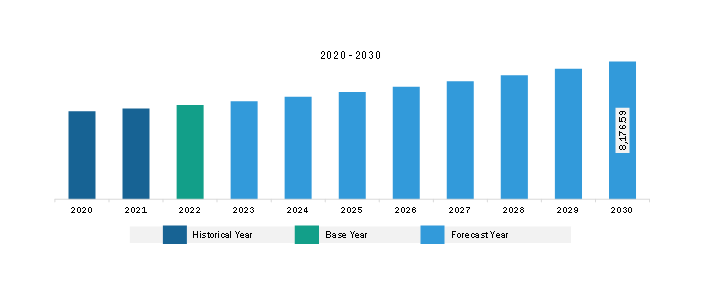

The North America pipe relining market was valued at US$ 5,594.10 million in 2022 and is expected to reach US$ 8,176.59 million by 2030; it is estimated to record a CAGR of 4.9% from 2022 to 2030.

Pipe relining is the method of restoring damaged pipes using liners. In the oil & gas industry, pipe restoration need occurs quite frequently, incurring significant costs. Pipe relining is generally preferred to eliminate the maintenance cost. Pipe relining is used to repair damaged pipes without digging the ground. This process involves the insertion of flexible and durable recliners into the damaged pipelines. The relining is inflated and left to harden inside the old pipes. The increasing number of oil and gas restoration facilities with growing government investments for building the pipelines is driving the pipe relining market growth. The oil and gas construction projects in the US hold the largest share. The oil and gas pipeline-related projects in the US Department of Energy has announced over US$ 30 million in funding to develop technology to rehabilitate aging natural gas pipelines. According to the Insight Partners' estimate, more than 196,130 km of trunk oil and gas pipelines are planned between 2023 and 2030 globally.

Country | Oil Pipelines (Kilometers) | Gas Pipelines (Kilometers) |

US | 91,067.0 | 333,366.0 |

Canada | 23,361.0 | 84,682.0 |

Oil and gas pipeline construction has increased across North America, with growing investment activities across the US. For instance, in 2019, Mountain Valley Pipeline officials completed a project valued at US$ 4.6 billion. In April 2023, US Michigan officials approved an investment of US$ 500 million to renovate the protective tunnel of an aging oil pipeline. The oil pipeline runs beneath Michigan, connecting two great lakes. Further, in April 2023, NV5 Global, Inc., a provider of conformity assessment and consulting solutions, was awarded a contract of US$ 16 million for the utility gas pipeline designing and supporting services for the California gas utilities. NV5 Global, Inc. offers engineering design for asset integrity management and gas pipeline improvements to support the reliable and safe delivery of natural gas. In May 2023, US Federal authorities announced funding of around US$ 196 million with a US$ 1 billion program for repairing and replacing the aging and leaking natural gas pipelines across the country. Such renovations in the oil and gas pipeline infrastructure across the globe are driving the pipe relining market.

The pipe relining market in North America comprises the US, Canada, and Mexico, and the US is a well-developed country in terms of technology adoption and the standard of living, as well as infrastructure. North America has ~51% of the world's oil and gas pipelines by total length. A few of the oil and gas pipelines across North America include the Keystone Oil Pipeline, with a length of ~3,462 kilometers, which is 2,151 miles. Rockies Express Gas Pipeline has a length of 2,702 kilometers and is 1,679 miles. GASBOL Gas Pipeline length is 3,150 kilometers, which is 1,957 miles, and the Druzhba Oil Pipeline length is 5,100 kilometers, which is 3,169 miles. The US, Canada, and Mexico are among the world's top 10 countries that lead the implementation of pipeline infrastructures. Pipelines in these countries are used to transport gas, liquids, and petroleum products from production areas to refineries to consumers and manufacturers. Natural gas is also transported to the farmers and industrial manufacturers using these pipelines. These countries are interconnected with each other by pipelines for cross-country transmission of gasoline and crude oil. A major part of the pipeline built in this region is buried under the ground, and only the pump stations are visible above the surface.

Various governing bodies in North America manage the water as well as wastewater infrastructure. Close to 20% of Americans are responsible for the maintenance of their sewage systems, while municipal water treatment plants serve 80% of Americans. The municipal treatment plants are quite old and carry an aged infrastructure. As the population is growing in the region, releases from this wastewater are becoming a problem for surface water facilities. Pipeline relining has proved to be highly beneficial as it is inexpensive compared to replacing the existing pipeline by digging. Also, the downtime for repairing the sewer pipes by curing them from the inside is very low. A quick fix can be done on the sewer pipe to prevent any harmful release of toxicants into the surface water and other environmental bodies.

Strategic insights for the North America Pipe Relining provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5,594.10 Million |

| Market Size by 2030 | US$ 8,176.59 Million |

| Global CAGR (2022 - 2030) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Solution Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Pipe Relining refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America pipe relining market is categorized into solution type, end user, and country.

Based on solution type, the North America pipe relining market is categorized into cured-in-place pipe, pull-in-place, pipe bursting, and internal pipe coating. The cured-in-place pipe segment held the largest market share in 2022. Cured-in-place pipe segment is further bifurcated into patch or spot repair and liner or longer repair.

In terms of end user, the North America pipe relining market is segmented into oil & gas, chemicals, municipal, and others. The oil & gas segment held the largest market share in 2022.

By country, the North America pipe relining market is segmented into the US, Canada, and Mexico. The US dominated the North America pipe relining market share in 2022.

Waterline Renewal Technologies Inc, Roto-Rooter Group Inc, Advanced Trenchless Solutions LLC, Sekisui Chemical Co Ltd, Granite Construction Inc, Aegion Corp, Silverlining Holding Corp, NuFlow Technologies Inc, Pipe Restoration Solution Inc, RPB Inc, and Aquam USA Inc are some of the leading companies operating in the North America pipe relining market.

The North America Pipe Relining Market is valued at US$ 5,594.10 Million in 2022, it is projected to reach US$ 8,176.59 Million by 2030.

As per our report North America Pipe Relining Market, the market size is valued at US$ 5,594.10 Million in 2022, projecting it to reach US$ 8,176.59 Million by 2030. This translates to a CAGR of approximately 4.9% during the forecast period.

The North America Pipe Relining Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Pipe Relining Market report:

The North America Pipe Relining Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Pipe Relining Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Pipe Relining Market value chain can benefit from the information contained in a comprehensive market report.