North America Security As A Service Market

No. of Pages: 117 | Report Code: BMIRE00027202 | Category: Technology, Media and Telecommunications

No. of Pages: 117 | Report Code: BMIRE00027202 | Category: Technology, Media and Telecommunications

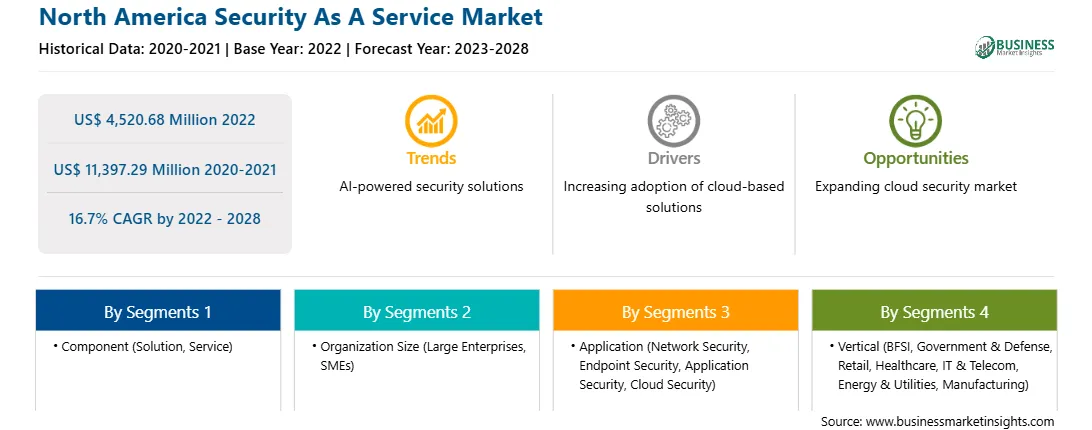

The North America security as a service market is expected to grow from US$ 4,520.68 million in 2022 to US$ 11,397.29 million by 2028; it is estimated to grow at a CAGR of 16.7% from 2022 to 2028.

A major part of several countries' national cybersecurity strategies is creating a "cyber-secure nation" for enterprises and individuals. The growth of secret organizational data, the increase in cybercrime activity, and the development of mobile device trends are the main factors driving the security as a service industry. The use of cloud technologies has grown significantly over time, which has increased the demand for more dependable and affordable security solutions. Significant market prospects are created by the rise of e-business, growing awareness of data protection, the trend of bringing your own device (BYOD), and acceptance of managed security measures. The need for sound governance has increased because of the Indian government's initiatives on cybersecurity, which have caused the governance structure to change quickly. The program would urge CISOs and front-line IT personnel from all government agencies to educate themselves on cybercrime and develop their self-defense skills. It is anticipated that such government policies to reduce potential cyber dangers and attacks will open up new business prospects during the projected period.

Vendors in the security as a service market can attract new customers and expand their footprints in emerging markets by offering products with new features and technologies. This factor is likely to drive the North America security as a service market at a good CAGR during the forecast period.

North America Security As A Service Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the North America Security As A Service provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Security As A Service refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Security As A Service Strategic Insights

North America Security As A Service Report Scope

Report Attribute

Details

Market size in 2022

US$ 4,520.68 Million

Market Size by 2028

US$ 11,397.29 Million

Global CAGR (2022 - 2028)

16.7%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Component

By Organization Size

By Application

By Vertical

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Security As A Service Regional Insights

North America Security As A Service Market Segmentation

The North America security as a service market is segmented on the basis of component, organization size, application, vertical, and country. Based on component, the market is segmented into solution and service. The solution segment dominated the market in 2022, and the service segment is expected to register the highest CAGR during forecast period. Based on organization size, the market is segmented into small and medium enterprises and large enterprises. The large enterprises segment dominated the market in 2022 and small and medium enterprises segment is expected to register the highest CAGR during the forecast period. Based on application, the North America security as a service market is segmented into network security, endpoint security, application security, cloud security, and others. The network security segment dominated the market in 2022, and the application security segment is expected to register the highest CAGR during the forecast period. Based on vertical, the North America security as a service market is segmented into BFSI, government & defense, retail, healthcare, IT & telecom, energy & utilities, manufacturing, and others. The BFSI segment dominated the market in 2022 and is expected to register the highest CAGR during the forecast period. Based on country, the North America security as a service market is segmented into the US, Canada, and Mexico.

Alert Logic, Inc.; Barracuda Networks, Inc.; Clearswift; IBM Corporation; McAfee, LLC; Microsoft Corporation; Radware; Silversky; Trend Micro Incorporated; and Zscaler, Inc.

are among the leading companies in the North America security as a service market.

The North America Security As A Service Market is valued at US$ 4,520.68 Million in 2022, it is projected to reach US$ 11,397.29 Million by 2028.

As per our report North America Security As A Service Market, the market size is valued at US$ 4,520.68 Million in 2022, projecting it to reach US$ 11,397.29 Million by 2028. This translates to a CAGR of approximately 16.7% during the forecast period.

The North America Security As A Service Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Security As A Service Market report:

The North America Security As A Service Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Security As A Service Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Security As A Service Market value chain can benefit from the information contained in a comprehensive market report.