Market Introduction

The North America plasma fractionation market is divided into the US, Canada, and Mexico. The growth of market is widely attributed by the growing application of coagulation factors concentrates, clotting factor concentrates and other plasma derived products to treat various hematological disorders such as hemophilia A, hemophilia B. Moreover, the growth of market in Canada is expected to grow due to increasing prevalence of multiple sclerosis and other neurological disorders. In addition, in Mexico, the market is estimated to grow owing to increasing awareness about blood and related disorders, immunological disorders along with rising awareness about plasma derived therapies in the treatment of chronic disorders.

The COVID-19 pandemic is creating unprecedented operational and clinical challenges for healthcare institutions in the region. Moreover, the shift of priorities from chronic diseases and disorders treatments to COVID-19 diagnosis and treatment devices is leading to a decline in market growth up to a certain extent. Although no specific drug therapy for COVID-19 has been approved, convalescent plasma therapy is expected to improve the survival rate of COVID-19 patients based on the results of a number of clinical trials. For instance, in North America, the food and drug administration has approved the emergency use authorization of convalescent plasma for the treatment and care of COVID-19 patients. The EUA, i.e., emergency use authorization, has authorized the distribution of convalescent plasma in the US for treating suspected and confirmed COVID-19 patients. Thus, the emergency use of convalescent plasma for treating COVID-19 patients is leading to a positive impact on market growth.

Moreover, due to the COVID-19 outbreak, there was an overall decrease in blood donations, which ultimately affected the blood and plasma-derived products. The decreased blood donations affected the surgical procedures and treatments of other chronic diseases that require plasma-derived products or blood transfusions. Thus, the COVID-19 outbreak negatively impacted the plasma fractionation market in North America. However, with the beginning vaccination drives and the decrease in transmission rate, healthcare systems will return to normal in the long run. This, in turn, is expected to increase the demand for blood and plasma-derived products for the treatment of various disorders.

Market Overview and Dynamics

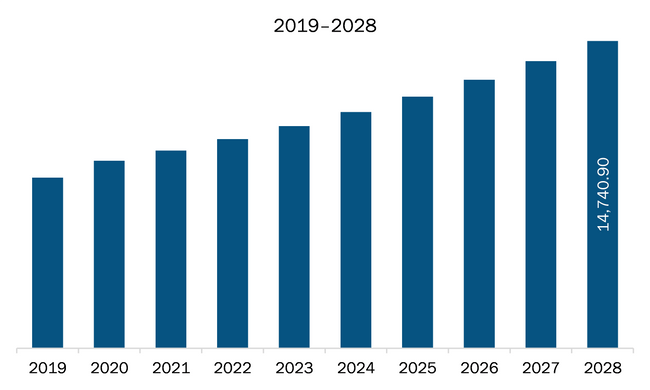

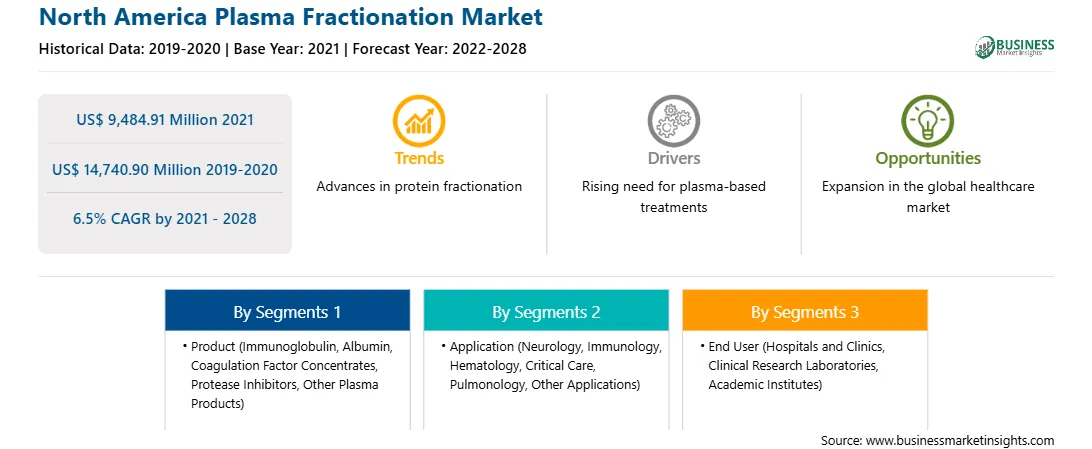

The plasma fractionation market in North America is expected to grow from US$ 9,484.91 million in 2021 to US$ 14,740.90 million by 2028; it is estimated to grow at a CAGR of 6.5% from 2021 to 2028. The market players associated with metabolomics are actively exploring the possible innovative technologies to facilitate researchers and medical care as the plasma containing the essential components to treat a disease, such as antibodies. Various studies are being carried out on the possible applications of plasma for illnesses that are difficult to cure by employing traditional approaches. Moreover, rising awareness about the advantages of blood donation and applications of plasma among people is expected to open new scope for the market.

Key Market Segments

North America plasma fractionation market is segmented into product, application, end user, and country. The North America plasma fractionation market, based on product, has been segmented into immunoglobulin, albumin, coagulation factor concentrates, protease inhibitors, and others. The immunoglobulin segment is likely to hold the largest share of the market in 2021. The North America plasma fractionation market, based on application is segmented into neurology, immunology, hematology, critical care, pulmonology, and others. In 2021, the Neurology segment is likely to hold the largest share of the market. The North America plasma fractionation market, based on end user is segmented into hospitals and clinics, clinical research laboratories, academic institutes. In 2021, the hospitals and clinics segment is likely to hold the largest share of the market. Based on country, the North America plasma fractionation market is segmented into the US, Canada, and Mexico. The US held the largest market share in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the plasma fractionation market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bharat Serums and Vaccines Limited (BSV); Bio Products Laboratory Ltd.; CSL Limited; Grifols, S.A.; Kedrion S.p.A; Octapharma AG; and SK Plasma.

Reasons to buy report

North America

Plasma Fractionation Market

Segmentation

North America Plasma Fractionation Market -

By Product

North America Plasma Fractionation Market - By

Application

North America Plasma Fractionation Market - By End User

North America Plasma Fractionation Market - By Country

North America Plasma Fractionation Market - Company Profiles

Strategic insights for the North America Plasma Fractionation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 9,484.91 Million |

| Market Size by 2028 | US$ 14,740.90 Million |

| Global CAGR (2021 - 2028) | 6.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Plasma Fractionation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Plasma Fractionation Market is valued at US$ 9,484.91 Million in 2021, it is projected to reach US$ 14,740.90 Million by 2028.

As per our report North America Plasma Fractionation Market, the market size is valued at US$ 9,484.91 Million in 2021, projecting it to reach US$ 14,740.90 Million by 2028. This translates to a CAGR of approximately 6.5% during the forecast period.

The North America Plasma Fractionation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Plasma Fractionation Market report:

The North America Plasma Fractionation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Plasma Fractionation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Plasma Fractionation Market value chain can benefit from the information contained in a comprehensive market report.