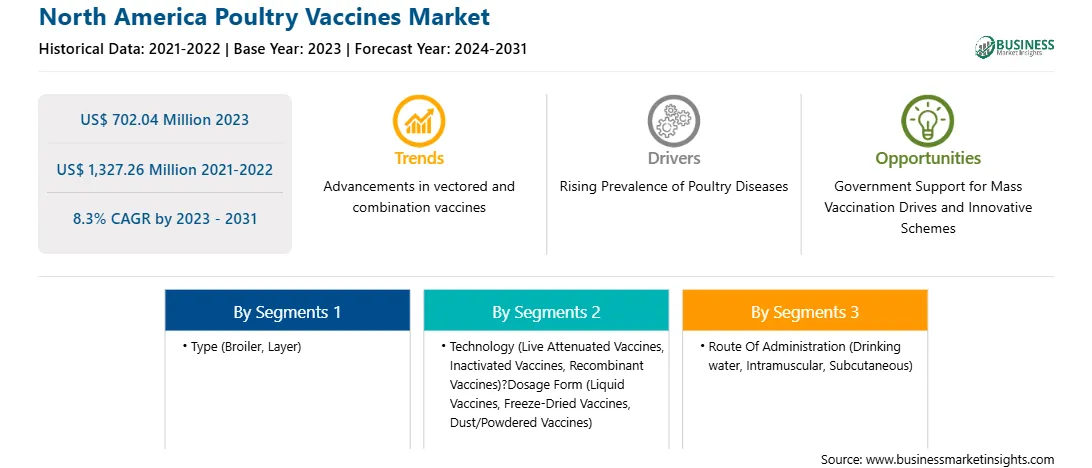

The North America poultry vaccines market was valued at US$ 702.04 million in 2023 and is expected to reach US$ 1,327.26 million by 2031; it is estimated to record a CAGR of 8.3% from 2023 to 2031.

Poultry production results in producing different types of animal proteins through eggs and meat. With rising poultry production, there are high chances of susceptibility to several zoonotic diseases such as “Fowl disease” that might result in huge economic losses, particularly in developing countries. For example, chickens are more prone to bacterial, viral, parasitic, and fungal infections. These viral outbreaks can cause Newcastle Disease, Avian Influenza, Infectious Bursal Disease, and other diseases in other poultry animals.

The table below provides disease outbreaks of Avian Influenza among mammals across Canada in 2022.

| ||

Country | Poultry Diseases | Disease Outbreak (2022) |

Canada | 40 | |

Canada | H5N5 | 2 |

|

|

|

Source: World Organization for Animal Health 2023

Poultry diseases are a major cause of death of chicks and also lead to reduced livestock productivity of chickens. Farmers are facing huge economic losses worldwide as they spread zoonotic diseases, posing a serious health risk to mammals. For example, poultry coccidiosis is one of the most common diseases across the globe; it leads to huge losses associated with mortality, reduced body weight, and extra expenses related to preventive and therapeutic control. As per the DSM company website, farmers face an economic loss of US$ 3 billion annually owing to coccidiosis in chickens and avian species worldwide. Newcastle disease is also considered an economically expensive disease causing huge production losses to the farmers of developing countries that export poultry products.

Therefore, the rising prevalence of poultry diseases resulting in huge economic losses boosts the demand for poultry vaccinations, which drives the market.

North America accounts major share for poultry vaccines market. Among the North America regional market, US accounts maximum share due to presence of top companies in the country and well-established centers providing vaccination services. Such aforementioned facts are one of the key factors that influence market growth in the region for the forecast period.

Strategic insights for the North America Poultry Vaccines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 702.04 Million |

| Market Size by 2031 | US$ 1,327.26 Million |

| Global CAGR (2023 - 2031) | 8.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Poultry Vaccines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America poultry vaccines market is categorized into type, technology, dosage form, disease, route of administration, end user, and country.

Based on type, the North America poultry vaccines market is bifurcated into broiler and layer. The broiler segment held a larger market share in 2023.

In terms of technology, the North America poultry vaccines market is categorized into live attenuated vaccines, inactivated vaccines, and recombinant vaccines. The live attenuated vaccines segment held the largest market share in 2023.

By dosage form, the North America poultry vaccines market is segmented into liquid vaccines, freeze-dried vaccines, and dust/powdered form vaccines. The liquid vaccines segment held the largest market share in 2023.

Based on disease, the North America poultry vaccines market is segmented into avian influenza, infectious bronchitis, Marek's disease, avian salmonellosis, infectious bursal disease (IBD), Newcastle disease, and others. The avian influenza segment held the largest market share in 2023.

In terms of route of administration, the North America poultry vaccines market is categorized into drinking water (D/W), intramuscular (I/M), subcutaneous (I/S), and others. The drinking water (D/W) segment held the largest market share in 2023.

Based on end user, the North America poultry vaccines market is segmented into poultry farms & hatchery, veterinary hospitals, and poultry vaccination enters & clinics. The poultry farms & hatchery segment held the largest market share in 2023.

By country, the North America poultry vaccines market is segmented into the US, Canada, and Mexico. The US dominated the North America poultry vaccines market share in 2023.

Starkey Laboratories Inc., Audina Hearing Instruments Inc, Sebotek Hearing Systems LLC, Earlens Corp, GN Store Nord AS, Cochlear Ltd, WS Audiology AS, Sonova Holding AG, Sonic Innovations Inc, and Amplifon Hearing Health Care Corp. are some of the leading companies operating in the North America poultry vaccines market.

The North America Poultry Vaccines Market is valued at US$ 702.04 Million in 2023, it is projected to reach US$ 1,327.26 Million by 2031.

As per our report North America Poultry Vaccines Market, the market size is valued at US$ 702.04 Million in 2023, projecting it to reach US$ 1,327.26 Million by 2031. This translates to a CAGR of approximately 8.3% during the forecast period.

The North America Poultry Vaccines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Poultry Vaccines Market report:

The North America Poultry Vaccines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Poultry Vaccines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Poultry Vaccines Market value chain can benefit from the information contained in a comprehensive market report.