All non-functional artificial materials orbiting the Earth at different altitudes can be termed space debris. Debris includes rocket body parts, fragmentation debris, refuse created during crewed missions, exhaust products from rockets, and defunct satellites. Most of such debris orbit the Earth at an average speed above 26,000 km per hour in Low Earth Orbits (LEO), posing a severe threat of collision for functional space assets. Such threats increase with each rocket launch for LEO and deep space. Growing collision threats of space objects are a persistent problem for the safe and sustainable use of outer space. These threats restrict unhindered access to space and prompt relevant parties to take necessary steps to mitigate risk. In November 2021, the Russian military conducted an anti-satellite test (ASAT) and blew up its defunct Cosmos 1408 satellite (which was launched in 1982) with a Nudol missile. Immediately after the blast, American and Russian astronauts aboard the International Space Station had to take preventive measures to avoid being struck by debris from the satellite, as the International Space Station was supposedly reasonably close to the satellite.

The North American satellite optical ground station market is segmented into US and Canada. Advanced satellite optical ground station technologies are being widely adopted in the US and Canada to improve defense capabilities. In August 2020, the US Space Center announced that United Launch Alliance (ULA) was awarded to launch its critical national security space missions for the US Space Force. The missions are planned to be deployed from Cape Canaveral Air Force Station in Florida in FY2027. These types of satellite launch help in the adoption of the ground station technologies.

Moreover, the launch of new satellite ground stations across the region and the expansion of existing ground stations is another major factor driving the growth of satellite optical ground stations across the North America region. For instance:

• In 2022, BlueHalo won a contract worth US$ 1.4 billion from the US Space Force for the upgrade of 12 military ground stations across the country wherein BlueHalo will replace the old parabolic satellite dishes with electronic phased array antennas across the military ground stations.

• In February 2023, Satellite operator KSAT announced that it is expanding its network with the installation of new ground station antennas across Antarctica and expanding its capacity in the US through multiple antennas in Hawaii, Alaska, and the Southeast US.

• In January 2023, SpaceX’s Starlink announced the launch of its fleet of second-generation satellites and expansion of its ground station infrastructure across the US.

• In May 2019, GigaSat, part of Ultra Electronics Communications & Integrated Systems (CIS), in partnership with Inmarsat, delivered 16 satellite multiband earth ground station terminals to Canada’s Department of National Defence (DND).

Strategic insights for the North America Satellite Optical Ground Station provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Satellite Optical Ground Station refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Satellite Optical Ground Station Strategic Insights

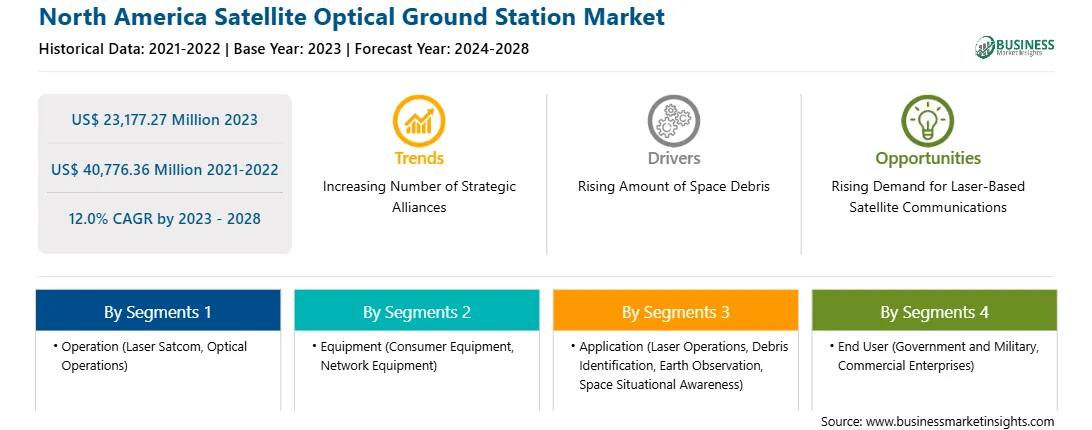

North America Satellite Optical Ground Station Report Scope

Report Attribute

Details

Market size in 2023

US$ 23,177.27 Million

Market Size by 2028

US$ 40,776.36 Million

Global CAGR (2023 - 2028)

12.0%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Operation

By Equipment

By Application

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Satellite Optical Ground Station Regional Insights

North America Satellite Optical Ground Station Market Segmentation

The North America satellite optical ground station market is segmented into operation, application, end user, equipment, and country.

Based on operation, the North America satellite optical ground station market is segmented into laser satcom and optical operations. The optical operations segment held a larger market share in 2023. The laser satcom segment is sub-segmented into OISL, direct-to-earth, and feeder links.

Based on application, the North America satellite optical ground station market is segmented into laser operation, debris identification, earth observation, and space situational awareness. The earth observation segment registered the largest market share in 2023. The laser operation segment is further sub-segmented into ranging and communication.

Based on end user, North America satellite optical ground station market is segmented into government & military and commercial enterprises. The government & military segment held a larger market share in 2023.

Based on equipment, the North America satellite optical ground station market is segmented into consumer equipment and network equipment. The network equipment segment held a larger market share in 2023.

Based on country, the North America satellite optical ground station market has been categorized into US and Canada. The US dominated the North America satellite optical ground station market in 2023.

AAC Clyde Space AB; Ball Corp; Comtech Telecomm Corp; General Atomics Aeronautical Systems Inc; Hensoldt AG; Mynaric AG; and Thales SA are some of the leading companies operating in the North America satellite optical ground station market.

The North America Satellite Optical Ground Station Market is valued at US$ 23,177.27 Million in 2023, it is projected to reach US$ 40,776.36 Million by 2028.

As per our report North America Satellite Optical Ground Station Market, the market size is valued at US$ 23,177.27 Million in 2023, projecting it to reach US$ 40,776.36 Million by 2028. This translates to a CAGR of approximately 12.0% during the forecast period.

The North America Satellite Optical Ground Station Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Satellite Optical Ground Station Market report:

The North America Satellite Optical Ground Station Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Satellite Optical Ground Station Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Satellite Optical Ground Station Market value chain can benefit from the information contained in a comprehensive market report.