Rising Approvals of Pulmonary Arterial Hypertension Drugs Drives North America Pulmonary Arterial Hypertension Market

In November 2021, the US Food and Drugs Administration (FDA) granted tentative approval for Yutrepia (treprostinil) inhalation powder. Yutrepia is indicated to treat PAH to improve exercise ability in adult patients with New York Heart Association (NYHA) Functional Class II-III symptoms. In July 2021, The Janssen Pharmaceutical Companies of Johnson & Johnson received the FDA’s approval for UPTRAVI (selexipag) injection for intravenous (IV) to treat pulmonary arterial hypertension (PAH, WHO Group I) in adult patients with WHO functional class (FC) II–III. These patients are temporarily unable to take oral therapy. Similarly, in August 2021, Aerami Therapeutics, Inc. announced that the FDA granted the company an orphan drug designation for imatinib to treat PAH patients. AER–901, a drug-device combination product candidate for inhaled imatinib for the treatment of PAH, completed its Phase 1 trial in 2021. Aerami plans to advance AER-901 into a Phase 2 trial by the first half of 2023, following an amendment to the open AER-901 IND application with the FDA.

In September 2020, Alembic Pharmaceuticals Limited announced that its subsidiary Alembic Global Holdings SA received tentative FDA approval for its Abbreviated New Drugs Application (ANDA) Treprostinil Injection is administered in 20-mL multidose vials in five strengths, containing 50 mg, 20 mg, 100 mg, and 200 mg (2.5 mg/mL, 1 mg/mL, 5 mg/mL, and 10 mg/mL) of treprostinil, respectively. In May 2022, United Therapeutic Corporation received FDA approval for Tyvaso DPI (treprostinil) inhalation powder to treat pulmonary hypertension associated with interstitial lung disease (PH-ILD; WHO Group 3) and pulmonary arterial hypertension (PAH; WHO Group 1) to enhance exercise ability.

Thus, the rising number of pulmonary arterial hypertension drug approvals is boosting the growth of the North America pulmonary arterial hypertension market.

