North America Security Information and Event Management Market Forecast to 2030 - Regional Analysis - by Component (Solution and Services), Deployment Mode (On-Premise and Cloud), Enterprise Size (Large Enterprise and SMEs), and End User (IT and Telecommunication, BFSI, Government, and Others)

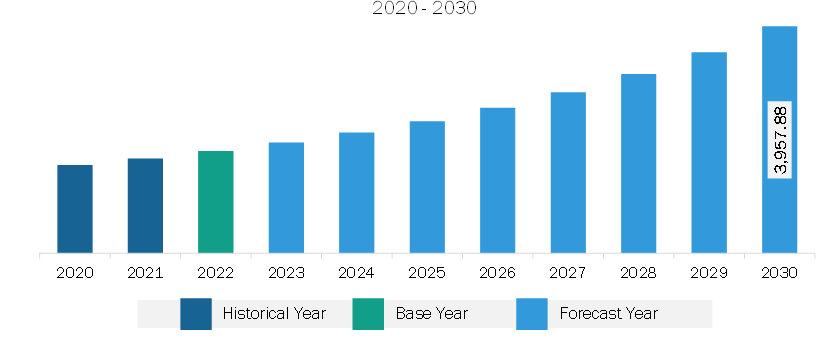

The North America security information and event management market is expected to grow from US$ 1,782.47 million in 2022 to US$ 3,957.88 million by 2030. It is estimated to grow at a CAGR of 10.5% from 2022 to 2030.

Integration of SIEM Solutions with Predictive Analytics Fuels North America Security Information and Event Management Market

SIEM systems need to advance to keep up with the more sophisticated threats. Predictive analytics and machine learning might aid enterprises in avoiding cyber assaults. To predict future events based on historical data, predictive analytics employs statistical modeling, data mining methods, and machine learning. By identifying patterns in data, businesses use it to detect dangers and data breach opportunities. Predictive analytics is mainly concerned with the identification and understanding of both recognized and unrecognized cyberattack patterns. This capacity is anticipated to significantly improve the effectiveness of quickly recognizing concealed threats, make it possible to find attackers, and even predict upcoming assaults with improved accuracy and a lower false positive rate. Organizations might strengthen their cybersecurity defenses and create a safer and more secure digital environment by utilizing the power of security analytics. Network detection and response (NDR) and user and entity behavior analytics (UEBA) are two excellent instances of predictive analytics at action in SIEM solutions. For instance, in March 2022, LogPoint announced the general availability of LogPoint Converged SIEM. The company stated that the integrated solutions offered managed security service providers with a single platform for threat detection and response. According to LogPoint, the entire system integrates threat detection and response across infrastructure, assets, endpoints, cloud platforms, and apps. In addition, customer data in Converged SIEM is housed in the US or the European Union in accordance with customers' compliance and privacy requirements, according to LogPoint. In January 2023, Gurucul, a pioneer in next-generation SIEM, UEBA, XDR, and identity and access analytics, declared that its next-generation SIEM product-Gurucul Next-Gen SIEM-has won the "CyberSecured" award in the category of security and automation response. The platform is praised for accelerating training through open and transparent models, cutting threat detection time, reducing human work through automation, and enhancing analyst productivity. Further, organizations can identify potential risks before they materialize and remain competitive by employing machine learning algorithms to evaluate data. Predictive analytics based SIEM solutions have numerous advantages over conventional SIEM, including earlier threat identification, improved accuracy, higher efficiency, and scalability. Thus, the integration of SIEM solutions with predictive analytics is anticipated to fuel the market growth during the forecast period.

North America Security Information and Event Management Market Overview

The US, Canada, and Mexico are major countries in North America. North America is one of the most heavily impacted regions in the world by cyberattacks. This is due to the prominent presence of financial sectors, essential infrastructure, and shared opportunities, such as private-public partnerships, all of which contribute to a more robust cyber ecosystem. Regional governments concentrate on enhancing legislation and policies to combat cyber risks in their countries. For example, the United States-Mexico-Canada Agreement (USMCA) and the North American Free Trade Agreement (NAFTA) have merged to produce a single regional solution for the manufacturing sector. Furthermore, the Department of Homeland Security has identified 16 important cybersecurity sectors, including manufacturing, construction, energy, food and agriculture, chemical, healthcare, government, and others. The expanding compliance and regulation rules, as well as the number of cyberattacks across sectors, are propelling the need for regional security information and event management.

Cyberattacks against traditional security operations are becoming increasingly common, producing reputational damage, financial impact, and operational outages. Thus, several players in North America are expanding in security information and event management. For instance, in July 2023, Kyndryl significantly increased the services it provides to allow business customers to swiftly detect, effectively respond to, and recover from cyberattacks. Thus, the expansion of such players in the region propels the growth of the security information and event management market.

