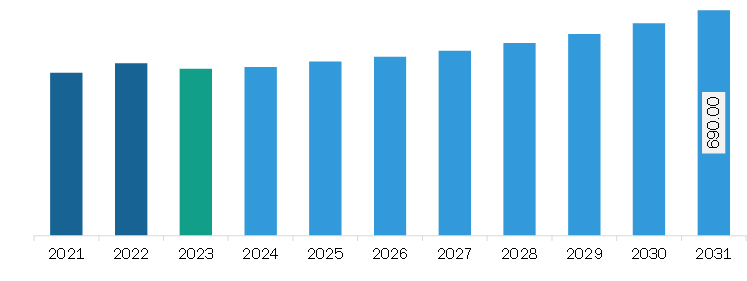

The North America polyacrylic acid market was valued at US$ 510.52 million in 2023 and is expected to reach US$ 690.00 million by 2031; it is estimated to register a CAGR of 3.8% from 2023 to 2031.

Water and wastewater treatment is becoming increasingly important in many countries and regions across the world. According to the Environmental Protection Agency (EPA), the wastewater treatment facilities in the US process ~34 billion gallons of wastewater every day. Further, in August 2022, the United States Department of Agriculture (USDA) announced a US$ 75 million investment in infrastructure improvements that involves providing clean drinking water and sanitary wastewater systems to Greenbrier County residents in the rural area. In December 2022, the US announced a US$ 84.7 million investment from President Biden's Bipartisan Infrastructure Act to help 36 communities in drought. Also, in March 2022, the US Department of the Interior stated that the Bureau of Reclamation invested US$ 420 million in rural water-building efforts in fiscal year 2022. This investment in rural water systems involves work associated with pipeline connections, the building of water treatment facilities and intakes, pump systems, reservoir construction, and other activities to deliver potable water to rural and tribal populations. These projects have brought clean, dependable drinking water to communities across the West of the US by investing in rainwater harvesting, groundwater storage, water reuse, aquifer recharge, ion exchange treatment, and other methods for extending the utilization of existing water supplies.

Polyacrylic acid is used as a flocculant to remove suspended solids and particles from water. It finds application as a clarifying agent, dispersing agent, and anti-scaling agent in membrane-based water treatment processes. Thus, the rising focus on water and wastewater treatment activities in various countries across the world drives the demand for polyacrylic acid.

According to a report released by the US Census Bureau, the value of total construction (private and public) investment in 2023 was US$ 1,978.7 billion, a 7% increase from investments of US$ 1,848.7 billion in 2022. According to the International Organization of Motor Vehicle Manufacturers, commercial vehicle production in the US increased from 9.2 million in 2021 to 10.1 million vehicles in 2022, a nearly 10% increase than in 2021. Paints and coatings and adhesives are major chemicals required in various end-use industries such as construction and automotive. Polyacrylic acid (PAA) serves as a versatile binder and adhesion promoter to various substrates such as plastics and ceramics. It forms a protective film over surfaces, enhancing coatings' durability and scratch resistance. PAA is a key ingredient in water-based adhesive formulations in the adhesive industry. Therefore, the increasing demand for paints, coatings, and adhesives is driving the requirement for polyacrylic acid and its derivatives.

Strategic insights for the North America Polyacrylic Acid provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Polyacrylic Acid refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Polyacrylic Acid Strategic Insights

North America Polyacrylic Acid Report Scope

Report Attribute

Details

Market size in 2023

US$ 510.52 Million

Market Size by 2031

US$ 690.00 Million

Global CAGR (2023 - 2031)

3.8%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Form

By Application

By End-Use Industry

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Polyacrylic Acid Regional Insights

The North America polyacrylic acid market is categorized into form, application, end-use industry, and country.

By form, the North America polyacrylic acid market is segmented into powder and liquid. The liquid segment held a larger share of the North America polyacrylic acid market share in 2023.

In terms of application, the North America polyacrylic acid market is segmented into dispersing agent, anti-scaling agent, thickeners, emulsifiers, ion-exchanger, and others. The anti-scaling agents segment held the largest share of the North America polyacrylic acid market share in 2023.

Based on end-use industry, the North America polyacrylic acid market is segmented into water treatment, personal care & cosmetics, detergents & cleaners, leather & textiles, pulp & paper, paints & coatings, ceramics, and others. The water treatment segment held the largest share of the North America polyacrylic acid market share in 2023.

Based on country, the North America polyacrylic acid market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America polyacrylic acid market in 2023.

Arkema SA, Ashland Inc, BASF SE, Evonik Industries AG, Nippon Shokubai Co Ltd, Sumitomo Seika Chemicals Co Ltd, The Dow Chemical Co, and The Lubrizol Corp are the among leading companies operating in the North America polyacrylic acid market.

The North America Polyacrylic Acid Market is valued at US$ 510.52 Million in 2023, it is projected to reach US$ 690.00 Million by 2031.

As per our report North America Polyacrylic Acid Market, the market size is valued at US$ 510.52 Million in 2023, projecting it to reach US$ 690.00 Million by 2031. This translates to a CAGR of approximately 3.8% during the forecast period.

The North America Polyacrylic Acid Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Polyacrylic Acid Market report:

The North America Polyacrylic Acid Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Polyacrylic Acid Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Polyacrylic Acid Market value chain can benefit from the information contained in a comprehensive market report.