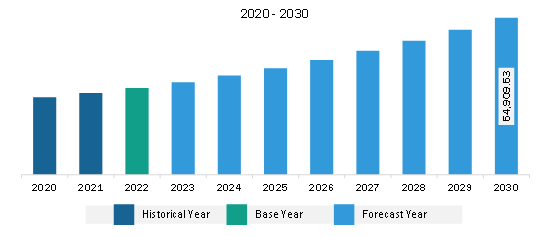

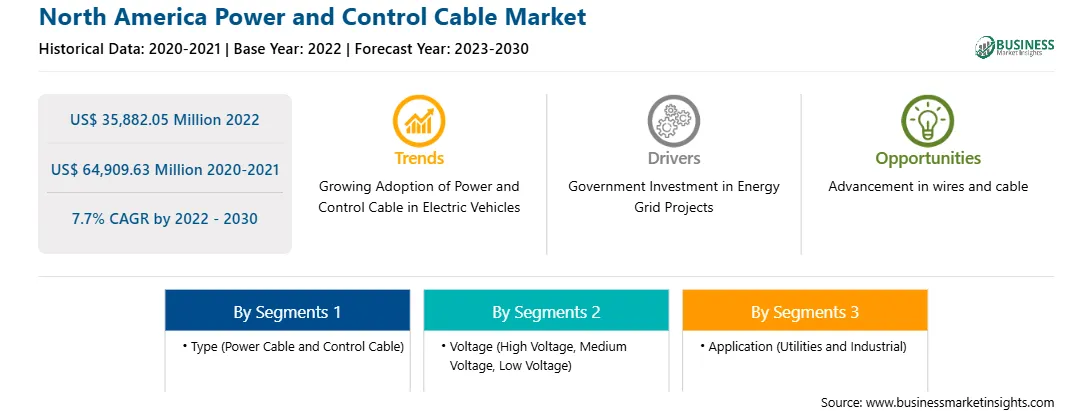

The North America power and control cable market was valued at US$ 35,882.05 million in 2022 and is expected to reach US$ 64,909.63 million by 2030; it is estimated to grow at a CAGR of 7.7% from 2022 to 2030.

Increasing Demand for Data Center and Cloud Computing Fuels the North America Power and Control Cable Market

The growth of data centers and technology-driven industries propelled the need for power and control cables to ensure uninterrupted power supply and data transmission. The cables are crucial to maintain the functioning of critical infrastructure. As the demand for data storage and processing continues to rise, more data centers are being built. These facilities require extensive power and control cable systems to distribute electricity and manage various systems and equipment. Modern data centers are designed to accommodate high-power-density servers and equipment. This generates a huge scope for power cable systems capable of handling larger electrical loads safely and efficiently. Lately, several data centers have been installed. In February 2023, AWS announced AWS Modular Data Center for the US Department of Defense Joint Warfighting Cloud Capability. The installations of data centers with high power density and critical capacities require power cables. Also, Schneider Electric and Compass Datacenters have announced a multi-year partnership valued at US$ 3 billion. The firms' current cooperation, which integrates their separate supply chains to produce and distribute prefabricated modular data center solutions, is extended by this arrangement. - Further, Skanska signed an agreement with an existing client to construct a US$ 171 million data center in Atlanta, US. Therefore, the growing data center industry relies heavily on power and control cables to ensure reliable, efficient, and safe operations. As data centers evolve and expand, the demand for these cables is expected to increase significantly in the coming years.