North America Security Information and Event Management Market Revenue and Forecast to 2030 (US$ Million)

Get more information on this report :

North America Security Information and Event Management Market Segmentation

The North America security information and event management market is segmented into component, deployment mode, enterprise size, end user, and country.

Based on component, the North America security information and event management market is bifurcated into software and services. The software segment held a larger share of the North America security information and event management market in 2022.

In terms of deployment mode, the North America security information and event management market is bifurcated into cloud and on-premise. The cloud segment held a larger share of the North America security information and event management market in 2022.

Based on enterprise size, the North America security information and event management market is bifurcated into SMEs and large enterprises. The large enterprises segment held a larger share of the North America security information and event management market in 2022.

Based on end user, the North America security information and event management market is segmented into IT and telecommunication, BFSI, healthcare, government, and others. The IT and telecommunication segment held the largest share of the North America security information and event management market in 2022.

By country, the North America security information and event management market is segmented into the US, Canada, and Mexico. The US dominated the North America security information and event management market in 2022.

AT&T Inc; International Business Machines Corp; LogRhythm Inc; SolarWinds Worldwide, LLC; Splunk Inc; Fortinet Inc; Zoho Corporation Pvt Ltd; Logpoint AS; Exabeam Inc; and Logsign Inc are some of the leading companies operating in the North America security information and event management market.

Table of Content

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Security Information and Event Management Market Landscape

