Market Introduction

The North America photomedicine devices and technologies market has been segmented into the US, Canada, and Mexico. The US holds held the largest share of the North American photomedicine devices and technologies market in 2020. The market growth in North America is attributed to increasing demand for cosmetic procedures in the region. The market for photomedicine devices and technologies market in the North American region is also likely to spur with various key players in the market. In addition, increase in number of energy-based device procedures, high disposable income of consumers, and the geriatric population in the region. Moreover, the Canadian government is also focusing on various initiatives to cope with heart disease and reduce mortality. In the efforts to deal with cardiac conditions, rehabilitation for the same is gaining the people who have had the cardiac disease or cardiac surgery, stroke, and coronary heart conditions in the country.

The North American region is highly affected due to the outbreak of the Covid-19 pandemic. Countries such as the US and Canada reported the highest numbers of COVID-19 positive cases. The US registered the highest number of deaths due to the COVID-19 pandemic. The chaotic situation was created in the medical industry across the countries, increased demand for COVID diagnostics and therapeutics have dramatically increased in the hospitals. In the US, due to an increasing number of infected patients, healthcare professionals and leading organizations distract the flow of healthcare resources from research & development to primary care, which is slowing down the process of innovation. Moreover, the cosmetic surgeons having a unique perspective of collaborating with patients and their teams create difficulties and challenges in distress. Furthermore, in light of the ongoing pandemic of COVID-19, the American Society of Plastic Surgeons (ASPS) in May 2020 released a statement to urge the suspension of elective and non-essential Technologies of cosmetic surgeries in the US. In addition, the cosmetic surgery societies are implementing various strategies to curb the financial losses and have amended their policies to support small businesses, such as the Small Business Administration offering expanded disaster impact loans and deferment of the federal income tax payments by three months to July 15. In addition, the COVID-19 pandemic is perplexing healthcare institutions in the region with unprecedented operational and clinical challenges. Moreover, shift of priorities from photomedicine devices treatment to corona virus diagnosis and treatment devices are leading to decline in photomedicine Devices and technologies, leading to decline in market growth up to certain extent.

Market Overview and Dynamics

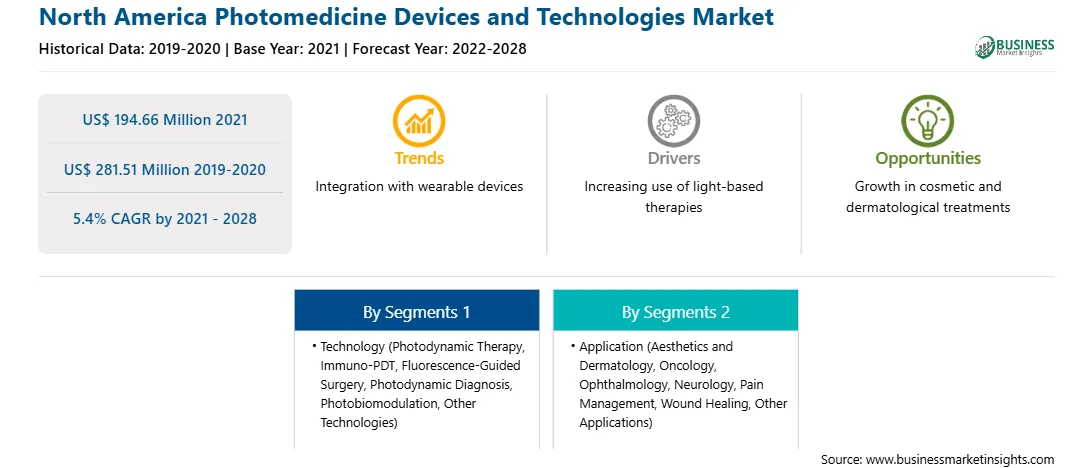

The photomedicine devices and technologies market in North America is expected to grow US$ 194.66 million in 2021 to US$ 281.51 million by 2028; it is estimated to grow at a CAGR of 5.4% from 2021 to 2028. The photomedicine devices and technologies market has grown in recent years, pushing the limits of product development approaches. In the photomedicine devices system market, one such growing trend is to expand devices by producing custom application-based versions. Noninvasive body contouring is currently the most popular aesthetic therapy because of the increasing awareness among the population regarding the painless procedure and the surging inclination of customers toward losing undesired body fat. In response to the growing demand for body contours, the manufacturers of photomedicine devices are developing the variants of a medium-600 nm red light wavelength to remove 99% of the cells within minutes. This type of new product development push is expected to result in photomedicine devices market players no longer maintaining personalized and customized equipment for pain management and wound healing. Companies are bringing in new product technologies in photomedicine that can aid deep penetration and help in skin regeneration and other disorders. For instance, THOR Photomedicine introduced novoTHOR Whole Body Light Pod. The product—which uses photobiomodulation technique—was launched in partnership with English Premier League soccer teams, US military forces, and the Harvard Medical School. NovoTHOR is a whole-body red-light therapy bed that uses red and near-infrared light to treat injuries, reduce pain, relax muscles and joints, and increase blood circulation.

Key Market Segments

In terms of technology, the photodynamic therapy (PDT) segment accounted for the largest share of the North America photomedicine devices and technologies market in 2021. In term of application, aesthetics and dermatology segment held a larger market share of the photomedicine devices and technologies market in 2021.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the photomedicine devices and technologies market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Alma Lasers; Beurer GmbH; Candela Medical; Koninklijke Philips N.V.; Iridex Corporation; Lumenis; THOR Photomedicine Ltd; biolitec AG; Lumibird; and Verilux, Inc., among others.

Reasons to buy report

North America Photomedicine Devices and Technologies Market Segmentation

North America Photomedicine Devices and Technologies Market – By Technology

North America Photomedicine Devices and Technologies Market – By

Application

North America Photomedicine Devices and Technologies Market – By

Country

North America Photomedicine Devices and Technologies Market – Companies Mentioned

Strategic insights for the North America Photomedicine Devices and Technologies provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 194.66 Million |

| Market Size by 2028 | US$ 281.51 Million |

| Global CAGR (2021 - 2028) | 5.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Photomedicine Devices and Technologies refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Photomedicine Devices and Technologies Market is valued at US$ 194.66 Million in 2021, it is projected to reach US$ 281.51 Million by 2028.

As per our report North America Photomedicine Devices and Technologies Market, the market size is valued at US$ 194.66 Million in 2021, projecting it to reach US$ 281.51 Million by 2028. This translates to a CAGR of approximately 5.4% during the forecast period.

The North America Photomedicine Devices and Technologies Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Photomedicine Devices and Technologies Market report:

The North America Photomedicine Devices and Technologies Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Photomedicine Devices and Technologies Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Photomedicine Devices and Technologies Market value chain can benefit from the information contained in a comprehensive market report.