North America Power and Control Cable Market Overview

North America comprises economies such as the US, Canada, and Mexico. Per the World Bank, the region presently has a population of ~500 million, with an ever-increasing demand for electricity. Electricity demand is promoting the requirement for the upgradation and expansion of the region's transmission and distribution (T&D) grids. Additionally, smart grids are being implemented rapidly in Canada and Mexico to modernize the safe and secure delivery of electricity. The US electric grid consists of more than 9,200 electric generating units, generating a capacity of above 1 million megawatts and connected through ~965,600 km of transmission lines. However, even with the establishment of such massive infrastructure, the electricity demand is still unmet. Hence, the US Department of Energy (DoE) is constantly focusing on improving the electricity supply infrastructure through the Grid Modernization Initiative (GMI). In August 2023, the DOE announced up to US$ 39 million for projects across DOE's National Laboratories to help modernize the electricity grid. It includes the Medium Voltage Resource Integration Technologies (MERIT) project, led by Oak Ridge National Laboratory (ORNL). MERIT supports the development of cost-effective, modular, and scalable medium voltage (MV) (4.16 kV to 34.5 kV) technologies that can integrate a range of distributed energy resources (solar, wind, fuel cells, etc.) onto the grid. Another similar funding opportunity was announced by the DOE in April 2023, worth US$ 38 million. It included the Power and Controls Electronics (PACE) project, which addressed gaps in "smart" MV electrical interfaces critical to a modernized grid through advances in modular, scalable, and cost-effective MV power and control electronics sub-system approach. Such supportive initiatives from the government are strongly promoting the demand for various cables in the US.

The Government of Canada claims that electricity systems will be the backbone of the country's net-zero economy and is committed to achieving its emissions-reduction targets under the Paris Agreement. Hence, the government is promoting the adoption of electric vehicles (EVs) and consumer electronics among the industry stakeholders. In May 2022, Stellantis announced its plan to invest US$ 2.8 billion in two Canadian EV manufacturing plants to increase their production capacity. The governments of Canada and Ontario supported such plans by announcing investments of up to US$ 410.7 million and US$ 398 million, respectively, in the domestic production of EVs and to mitigate the supply chain constraints. With the increasing adoption of EVs in the country, EV charging infrastructure is also gaining momentum. Similarly, citizens have been opting for electric heat pumps over gas/fuel-powered pumps, leading to a boost in demand for electricity consumption. All such factors drive the demand for various power and control cables in the region.

The electricity T&D infrastructure of Mexico has been under development, and it directly hampers the progress of the clean energy transition strategy. The country is focusing on modernizing and expanding its electrical infrastructure to meet the energy demands of various industries. In April 2023, the Mexican government agreed to purchase 13 power plants from Spanish energy giant Iberdrola in a deal worth ~US$ 6 billion. Post the COVID-19 pandemic, during which several corporations in the region struggled with supply chain distribution, the country has been focusing on offering them a "nearshoring" solution. According to 2022 estimates by the Inter-American Development Bank (IDB), Mexico's share in nearshoring can record US$ 35.3 billion annually. US-based corporations from vital industries that offer products such as batteries, minerals, medical devices, medicines, and semiconductors are interested in mitigating future supply chain challenges by favoring neighboring countries for manufacturing expertise. Additionally, the Inflation Reduction Act of 2022, passed in the US, allocated US$ 369 billion for investment in sustainable energy and electric battery technology, which also supports nearshoring. Such opportunities are expected to boost the growth of the industrial sector of Mexico in the coming years, leading to a high demand for various power and control cables.

North America Power and Control Cable Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Power and Control Cable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 35,882.05 Million |

| Market Size by 2030 | US$ 64,909.63 Million |

| Global CAGR (2022 - 2030) | 7.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Power and Control Cable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Belden Inc

2. Encore Wire Corp

3. Furukawa Electric Co Ltd

4. HENGTONG GROUP CO., LTD.

5. LEONI AG

6. Nexans SA

7. Prysmian SpA

8. Southwire Company LLC

9. Sumitomo Electric Industries Ltd

The North America Power and Control Cable Market is valued at US$ 35,882.05 Million in 2022, it is projected to reach US$ 64,909.63 Million by 2030.

As per our report North America Power and Control Cable Market, the market size is valued at US$ 35,882.05 Million in 2022, projecting it to reach US$ 64,909.63 Million by 2030. This translates to a CAGR of approximately 7.7% during the forecast period.

The North America Power and Control Cable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Power and Control Cable Market report:

The North America Power and Control Cable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Power and Control Cable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Power and Control Cable Market value chain can benefit from the information contained in a comprehensive market report.