The pet oral care products market in North America is further segmented into the US, Canada, and Mexico. The US held the largest share of the North America pet oral care products market in 2020. Increasing number of pet owners and rising concern to maintain the health of pets are driving the market growth. For instance, as per Animal Health Institute (AHI), more than 67% of American households own pets, totaling nearly 400 million pets, including dogs, cats, horses, birds, fish, horses, and more. In addition, as per the American Pet Products Association (APPA), the total pet industry expenditures average in the United States was US$ 90.5 billion in 2018, which increased to 99 billion in 2020. Therefore, high awareness about pet health among pet owners and a rise in the number of dental procedures are some other factors propelling growth of the market. The market is primarily driven by the high prevalence of dental diseases in pets. According to the Australian and American veterinary dental societies, more than 80% of dogs develop gum disease by the age of three, compared to more than 70% of cats at the same age. Therefore, the rise in awareness of pet oral health and the increase in veterinary health expenditure are the factors to propel market growth over the forecast period. In addition, in the United States presence of strong players, with continuous development in the region, is further augmenting the market growth. Through expansion strategy, companies intend to reach a wider customer base in the global market. For instance, in 2019, Greenies Dental Treats, a subsidiary of Mars Inc., expanded its product distribution to grocery, drug, and other mass retailers. In addition to the rise in awareness about pet oral health, an increase in veterinary health expenditure is giving major boost to the market growth. For instance, in 2018, Virbac launched an online campaign in North America encouraging owners to consult their veterinarian about their dog’s dental health. Increasing rising companion animal adoption, and the increasing per capita animal healthcare expenditure are projected to accelerate the growth of the Pet Oral Care Products market.

The COVID-19 pandemic has posed threats to pet care supply chains and related trade activities due to restricted trade policies and labor availability. The retail e-commerce platforms witnessed high growth due to several restrictions on the brick-and-mortar stores and the disruption of the overall supply channel. Sales have spiked for at home pet oral care and do-it-yourself products, driven by the shuttering of veterinary clinics and professional salons. Chewy.com has witnessed an acceleration in sales since February 2020; the e-commerce player generates ~70% of its sales through subscription customers. All these developments suggest increased online penetration due to the pandemic. Changes in pet ownership are another long-term consequence of COVID-19. Also, the pet population has increased in North America during lockdown phases due to people’s preference for a companion. Further, the home isolation practices dove the short-term pet fostering programs that may translate into long-term pet population growth in the future. On the contrary, misinformation on the relationship between animals and COVID-19 led to pet abandonments in the region. Despite some disruptions caused by COVID-19 containment measures, the long-term growth potential of the pet oral care product industry remains intact.

Strategic insights for the North America Pet Oral Care Products provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

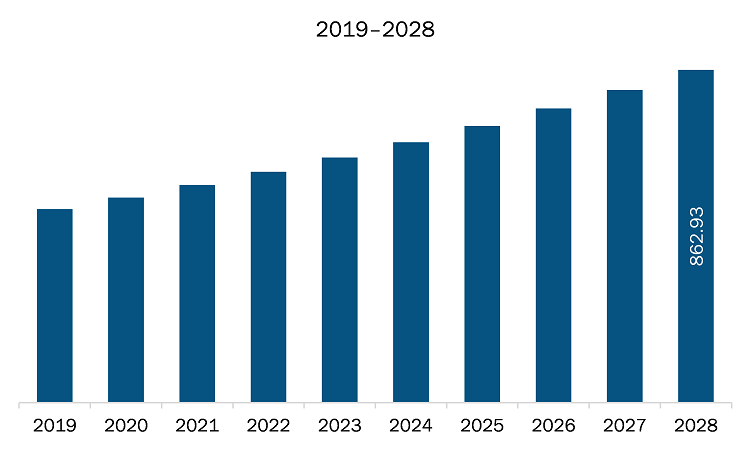

| Market size in 2021 | US$ 564.12 Million |

| Market Size by 2028 | US$ 862.93 Million |

| Global CAGR (2021 - 2028) | 6.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Animal

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Pet Oral Care Products refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The pet oral care products market in North America is expected to grow from US$ 564.12 million in 2021 to US$ 862.93 million by 2028; it is estimated to grow at a CAGR of 6.3% from 2021 to 2028. The veterinary healthcare market is improving owing to the initiatives led by the animal welfare associations and governments of several countries worldwide. Governments are taking part in raising awareness among the population concerning animal diseases and the privatization of animal healthcare services. One such scheme is the World Organization for Animal Health (OIE), the intergovernmental organization in charge of improving animal health worldwide. Similarly, the 2020 Healthy Pets Healthy Families Initiative (HPHF) was launched by the Veterinary Public Health Program (VPH) at the Los Angeles County Department of Public Health, to develop animal and human health. Moreover, in June 2018, Kane Biotech introduced companion pet oral care products in Canada under the brand names: StrixNB and Bluestem. As a result, the company received notification under Health Canada’s Low-Risk Veterinary Health Products (LRVHP) program, and approvals have been in place. Moreover, in 2017, Tata Trusts, in partnership with People for Animals, initiated the development of multi-specialty veterinary hospitals and emergency clinics to serve the needs of all domestic and farm animals. Thus, the major awareness programs and support from several organizations for animal healthcare is driving the growth of the pet oral care products market.

The market for North America pet oral care products market is segmented into Animal, product, end user, distribution channel and country. Based on Animal, the market is segmented into cats and dogs. In 2020, the dogs segment held the largest share. Based on product the Pet oral care products market is divided into mouthwash/rinse, tooth brush and paste, dental cleansing sprays, anti-plaque pens, and other product types. In 2020, the tooth brush and paste segment held the largest share. Based on the end user the market is segmented into veterinary hospitals, private clinics, and home care. The home care segment accounts for largest market share. Similarly, based on distribution channel, the market is bifurcated into supermarkets/hypermarkets, online channels, specialized pet shops, and other distribution channels. The specialized pet shops segment contributed a substantial share in 2020 in the pet oral care products market.

A few major primary and secondary sources referred to for preparing this report on the pet oral care products market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Vetoquinol SA; Dechra Pharmaceuticals Products, PLC; AllAccem, Inc.; Imrex, Inc.; Virbac; CEVA; Hills Pet Nutrition, Inc.; Nestle; Mars, Incorporated; and TropiClean Pet Products among others.

The North America Pet Oral Care Products Market is valued at US$ 564.12 Million in 2021, it is projected to reach US$ 862.93 Million by 2028.

As per our report North America Pet Oral Care Products Market, the market size is valued at US$ 564.12 Million in 2021, projecting it to reach US$ 862.93 Million by 2028. This translates to a CAGR of approximately 6.3% during the forecast period.

The North America Pet Oral Care Products Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Pet Oral Care Products Market report:

The North America Pet Oral Care Products Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Pet Oral Care Products Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Pet Oral Care Products Market value chain can benefit from the information contained in a comprehensive market report.