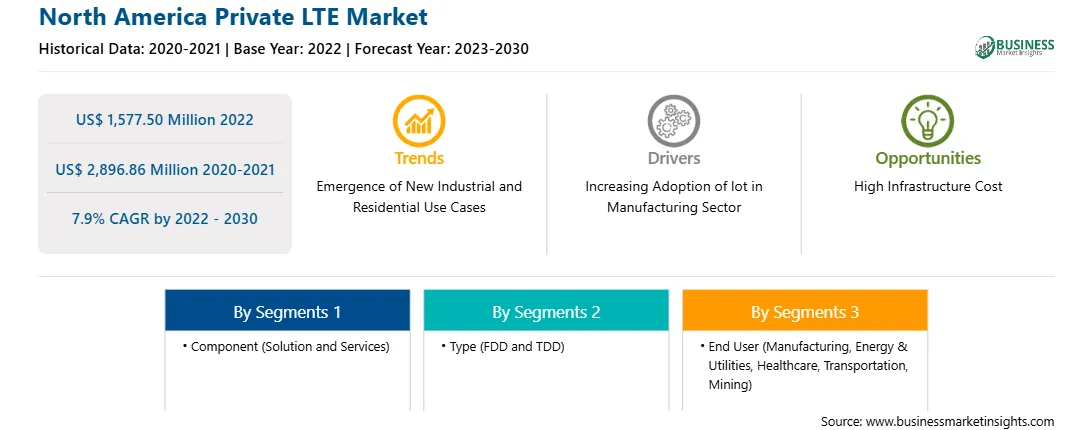

The North America private LTE market was valued at US$ 1,577.50 million in 2022 and is expected to reach US$ 2,896.86 million by 2030; it is estimated to grow at a CAGR of 7.9% from 2022 to 2030.

The increasing adoption of Industry 4.0, industrial IoT, and automated technology are significantly fueling the demand for the private LTE market. The continuous advancements in connectivity are the key parameters positively influencing the market. An increasing number of connected devices in the manufacturing sector are generating massive amounts of data, which needs to be analyzed effectively for smooth business operations. The growing investments in machine-to-machine (M2M) and traditional IoT have enabled a significant increase in the economies of scale that drive the adoption of private LTE across the sector.

Private LTE service providers highly focus on offering personal LTE services for the manufacturing sector worldwide. The market is witnessing various initiatives for the development of advanced private LTE solutions for the manufacturing sector. For instance, in 2023, DXC Technology and Nokia launched DXC Signal Private LTE and 5G. It is a managed, secure private wireless network and digitalization platform solution that aids in the digital transformation of industrial firms' operations. The goal of DXC Signal Private LTE and 5G is to address the rising need for private wireless networks in important industry sectors such as manufacturing. Also, in 2023, the world's largest provider of IT infrastructure services, Kyndryl, and the leader in cutting-edge networking technology, Nokia, announced a three-year extension as well as an expansion of their global network and edge partnership. The primary goals of this partnership are to develop and provide customers worldwide with Industry 4.0 solutions and industry-leading LTE and 5G private wireless services. In February 2022, Kyndryl and Nokia formed their collaboration for edge computing and global networks. Since then, the relationship has expanded rapidly, and it now has over 100 ongoing partnerships with multinational corporations ranging from testing or consulting to complete implementation across 24 countries through piloting. 90% of the current engagements are businesses in the industrial manufacturing sector, including multinational mining, petrochemical, and timber, as well as utilities/energy companies. These businesses share a common vision and are committed to assisting enterprise and mission-critical infrastructure customers in accelerating their digital transformations with cutting-edge LTE and 5G private wireless networking. Thus, owing to the above parameters increasing adoption of IoT in manufacturing sector is a potential driver for the private LTE market.

North America is segmented into the US, Canada, and Mexico. The US is a developed country in terms of modern technology, the standard of living, and infrastructure. Across North America, technological advancements have led to highly competitive markets. With the increasing customer demand for high-quality products and services, the market players are constantly focusing on innovating to serve their customers in the best possible way. The Internet plays a critical business function in North America, particularly in the US. As per the Bureau of Economic Analysis, in 2022, the US manufacturing sector was one of the world's largest, valued at US$ 2.55 trillion. The country is now shifting toward the development across the banking and finance sectors and growth in the telecommunication sector owing to the increasing implementation of LTE. The US manufacturing industry is anticipated to grow faster during the forecast period due to several favorable factors, including rising adoption of IoT, enhanced productivity due to the presence of advanced technologies, decreasing oil & gas prices, mounting labor costs in emerging markets, and availability of better LTE connectivity to companies for collecting real-time data and communicating with others remotely.

In 2021, the US Federal Communications Commission (FCC) revealed a band of the radio spectrum that permits communication service providers such as neutral hosts and businesses to transform how enterprises obtain local mobile connectivity, along with enhanced security and quality from this connectivity. Private long-term evolution (LTE) networks are localized systems mainly designed to aid government education or specific business purposes with enhanced features through this connectivity. Similarly, the Citizens Broadband Radio Service (CBRS) Alliance was introduced by the Federal Communications Commission (FCC), which permits the commercial use of the 3.5 GHz band by the military and fixed satellite stations across the US. According to the CBRS plan, a three-tiered system was announced for dictating and coordinating with the assigned spectrum. The three-tiered system includes Incumbent, General Authorized Access (GAA) users, and Priority Access License (PAL). All such strategic plans enhance the requirement for private LTE across industries such as manufacturing, oil & gas, and telecommunication.

Major private LTE providers in the region include CommScope Inc.; Future Technologies, Inc.; NetNumber, Inc.; and Cisco Systems, Inc.

Strategic insights for the North America Private LTE provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Private LTE refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Private LTE Strategic Insights

North America Private LTE Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,577.50 Million

Market Size by 2030

US$ 2,896.86 Million

Global CAGR (2022 - 2030)

7.9%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Component

By Type

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Private LTE Regional Insights

The North America private LTE market is segmented based on component, type, end user, and country.

Based on component, the North America private LTE market is segmented into solution and services. The solution segment held a larger market share in 2022. The services segment is further bifurcated into professional and managed services.

Based on type, the North America private LTE market is bifurcated into FDD and TDD. The FDD segment held a larger market share in 2022.

Based on end user, the North America private LTE market is segmented into manufacturing, energy & utilities, healthcare, transportation, mining, and others. The manufacturing segment held the largest market share in 2022.

Based on country, the North America private LTE market is segmented into the US, Canada, and Mexico. The US dominated the North America private LTE market share in 2022.

Cisco Systems Inc, Telefonaktiebolaget LM Ericsson, Huawei Investment & Holding Co Ltd, Samsung Group, Verizon Communications Inc, CommScope Holding Co Inc, Future Technologies Inc, Star Solutions, Sierra Wireless Inc, and Kyndryl Holdings Inc are some of the leading companies operating in the North America private LTE market.

The North America Private LTE Market is valued at US$ 1,577.50 Million in 2022, it is projected to reach US$ 2,896.86 Million by 2030.

As per our report North America Private LTE Market, the market size is valued at US$ 1,577.50 Million in 2022, projecting it to reach US$ 2,896.86 Million by 2030. This translates to a CAGR of approximately 7.9% during the forecast period.

The North America Private LTE Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Private LTE Market report:

The North America Private LTE Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Private LTE Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Private LTE Market value chain can benefit from the information contained in a comprehensive market report.