North America comprises significant economies such as the US, Canada, and Mexico. The growth of the North America protective cultures market is attributed to the rising per capita consumption of dairy products, increasing requirement of packaged food products with extended shelf life, and growing awareness amongst the health-conscious people about the consumption of minimally processed and preservative-free food and beverage products across the region. According to the US Department of Agriculture Economic Research Services (ERS) calculations, in 2019, the per capita consumption of dairy products in the US was over 650 pounds per person, and out of these cheese, butter, and yogurt are driving significant growth in consumption. With the increasing consumption of dairy products across the region, the need for sustainable dairy products with shorter ingredient lists and greater transparency in product labelling is rising. According to industry experts, North American consumers are willing to pay extra for products with natural and sustainable ingredients. Protective cultures are food-grade bacteria that give appropriate body, texture, and flavor to the food products and limit the growth of undesirable microorganisms through the synthesis of low molecular mass chemicals. These cultures have been granted as the GRAS (Generally Regarded As Safe) status by the US Food and Drug Administration (FDA). Initially, manufacturers used to employ artificial preservatives in dairy products, such as cheese, milk, and yogurt, to extend their shelf life. However, in recent years, the clean label trend has propelled the incorporation of natural additives and ingredients in processed dairy products. Surging demand for clean label products is driving the growth of the protective cultures market across North America. Protective cultures are also incorporated in processed poultry and meat products to inhibit the growth of pathogenic micro-organisms, which extends their shelf life. The demand for processed meat products is surging in the US, Canada, and Mexico owing to the changing consumption patterns of consumers and the high availability of processed meat products in the retail stores across the countries, which is driving the growth of the protective cultures market across North America. Manufacturers of meat and dairy products are employing protective cultures as preservatives in the products owing to the rising trend of using natural ingredients. This factor is expected to provide lucrative growth opportunities to the manufacturers of protective cultures in the coming years. Furthermore, pet food and animal feed manufactures are concerned about a few factors such as the improving palatability of the food or feed, maintaining freshness, and controlling mold growth. Protective cultures are employed in pet food and animal feed to inhibit the growth of mold and fungi and enhance their palatability while maintaining their freshness. These cultures also ensure the clean label concerns of the manufacturers and the consumers. The rising inclination of consumers in North America toward clean label pet food products and animal feed is projected to open lucrative opportunities for the protective cultures market during the forecast period.

North America is one of the worst-affected economies due to the COVID-19 pandemic. The US reported the highest number of confirmed cases of COVID-19, followed by Canada and Mexico. However, the COVID-19 pandemic has had a relatively positive impact on the protective cultures market. The pandemic helped to develop more awareness and interest in the microbial cultures. It has been a disagreeable and a stressful time for most of the population across the world, and therefore the people have started consuming clean label products. The COVID-19 pathophysiology has changed the consumer’s perception of clean beyond labels or products. They continue to maintain their focus on clean label for at-home as well as out-of-home purchases.

Strategic insights for the North America Protective Cultures provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 54.62 Million |

| Market Size by 2028 | US$ 106.25 Million |

| Global CAGR (2021 - 2028) | 10.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Target Microorganism

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Protective Cultures refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

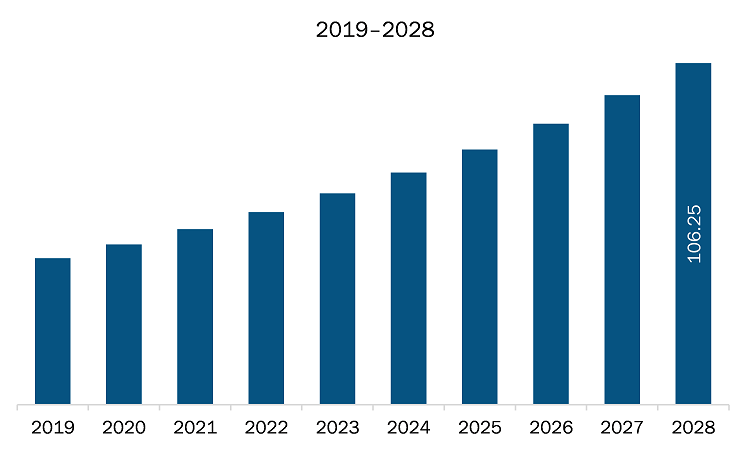

The protective cultures market in North America is expected to grow from US$ 54.62 million in 2021 to US$ 106.25 million by 2028; it is estimated to grow at a CAGR of 10.0% from 2021 to 2028. Emergence of animal feed as lucrative application; Animal feed products improve animals' health. Rapid urbanization and increasing consumption of meat and other end products, such as eggs and milk, across diverse regions stimulate the growth of the animal feed market. The animal feed helps enhance the animal's abilities by providing enriched nutrients and feedstuff, which accelerate growth and weight gain and strengthen immunity. Outbursts of diseases in animals are bolstering the adoption of animal feed as it heightens the animals' health and proper regulation of the food chain. Moreover, the high growth in the animal feed market is supported by the growth strategies of significant players in the form of investments and expansions, which helps them enhance the product portfolio and reach out to new target markets. Moreover, protective cultures have application in formulating clean label animal feed and pet foods. Animal feed manufacturers are focusing on evolving specialty cultures for animal feed. In recent years, silage producers in Europe have been using microbial strains to inhibit the growth of pathogenic micro-organisms in silage. For instance, DeLaval Inc. offers Feedtech Silage F3000, a bacterial culture that safeguards mold, clostridia, and yeast from developing and destroying the silage. Such rising initiatives by manufacturers for developing protective cultures for animal feed preservation are projected to create lucrative opportunities for the protective cultures market during the forecast period. This is bolstering the growth of the protective cultures market.

Based on target microorganism, the North America protective cultures market is bifurcated into bacteria, and yeasts & molds. In 2020, the yeasts & molds segment held the largest share North America protective cultures market. Based on application the market is divided into food processing and animal feed. The food processing segment accounts for largest market share in the 2020. Similarly, based on food processing, the market is bifurcated into dairy products

A few major primary and secondary sources referred to for preparing this report on the protective cultures market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bioprox, Chr. Hansen Holding A/S, DSM, Lallemand Inc., International Flavors & Fragrances Inc., Kerry Group and Sacco System among others.

The North America Protective Cultures Market is valued at US$ 54.62 Million in 2021, it is projected to reach US$ 106.25 Million by 2028.

As per our report North America Protective Cultures Market, the market size is valued at US$ 54.62 Million in 2021, projecting it to reach US$ 106.25 Million by 2028. This translates to a CAGR of approximately 10.0% during the forecast period.

The North America Protective Cultures Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Protective Cultures Market report:

The North America Protective Cultures Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Protective Cultures Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Protective Cultures Market value chain can benefit from the information contained in a comprehensive market report.