According to the World Health Organization, workplace stress is the health epidemic of the 21st century. Consumer lifestyle is becoming hectic due to increased work pressure, making them feel exhausted after their regular working hours. Working professionals increasingly prefer convenient and smart household appliances, including kitchen appliances. These appliances help save time and effort in getting through the hectic routine. The food processor is becoming an essential tool in the kitchen as it can easily make a puree and chop, shred, slice, and grind almost all kinds of food. It also helps process the food quickly according to the consumer’s need by changing the blades, and the processors are multifunctional and fast. The food processor works effectively and significantly eases the cooking process even if a user is cooking for many people. Along with this, kitchen appliances come with a requirement for space, and every kitchen may not have enough space. Thus, a small food processor is ideal for a space-crunched kitchen. Small food processors consist of various mechanisms and perform the same function as mid or large-sized counterparts with the added advantage of saving space in the kitchen. Also, due to the COVID-19 pandemic, consumers increasingly adopted convenient kitchen appliances that require less effort. Consumers focused on their health during the COVID-19 pandemic, which led to increased consumption of fresh food and juices. Therefore, there is a growing demand for multifunctional cooking appliances in residential applications. Thus, surging demand for convenient products drives the growth of the residential food processor market.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is driving the growth of North America residential food processors market at a substantial CAGR.

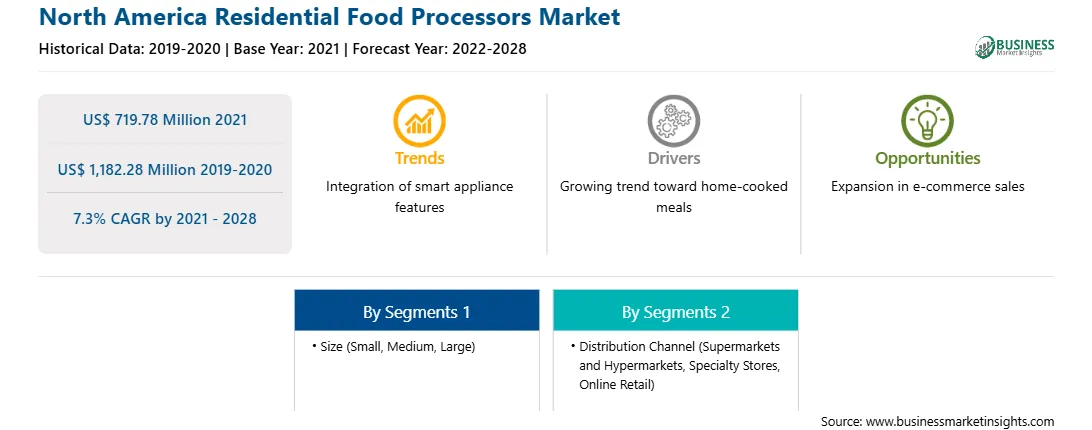

The North America residential food processors market is segmented on the basis of size, distribution channel, and country. Based on size, the market is segmented into small, medium, and large. In 2020, the medium segment held the largest market share; however, the small segment is expected to register the highest CAGR during the forecast period. Based on distribution channel, the North America residential food processors market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. In 2020, the specialty stores treatment segment held the largest market share; however, the supermarkets and hypermarkets segment is expected to register the highest CAGR during the forecast period. Further, based on country, the North America residential food processors market is segmented into the US, Canada, and Mexico. In 2020, the US held the largest market share and is also expected to grow at the fastest CAGR during the forecast period.

Koninklijke Philips N.V.; Whirlpool Corporation; Breville Group Limited; De’Longhi Appliances S.r.l.; Robert Bosch GmbH; MAGIMIX; Groupe SEB; Spectrum Brands, Inc.; Conair Corporation; and SharkNinja Operating LLC are among the leading companies in the North America residential food processors market.

Strategic insights for the North America Residential Food Processors provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 719.78 Million |

| Market Size by 2028 | US$ 1,182.28 Million |

| Global CAGR (2021 - 2028) | 7.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Size

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Residential Food Processors refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Residential Food Processors Market is valued at US$ 719.78 Million in 2021, it is projected to reach US$ 1,182.28 Million by 2028.

As per our report North America Residential Food Processors Market, the market size is valued at US$ 719.78 Million in 2021, projecting it to reach US$ 1,182.28 Million by 2028. This translates to a CAGR of approximately 7.3% during the forecast period.

The North America Residential Food Processors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Residential Food Processors Market report:

The North America Residential Food Processors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Residential Food Processors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Residential Food Processors Market value chain can benefit from the information contained in a comprehensive market report.