inspection Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Security Inspection Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Security Inspection Market value chain can benefit from the information contained in a comprehensive market report.