The US, Canada, and Mexico are among the major economies in North America. The generation of a huge number of waste tires annually and increasing demand for green products and rubber products are among the factors boosting the recovered carbon black market in the region. North America is one of the top producers of end-of-life tires. More than 50 million tires are manufactured in the region every year. Recovered carbon black is sustainably extracted from end-of-life tires. The US is a major market for recovered carbon black in North America. Tires are one of the most important products recycled in the US. Thus, the rising requirement of tires from the automotive industry fuels the recovered carbon black market growth in North America. The key recovered carbon black market players operating in the region focus on offering high-quality and cost-effective products. Bridgestone Americas, Inc. partnered with Delta-Energy LLC for the use of recovered carbon black to the tire market. Delta-Energy LLC has expertise in green technology that recovers carbon black. Pyrolyx, a recovered carbon black manufacturer, has entered into a five-year agreement with Continental AG for the supply of recycled carbon black. These key developments support the sustainable development initiatives and the recovered carbon black market growth in the region. Ecological benefits of recovered carbon black is the major factor driving the growth of the North America recovered carbon black market.

North America is one of the worst affected economies due to COVID-19 pandemic. The US has the highest number of confirmed cases of COVID-19, compared to Canada and Mexico. The unprecedented rise in number of COVID-19 cases across the US and Canada and the subsequent lockdown of its numerous manufacturing facilities has negatively influenced the growth of various markets. The significant disruption in manufacturing facilities along with raw material sourcing have had a negative impact upon the demand for recovered carbon black in the country. However, the market is reviving on account of significant measures undertaken by the governments such as vaccination drives. With the state of economic recovery, several industrial sectors are strategically planning to invest in advanced products to maximize revenue. This is expected to provide impetus to market growth.

Strategic insights for the North America Recovered Carbon Black provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