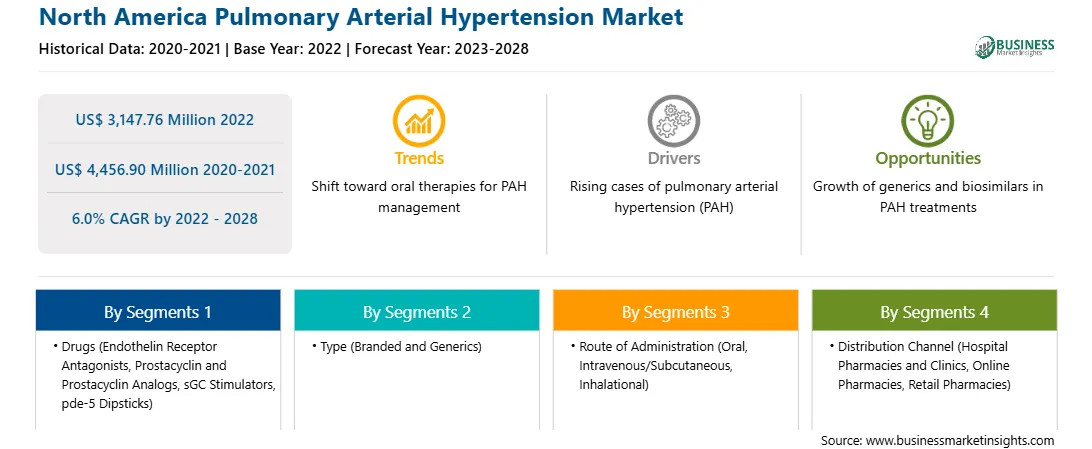

North America Pulmonary Arterial Hypertension Market Overview

The North America pulmonary arterial hypertension market is segmented into the US, Canada, and Mexico. The market growth in this region is attributed due to a surge in health expenditure, the high prevalence of pulmonary arterial hypertension, and a rise in initiatives by the government and manufacturers. The US pulmonary arterial hypertension market holds a significant share in North America. The rising healthcare expenditure is fueling the drug development of pulmonary arterial hypertension (PAH). According to US Centers for Medicare & Medicaid Services, the national healthcare expenditure in the US increased by 9.7% in 2019 and reached US$ 4.1 trillion in 2020. Furthermore, as per the same source, national health spending is expected to grow at a 5.4% annual rate from 2019 to 2028, and it is expected to reach US$ 6.2 trillion by 2028. The rising healthcare expenditure is estimated to increase the research and development of PAH drugs due to the availability of limited drugs in the market for treating PAH.

According to the American Lung Association, PAH is a rare and progressive disorder that accounts for ~500-1000 new cases being diagnosed each year in the US. Additionally, as per the same source, approximately 15-20% of PAH patients are suffering from heritable PAH, which is caused by genetic mutations. Further, manufacturers are taking various initiatives to provide information and resources to healthcare practitioners, fueling the market growth. For instance, the PAH Initiative, supported by United Therapeutics, provides resources and information to assist healthcare providers in treating patients impacted by PAH. Thus, the rising cases of PAH diagnosed each year and initiatives undertaken by drug manufacturers fuel the demand for pulmonary arterial hypertension drugs and other treatment methods, further bolstering the pulmonary arterial hypertension market growth in the US.

Strategic insights for the North America Pulmonary Arterial Hypertension provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3,147.76 Million |

| Market Size by 2028 | US$ 4,456.90 Million |

| Global CAGR (2022 - 2028) | 6.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Drugs

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Pulmonary Arterial Hypertension refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Pulmonary Arterial Hypertension Market Segmentation

The North America pulmonary arterial hypertension market is segmented on the basis of drugs, type, route of administration, distribution channel, and country.

Based on drugs, the North America pulmonary arterial hypertension market is segmented into endothelin receptor antagonists (ERAs), prostacyclin and prostacyclin analogs, sGC stimulators, and pde-5 dipsticks. In 2022, the prostacyclin and prostacyclin analogs segment registered the largest share in the North America pulmonary arterial hypertension market.

Based on type, the North America pulmonary arterial hypertension market is bifurcated into branded and generics. In 2022, the branded segment registered a larger share in the North America pulmonary arterial hypertension market.

Based on route of administration, the North America pulmonary arterial hypertension market is segmented into oral, intravenous/subcutaneous, and inhalational. In 2022, the oral segment registered the largest share in the North America pulmonary arterial hypertension market.

Based on distribution channel, the North America pulmonary arterial hypertension market is segmented into hospital pharmacies and clinics, online pharmacies, and retail pharmacies. In 2022, the hospital pharmacies and clinics segment registered the largest share in the North America pulmonary arterial hypertension market.

Based on country, the North America pulmonary arterial hypertension market is segmented into the US, Canada, and Mexico. In 2022, the US registered the largest share in the North America pulmonary arterial hypertension market.

Aerami Therapeutics Holdings Inc, Bayer AG, Gilead Sciences Inc, GSK Plc, Johnson & Johnson, Lupin Ltd, Novartis AG, Pfizer Inc, Teva Pharmaceutical Industries Ltd, and United Therapeutics Corp are the leading companies operating in the North America pulmonary arterial hypertension market.

The North America Pulmonary Arterial Hypertension Market is valued at US$ 3,147.76 Million in 2022, it is projected to reach US$ 4,456.90 Million by 2028.

As per our report North America Pulmonary Arterial Hypertension Market, the market size is valued at US$ 3,147.76 Million in 2022, projecting it to reach US$ 4,456.90 Million by 2028. This translates to a CAGR of approximately 6.0% during the forecast period.

The North America Pulmonary Arterial Hypertension Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Pulmonary Arterial Hypertension Market report:

The North America Pulmonary Arterial Hypertension Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Pulmonary Arterial Hypertension Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Pulmonary Arterial Hypertension Market value chain can benefit from the information contained in a comprehensive market report.