Burgeoning Adoption of Child Resistant Closures in Packaging to Avoid Accidental Poisoning

In today's technology-driven world, robots play an important role in manufacturing, with about half of those used for welding applications. Many of those welding robots are being used in the automotive industry. Over the past 30 years, automotive welding robots have been busy changing the industry. They have made automotive assembly lines faster, safer, cost-effective, and more efficient. Automotive welding robots have made factories safer because they eliminate the risk of human errors causing accidents. An automotive robot can also work in hazardous conditions as it can withstand heat and chemical reactions and come into contact with structures and parts. Being able to perform dangerous jobs has helped protect workers and future consumers because robots can perform crash tests that evaluate the safety of the vehicles being manufactured. Many automobile manufacturers have been able to save millions of dollars by doubling or tripling their production time with automotive robots. Also, robots can work around the clock as they do not require breaks, sick days, etc. Many companies are also saving money with automotive welding robots since they do not need a salary or benefits. These factors affect the occasional maintenance and repair costs, making robots the cheaper option compared to humans. These advantages of automotive welding robots are fueling the growth of this market. Automotive welding robots are driving the automotive industry significantly by constantly meeting industry expectations. Welding robots used in the automotive industry can also perform other tasks, such as painting, welding, finishing, and many more. They can be programmed to do complex jobs, such as welding. New industry standards call for lighter cars, but the need for tighter welding adjoins it. This can only be accomplished through robots to ensure there is no rattling (another industry standard) and that the vehicle is safe. Robotic welding is essential for producing new, advanced, and high-quality cars. As industry repeatability specifications become more precise, robots are meeting them at faster speeds making them more efficient than humans. The top robot models used by automotive manufacturers include the Motoman UP130, UP6, and UP20. Other popular industry robots come from the FANUC R-2000 and ARC Mate series.

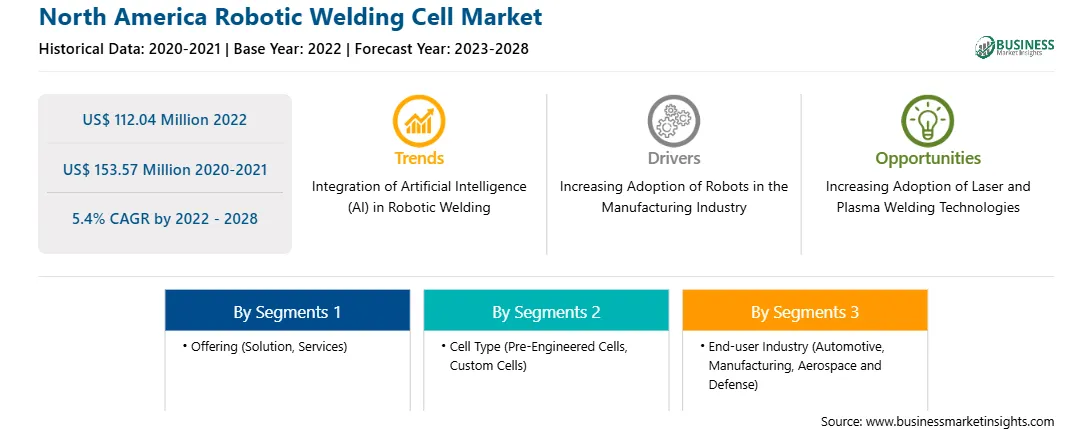

Market Overview

The robotic welding cell market in North America is segmented into the US, Canada, and Mexico. Automation improved the industrial sector drastically, changed the production methods, and reduced the manufacturing time and production cost, allowing welding robot manufacturers to shift to manufacturing intelligent and networked robots compatible with industry 4.0 principles. Additionally, the robotic welding market players adopted various strategic initiatives toward advanced industry 4.0-ready solutions. For instance, in October 2020, Fujitsu; FANUC Corporation; and NTT Communications established DUCNET Co., Ltd. to offer a cloud service for supporting digital transformation (DX) in the machine tool industry and the broader manufacturing industry. However, the growing automation demand across industries and significant technological development are expected to fuel the demand for robotic welding, which is further anticipated to drive the robotic welding market in North America.

Strategic insights for the North America Robotic Welding Cell provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Robotic Welding Cell refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Robotic Welding Cell Strategic Insights

North America Robotic Welding Cell Report Scope

Report Attribute

Details

Market size in 2022

US$ 112.04 Million

Market Size by 2028

US$ 153.57 Million

Global CAGR (2022 - 2028)

5.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Offering

By Cell Type

By End-user Industry

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Robotic Welding Cell Regional Insights

North America Robotic welding Cell Market Segmentation

The North America robotic welding cell market is segmented into offering, cell type, end user, and country.

Based on offering, the market is segmented into solution and services. The solution segment registered the largest market share in 2022. Based on cell type, the market is categorized into pre-engineered cells and custom cells. The pre-engineering segment held the largest market share in 2022. Based on end user, the North America robotic welding cell market is segmented into automotive, manufacturing, and aerospace and defense. The manufacturing segment held the largest market share in 2022. Based on country, the market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022. ABB Ltd; The Lincoln Electric Company; Kuka AG; Kawasaki Heavy Industries, Ltd.; and WEC Group Ltd are the leading companies operating in the robotic welding cell market in the region.

The North America Robotic Welding Cell Market is valued at US$ 112.04 Million in 2022, it is projected to reach US$ 153.57 Million by 2028.

As per our report North America Robotic Welding Cell Market, the market size is valued at US$ 112.04 Million in 2022, projecting it to reach US$ 153.57 Million by 2028. This translates to a CAGR of approximately 5.4% during the forecast period.

The North America Robotic Welding Cell Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Robotic Welding Cell Market report:

The North America Robotic Welding Cell Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Robotic Welding Cell Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Robotic Welding Cell Market value chain can benefit from the information contained in a comprehensive market report.