North America Power System Analysis Software Market

No. of Pages: 134 | Report Code: BMIRE00028536 | Category: Technology, Media and Telecommunications

No. of Pages: 134 | Report Code: BMIRE00028536 | Category: Technology, Media and Telecommunications

People and businesses are highly dependent on electricity for almost all operations. Therefore, there is a need for constant and uninterrupted power supply. However, there is a surge in power outages worldwide due to changing weather conditions, storms, and aging power infrastructure. For instance,

Power system analysis software can help to predict the outage situation due to bad weather. It quickly analyzes the location of the damaged network and the extent of the damage. It monitors the damage situation and suggests the necessary actions. It suggests resource needs, dispatches the repair crews, and communicates key damage and restoration information internally and externally. Therefore, the rise in the cases of power outages worldwide is boosting the demand for power system analysis software to better manage power generation, transmission, and distribution, thereby contributing to the North America power system analysis software market growth.

Based on country, the North America power system analysis software market is segmented into the US, Canada, and Mexico. The US and Canada are pioneers in adopting new technologies and automation across their businesses. The high penetration of the internet across the region, coupled with government initiatives to promote the adoption of digital technologies for smooth and seamless business operations and minimizing human errors, is catalyzing the adoption of power system analysis software across North America. Due to rise in energy demand in the region, power system analysis services are crucial software systems today. Additionally, the region has a robust coal production sector for electricity generation, which boosts the adoption of power system analysis software. According to the US Energy Information Administration, the coal production in the US was 139.97 million metric tons [154.3 million short tons (MMst)] in the third quarter of 2022, which is an increase of 5.9% than the second quarter of 2022 and a growth of ~4.0% compared to the third quarter of 2021. The government is looking for a better solution to generate electricity and reduce CO2 emissions. For instance, a report by International Energy Agency (IEA) in November 2022 stated that IEA's Net Zero Emissions by 2050 aims to reduce the use of coal and look for newer technologies. Moreover, the region is adopting hydropower electricity generation as it is one of the clean sources of energy and is extensively used for power system flexibility and resilience. These factors are contributing to the increase in demand for power system analysis software across the power generation industry in the region. Furthermore, the region has a significant presence of power system analysis software market players such as ARTELYS; PowerWorld Corporation; Opal RT Technologies; Trimble Inc.; Operation Technology, Inc.; and GENERAL ELECTRIC. Strategies adopted by these companies to expand their market share and geographical presence are further contributing to the growth of the North America power system analysis software market.

Strategic insights for the North America Power System Analysis Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

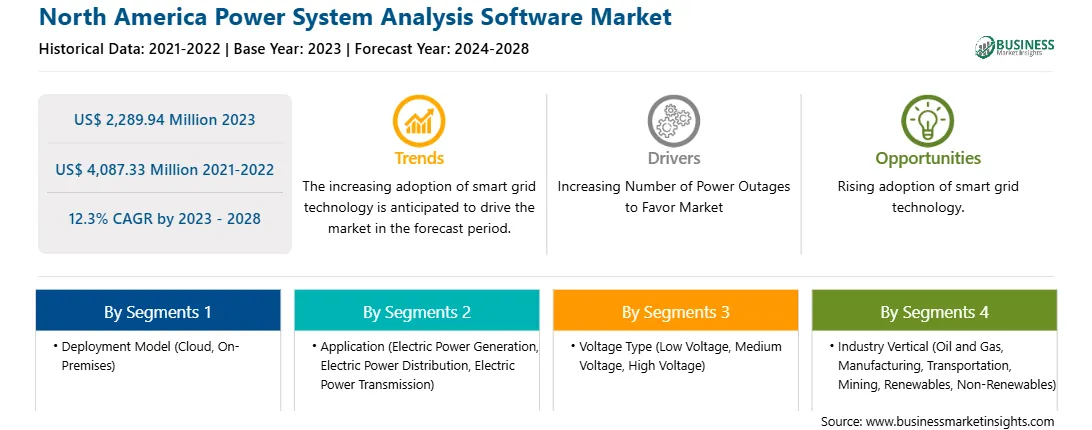

| Market size in 2023 | US$ 2,289.94 Million |

| Market Size by 2028 | US$ 4,087.33 Million |

| Global CAGR (2023 - 2028) | 12.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2028 |

| Segments Covered |

By Deployment Model

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Power System Analysis Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Power System Analysis Software Market Segmentation

The North America power system analysis software market is segmented into deployment model, application, voltage type, industry vertical, and country.

Based on deployment model, the North America power system analysis software market is bifurcated into cloud and on-premises. In 2023, the on-premises segment registered a larger share in the North America power system analysis software market.

Based on application, the North America power system analysis software market is segmented into electric power generation, electric power distribution, and electric power transmission. In 2023, the electric power generation segment registered a largest share in the North America power system analysis software market.

Based on voltage type, the North America power system analysis software market is segmented into low voltage, medium voltage, and high voltage. In 2023, the low voltage segment registered a largest share in the North America power system analysis software market.

Based on industry vertical, the North America power system analysis software market is segmented into oil and gas, manufacturing, transportation, mining, renewables, non-renewables, and others. In 2023, the oil and gas segment registered a largest share in the North America power system analysis software market.

Based on country, the North America power system analysis software market is segmented into the US, Canada, and Mexico. In 2023, the US segment registered a largest share in the North America power system analysis software market.

ABB Ltd; DIgSILENT GmbH; General Electric Co; Neplan AG; Operation Technology Inc; RINA SpA; Schneider Electric SE; Siemens AG; and Trimble Inc are the leading companies operating in the North America power system analysis software market.

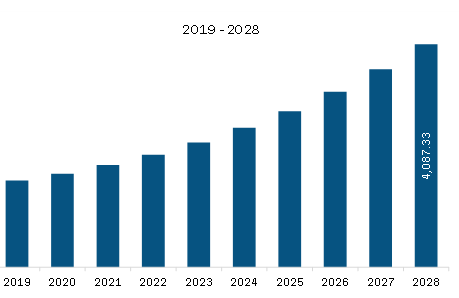

The North America Power System Analysis Software Market is valued at US$ 2,289.94 Million in 2023, it is projected to reach US$ 4,087.33 Million by 2028.

As per our report North America Power System Analysis Software Market, the market size is valued at US$ 2,289.94 Million in 2023, projecting it to reach US$ 4,087.33 Million by 2028. This translates to a CAGR of approximately 12.3% during the forecast period.

The North America Power System Analysis Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Power System Analysis Software Market report:

The North America Power System Analysis Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Power System Analysis Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Power System Analysis Software Market value chain can benefit from the information contained in a comprehensive market report.