4.1 Overview

4.2 Ecosystem Analysis

4.2.1 Service Providers

4.2.2 End User Industry

4.2.3 List of Vendors in Value Chain

5. North America Security Information and Event Management Market - Key End User Dynamics

5.1 Security Information and Event Management Market - Key End User Dynamics

5.2 Market Drivers

5.2.1 Rise in Cybersecurity Incidents

5.2.2 Surge in Need for Modern Security Solutions to Manage and Monitor High Volume of Security Alerts

5.2.3 Rise in Popularity of SaaS Model

5.3 Market Restraints

5.3.1 Lack of Skilled Personnel and Increased Complexity of Managing SIEM Solutions

5.3.2 High Cost of Implementation

5.4 Market Opportunities

5.4.1 Increasing Need for Monitoring Compliance Standards in Organizations

5.4.2 Rising Need for Threat Monitoring and Detection in Changing Retail Industry

5.5 Future Trends

5.5.1 Integration of SIEM Solutions with Predictive Analytics

5.6 Impact of Drivers and Restraints:

6. Security Information and Event Management Market - North America Market Analysis

6.1 North America Security Information and Event Management Market Revenue (US$ Million), 2020 - 2030

6.2 North America Security Information and Event Management Market Forecast and Analysis

7. North America Security Information and Event Management Market Analysis - Component

7.1 Solution

7.1.1 Overview

7.1.2 Solution Market, Revenue and Forecast to 2030 (US$ Million)

7.2 Services

7.2.1 Overview

7.2.2 Services Market, Revenue and Forecast to 2030 (US$ Million)

8. North America Security Information and Event Management Market Analysis - Deployment Mode

8.1 Cloud

8.1.1 Overview

8.1.2 Cloud Market Revenue and Forecast to 2030 (US$ Million)

8.2 On-Premise

8.2.1 Overview

8.2.2 On-Premise Market Revenue and Forecast to 2030 (US$ Million)

9. North America Security Information and Event Management Market Analysis - Enterprise Size

9.1 Large Enterprise

9.1.1 Overview

9.1.2 Large Enterprise Market Revenue and Forecast to 2030 (US$ Million)

9.2 SMEs

9.2.1 Overview

9.2.2 SMEs Market Revenue and Forecast to 2030 (US$ Million)

10. North America Security Information and Event Management- End User

10.1 IT and telecommunication

10.1.1 Overview

10.1.2 IT and telecommunication Market Revenue and Forecast to 2030 (US$ Million)

10.2 BFSI

10.2.1 Overview

10.2.2 BFSI Market Revenue and Forecast to 2030 (US$ Million)

10.3 Healthcare

10.3.1 Overview

10.3.2 Healthcare Market Revenue and Forecast to 2030 (US$ Million)

10.4 Government

10.4.1 Overview

10.4.2 Government Market Revenue and Forecast to 2030 (US$ Million)

10.5 Others

10.5.1 Overview

10.5.2 Others Market Revenue and Forecast to 2030 (US$ Million)

11. North America Security Information and Event Management Market - Country Analysis

11.1 North America

11.1.1 North America Security Information and Event Management Market Overview

11.1.2 North America Security Information and Event Management Market, By Key Country - Revenue 2022 (US$ Mn)

11.1.3 North America Security Information and Event Management Market Revenue and Forecasts and Analysis - By Country

11.1.3.1 North America Security Information and Event Management Market Revenue and Forecasts and Analysis - By Country

11.1.3.2 US Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn)

11.1.3.2.1 US Security Information and Event Management Market Breakdown by Component

11.1.3.2.2 US Security Information and Event Management Market Breakdown by Deployment Mode

11.1.3.2.3 US Security Information and Event Management Market Breakdown by Enterprise Size

11.1.3.2.4 US Security Information and Event Management Market Breakdown by End User

11.1.3.3 Canada Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn)

11.1.3.3.1 Canada Security Information and Event Management Market Breakdown by Component

11.1.3.3.2 Canada Security Information and Event Management Market Breakdown by Deployment Mode

11.1.3.3.3 Canada Security Information and Event Management Market Breakdown by Enterprise Size

11.1.3.3.4 Canada Security Information and Event Management Market Breakdown by End User

11.1.3.4 Mexico Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn)

11.1.3.4.1 Mexico Security Information and Event Management Market Breakdown by Component

11.1.3.4.2 Mexico Security Information and Event Management Market Breakdown by Deployment Mode

11.1.3.4.3 Mexico Security Information and Event Management Market Breakdown by Enterprise Size

11.1.3.4.4 Mexico Security Information and Event Management Market Breakdown by End User

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 Product Development

12.4 Mergers & Acquisitions

13. Company Profiles

13.1 AT&T Inc

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 International Business Machines Corp

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 LogRhythm Inc

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 SolarWinds Worldwide, LLC

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Splunk Inc

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Fortinet Inc

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Zoho Corporation Pvt Ltd

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Logpoint AS

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Exabeam Inc

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Logsign Inc

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About the Insight Partners

14.2 Word Index

List of Tables

Table 1. Security Information and Event Management Market Segmentation

Table 2. North America Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Million)

Table 3. North America Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Million) - Component

Table 4. Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Million) - Deployment Mode

Table 5. Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Million) - Enterprise Size

Table 6. Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Million) - End User

Table 7. North America Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By Country

Table 8. US Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By Component

Table 9. US Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By Deployment Mode

Table 10. US Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By Enterprise Size

Table 11. US Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By End User

Table 12. Canada Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By Component

Table 13. Canada Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By Deployment Mode

Table 14. Canada Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By Enterprise Size

Table 15. Canada Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By End User

Table 16. Mexico Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By Component

Table 17. Mexico Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By Deployment Mode

Table 18. Mexico Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By Enterprise Size

Table 19. Mexico Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn) - By End User

Table 20. List of Abbreviation

List of Figures

Figure 1. Security Information and Event Management Market Segmentation, By Country

Figure 2. Ecosystem: Security Information and Event Management Market

Figure 3. Impact Analysis of Drivers and Restraints

Figure 4. North America Security Information and Event Management Market Revenue (US$ Million), 2020 - 2030

Figure 5. North America Security Information and Event Management Market Share (%) - Component, 2022 and 2030

Figure 6. Solution Market Revenue and Forecasts to 2030 (US$ Million)

Figure 7. Services Market Revenue and Forecasts to 2030 (US$ Million)

Figure 8. Security Information and Event Management Market Share (%) Deployment Model, 2022 and 2030

Figure 9. Cloud Market Revenue and Forecasts to 2030 (US$ Million)

Figure 10. On-Premise Market Revenue and Forecasts to 2030 (US$ Million)

Figure 11. Security Information and Event Management Market Share (%) Enterprise Size, 2022 and 2030

Figure 12. Large Enterprise Market Revenue and Forecasts to 2030 (US$ Million)

Figure 13. SMEs Market Revenue and Forecasts to 2030 (US$ Million)

Figure 14. Security Information and Event Management Market Share (%) End User, 2022 and 2030

Figure 15. IT and telecommunication Market Revenue and Forecasts to 2030 (US$ Million)

Figure 16. BFSI Market Revenue and Forecasts to 2030 (US$ Million)

Figure 17. Healthcare Market Revenue and Forecasts to 2030 (US$ Million)

Figure 18. Government Market Revenue and Forecasts to 2030 (US$ Million)

Figure 19. Others Market Revenue and Forecasts to 2030 (US$ Million)

Figure 20. Security Information and Event Management Market, By Key Country - Revenue 2022 (US$ Mn)

Figure 21. Security Information and Event Management Market Breakdown by Key Countries, 2022 and 2030 (%)

Figure 22. US Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn)

Figure 23. Canada Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn)

Figure 24. Mexico Security Information and Event Management Market Revenue and Forecasts to 2030 (US$ Mn)

1. AT&T Inc

2. International Business Machines Corp

3. LogRhythm Inc

4. SolarWinds Worldwide, LLC

5. Splunk Inc

6. Fortinet Inc

7. Zoho Corporation Pvt Ltd

8. Logpoint AS

9. Exabeam Inc

10. Logsign Inc

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America security information and event management market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in North America security information and event management market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing, and distribution.