North America Point-of-Care Molecular Testing for Infectious Diseases Market

No. of Pages: 162 | Report Code: BMIRE00030329 | Category: Life Sciences

No. of Pages: 162 | Report Code: BMIRE00030329 | Category: Life Sciences

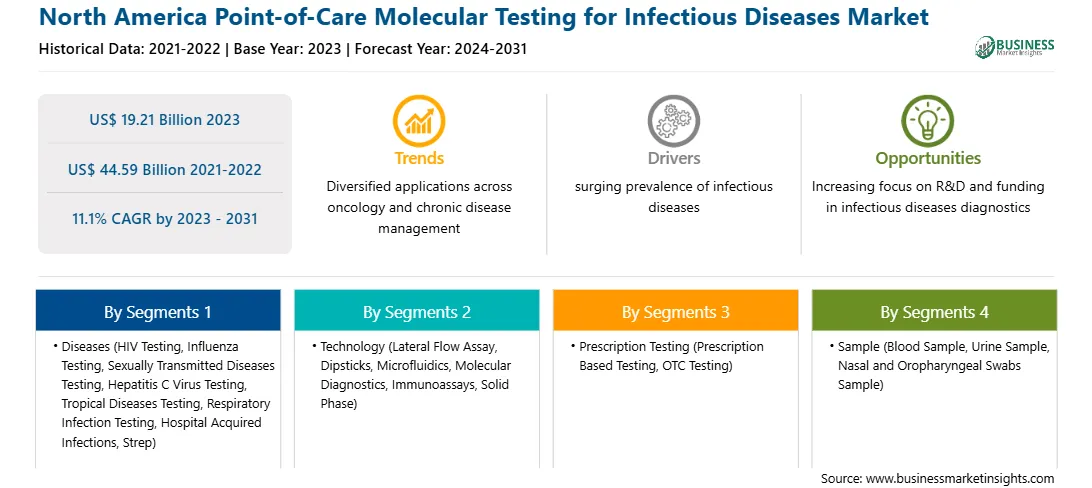

The global North America point-of-care molecular testing for infectious diseases market is expected to reach US$ 44.59 billion in 2031 from US$ 19.21 billion in 2023. The market is estimated to grow with a CAGR of 11.1% from 2023 to 2031.

The North America point-of-care molecular testing for infectious diseases market forecast presented in this report can help stakeholders in this marketplace plan their growth strategies. The surging prevalence of infectious diseases and preference for rapid diagnostic solutions are the key factors propelling the market development. However, inadequate reimbursement scenarios impede the North America point-of-care molecular testing for infectious diseases market growth.

Research and development (R&D) is an essential component of pharmaceutical and biopharmaceutical companies. R&D enables market players to develop new products for various therapeutic applications with significant medical and commercial potential. The following table displays the annual funding for various research and disease categories based on contracts, grants, and other funding mechanisms adopted by the NIH.

Research/Disease Areas | 2019 (US$ Million) | 2020 (US$ Million) | 2021 (US$ Million) | 2022 (US$ Million) |

Emerging Infectious Diseases | 2,950 | 4,867 | 5,069 | 4,318 |

Infectious Diseases | 6,313 | 8,301 | 8,599 | 8,019 |

Sexually Transmitted Infections | 354 | 394 | 404 | 419 |

Note: The current conversion rate is considered for the currencies.

Source: Annual Reports and The Insight Partners Analysis

In response to the shortage of laboratory capabilities and molecular testing reagents, coupled with the rising cases of infectious diseases, diagnostic testing manufacturers offer fast and easy-to-use devices to facilitate out-of-laboratory testing. Following is a list of a few key funding initiatives undertaken by manufacturers in the North America point-of-care testing for infectious diseases market.

Thus, rising focus on R&D and funding in infectious disease diagnostics is expected to create lucrative opportunities for the growth of North American point-of-care testing in the infectious disease market in the coming years.

The possibility of reimbursement remains low if there exists data that does not indicate the cost-effectiveness of new tests or prove the existing tests are expensive. Thus, low reimbursement rates for most diagnostic tests discourage manufacturing companies from investing large resources in developing new tests. Difficulties and concerns about reimbursing new or expensive diagnostic tests pose significant challenges to the widespread deployment of diagnostic technologies. In the US, reimbursement comprises coverage by third-party payers coding health services or conditions to determine payment level. For outpatient tests with Current Procedural Terminology (CPT) codes, the Medicare Coverage Advisory Committee promotes the Centers for Medicare & Medicaid Services (CMS) regarding diagnostic test coverage, including determining sufficient evidence and health benefits. However, most Medicare reimbursement decisions are made locally and not nationally. Coverage for diagnostic tests differs as per region. Also, the lack of standards in determining coverage can challenge the development and availability of a new diagnostic product.

In some cases, the reimbursement does not cover test costs, which limits laboratories in offering the test and reduces test availability and use. In other cases, test charges may be high but may leave a considerable cost to the patient, which limits physicians from ordering the test routinely.

The increasing prevalence of infectious diseases, the rising geriatric population, and a surging number of product launches by key players are the primary contributors to the point-of-care testing for infectious diseases market growth in the US. Aging is a prominent risk factor for infectious diseases, as people aged more than 60 may have compromised immunity. According to a study published by the Population Reference Bureau in 2020, the population of individuals aged 65 and above was 55 million in the US in 2020, and the number is expected to reach 95 million by 2060. Regulatory agencies in the US rigorously monitor the development of point-of-care (POC) testing products. For instance, in March 2021, the US Food Drug Administration (FDA) authorized Binx Health IO CT/NG Assay for community-based clinics, urgent care settings, and outpatient healthcare facilities; it is the first POC testing product for diagnosing chlamydial and gonorrheal infections.

A few of the major primary and secondary sources referred to while preparing the report on the North America point-of-care molecular testing for infectious diseases market are the World Bank Data, National Health Service (NHS), US Department of Health and Human Services (HHS), and WHO (World Health Organization).

Strategic insights for the North America Point-of-Care Molecular Testing for Infectious Diseases provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 19.21 Billion |

| Market Size by 2031 | US$ 44.59 Billion |

| Global CAGR (2023 - 2031) | 11.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Diseases

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Point-of-Care Molecular Testing for Infectious Diseases refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The List of Companies - North America Point-of-Care Molecular Testing for Infectious Diseases Market

The North America Point-of-Care Molecular Testing for Infectious Diseases Market is valued at US$ 19.21 Billion in 2023, it is projected to reach US$ 44.59 Billion by 2031.

As per our report North America Point-of-Care Molecular Testing for Infectious Diseases Market, the market size is valued at US$ 19.21 Billion in 2023, projecting it to reach US$ 44.59 Billion by 2031. This translates to a CAGR of approximately 11.1% during the forecast period.

The North America Point-of-Care Molecular Testing for Infectious Diseases Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Point-of-Care Molecular Testing for Infectious Diseases Market report:

The North America Point-of-Care Molecular Testing for Infectious Diseases Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Point-of-Care Molecular Testing for Infectious Diseases Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Point-of-Care Molecular Testing for Infectious Diseases Market value chain can benefit from the information contained in a comprehensive market report.