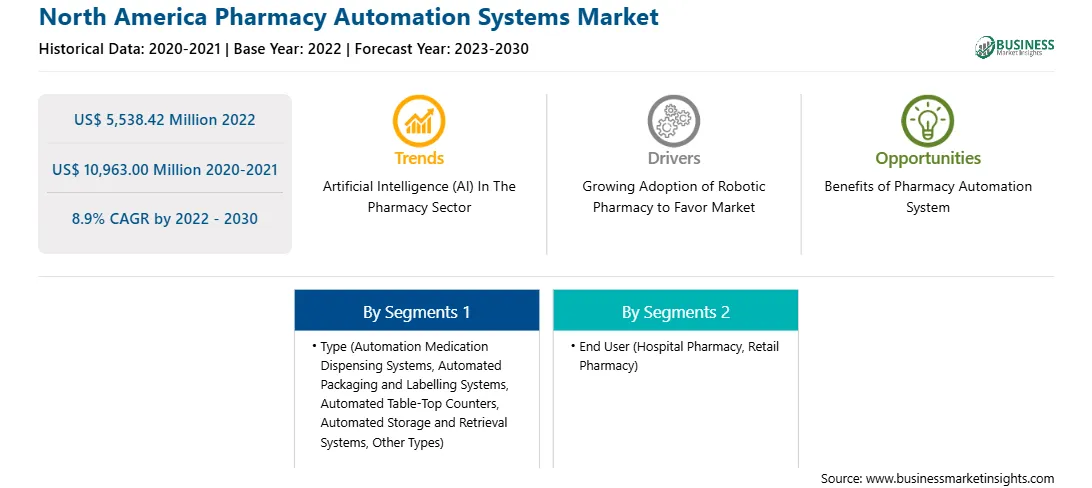

The North America pharmacy automation systems market was valued at US$ 5,538.42 million in 2022 and is expected to reach US$ 10,963.00 million by 2030; it is estimated to grow at a CAGR of 8.9% from 2022 to 2030.

Growing Adoption of Robotic Pharmacy Fuels the North America Pharmacy Automation Systems Market

In the healthcare sector, automated systems are incorporated into different processes to provide information about stock and inventory, and aid in traceability and streamlined storage. Thus, automation relieves pharmacists from labor-intensive distributive functions and enhances workflow efficiency in pharmacies. Moreover, the adoption of robotics and automated systems is rising in pharmacies in developing regions. In 2023, Oak Lawn Pharmacy partnered with Phoenix-based MedAvail Holdings to deploy 10 M4 MedCenter kiosks across Texas. Also, in 2022, the US pharmaceutical operator Walgreens announced using robots to fill prescriptions for pharmacies as there is a national lack of pharmacists and pharmacy technicians.

Leading pharmacy automation system vendors continuously focus on developments and introduction of their innovations. In February 2021, Omnicell Inc. announced the launch of its Medimat system. Medimat is a next-generation, automated dispensing system for retail pharmacies. Medimat has been built for improved patient safety, efficient time utilization, and financial savings. Similarly, in August 2021, innovativeAspirations (iA), a commercial provider of software-enabled pharmacy fulfillment and automation solutions, launched three solutions that are integrated with Medimat's NEXiA technology to manage the fulfillment of prescribed medicines centrally. iA has also introduced SmartPod, a next-generation robot with a modular autofill unit. SmartPod allows pharmacy providers to adjust and scale their centralized fulfillment solutions. Thus, the growing adoption of robotic pharmacies with the introduction of next-generation automated systems fuels growth of the pharmacy automation systems market.

North America Pharmacy Automation Systems Market Overview

North America holds the largest share of the pharmacy automation systems market. The market in this region is split into the US, Canada, and Mexico. The growth of the market in the region is attributed to factors such as growing public awareness about automated technologies and rising strategic moves by governments and pharmacy automation system vendors. The US is the largest contributor to the pharmacy automation systems market in North America and the world. Market growth in the US is mainly attributed to the rise in medication errors and a surge in demand for pharmaceutical products. According to the study "Medication Errors," published in StatPearls in June 2020, medication errors result in 7,000-9,000 deaths annually in the US. Thus, healthcare organizations have increased developments in pharmacy automation systems to avoid medication errors. In July 2023, Capsa Healthcare, one of the US-based players, acquired MASS Medical Storage. The acquisition of MASS Medical Storage provided Capsa with expertise in making medical storage and endoscope cabinet drying systems. Additionally, the acquisition would help strengthen Capsa Healthcare's position in the global market, expanding the reach of its various pharmacy automation systems to end users such as hospitals, clinics, and ambulatory surgical centers.

North America Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Pharmacy Automation Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5,538.42 Million |

| Market Size by 2030 | US$ 10,963.00 Million |

| Global CAGR (2022 - 2030) | 8.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Pharmacy Automation Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. McKesson Corp

2. Becton Dickinson and Co

3. Capsa Solutions LLC

4. Omnicell Inc

5. Oracle Corp

6. ScriptPro LLC

7. Veradigm LLC

8. Innovation Associates

9. YUYAMA Manufacturing Co Ltd

10. Swisslog Healthcare AG

The North America Pharmacy Automation Systems Market is valued at US$ 5,538.42 Million in 2022, it is projected to reach US$ 10,963.00 Million by 2030.

As per our report North America Pharmacy Automation Systems Market, the market size is valued at US$ 5,538.42 Million in 2022, projecting it to reach US$ 10,963.00 Million by 2030. This translates to a CAGR of approximately 8.9% during the forecast period.

The North America Pharmacy Automation Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Pharmacy Automation Systems Market report:

The North America Pharmacy Automation Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Pharmacy Automation Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Pharmacy Automation Systems Market value chain can benefit from the information contained in a comprehensive market report.