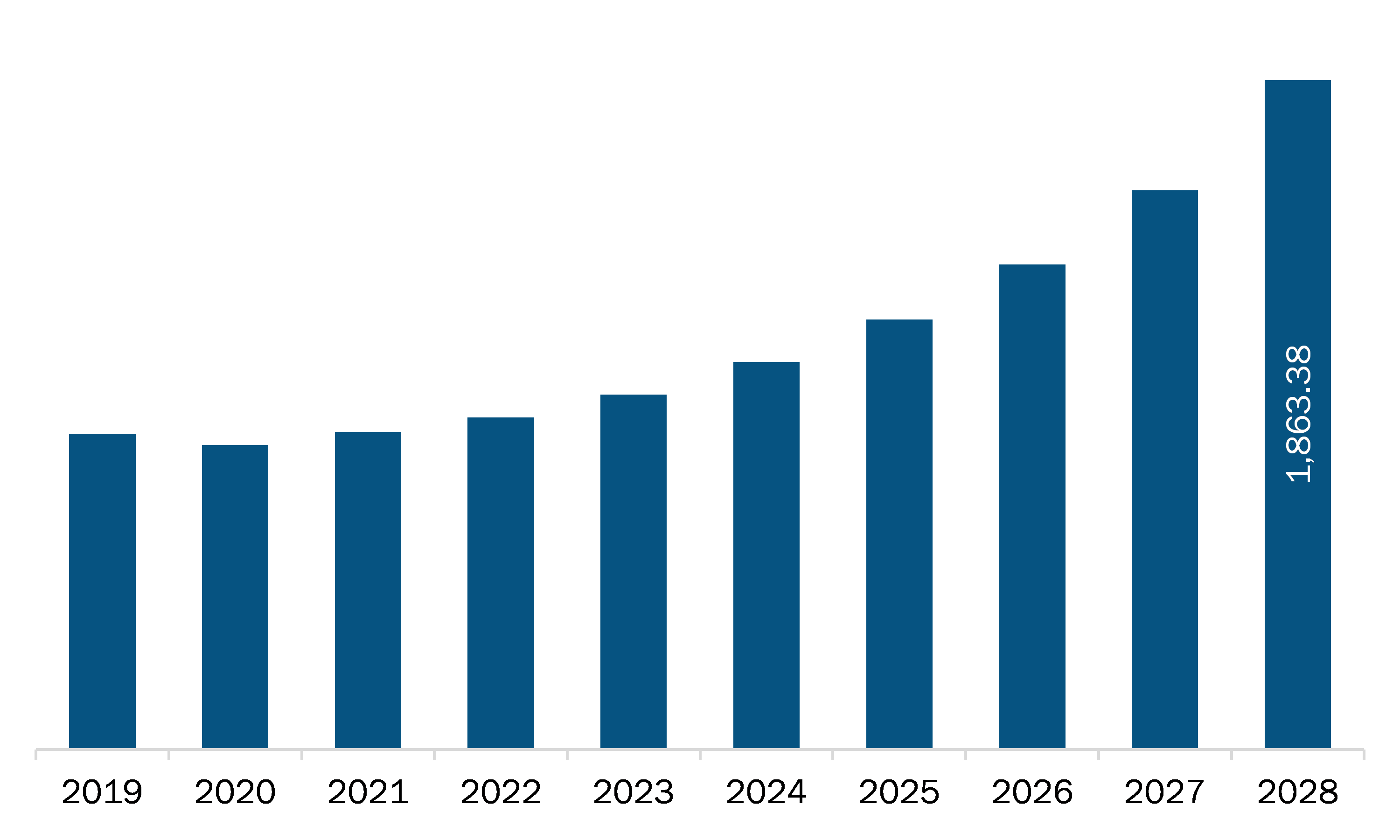

| Market size in 2021 | US$ 884.67 Million |

| Market Size by 2028 | US$ 1,863.38 Million |

| Global CAGR (2021 - 2028) | 11.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Recovered Carbon Black refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The recovered carbon black market in North America is expected to grow from US$ 884.67 million in 2021 to US$ 1,863.38 million by 2028; it is estimated to grow at a CAGR of 11.2% from 2021 to 2028. Waste tires are becoming a major environmental, economic, and technical challenge due to their high content of combustible components and potential to offer valuable materials as well as energy resources. In recent years, a variety of waste tire management methods have been adopted and applied around the world, including other important alternative methods for end of life tire management defined in 3R: reduction, reuse, and recycling to minimize damage, which is a serious threat to the natural environment and the humans. The European Union collects ~3.4 million tons of used tires every year. The tire industry is the largest consumer of virgin carbon black in the EU as it consumes ~1.8 million tons of the same annually, accounting for ~73% of total demand. The production of 1 ton of carbon black requires 1.5–2.0 tons of oil and releases ~2.5–3 tons of CO2. In addition to petroleum, natural gas, and steel, recycled carbon black is used as a key material in the production of tires, conveyor belts, and rubber parts; it is also being used in the production of paints in some cases. By reusing tires, it is possible to reduce CO2 emissions, thereby aiding in waste tire management. Thus, emphasis on waste tire management is giving rise to several key trends that are bound to impact the recovered carbon black market growth in the coming years.

Based on application, North America recovered carbon black market is segmented into tire, non-tire rubber, plastics, and others. The tire segment dominated the market in 2020 and non-tire rubber segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on recovered carbon black market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bolder Industries; Delta Energy LLC; ENRESTEC; Klean Carbon; Pyrolyx AG; and SR2O Holdings, LLC are among others.

The North America Recovered Carbon Black Market is valued at US$ 884.67 Million in 2021, it is projected to reach US$ 1,863.38 Million by 2028.

As per our report North America Recovered Carbon Black Market, the market size is valued at US$ 884.67 Million in 2021, projecting it to reach US$ 1,863.38 Million by 2028. This translates to a CAGR of approximately 11.2% during the forecast period.

The North America Recovered Carbon Black Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Recovered Carbon Black Market report:

The North America Recovered Carbon Black Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Recovered Carbon Black Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Recovered Carbon Black Market value chain can benefit from the information contained in a comprehensive market report.