Rising Popularity of Pet Humanization have Increased the Demand for North America Palatants Market

In recent years, the humanization of pets grew significantly across the region. The shift from pet owning to pet parenting has been a defining trend in the palatants market, especially in developed economies. According to the 2021-2022 National Pet Owners Survey conducted by the American Pet Products Association (APPA), 70%, i.e., approximately 90.5 million of the US households, own one or more pets, the majority being dogs and cats. Increasing consumer spending on pet care categories is attributed to the growing trend of pet humanization. Consumers are increasingly spending on premium pet food and products that are healthy, nutritious, and improving living conditions. There is a growing focus on pet health and wellness, sustainable products, eco-friendly, natural and locally-sourced ingredients. Consumers are also investing in special diets and indulgent products, which promise a better quality of life to their pets. The use of palatants in pet food helps improve the taste, flavor, and texture that resemble their original meat food. Thus, the rising popularity of pet humanization have increased the demand for North America palatants market during the forecast period.

North America Palatants Market Overview

North America palatants market is a prominent contributor as it is one of the significant markets for the pet food and animal feed industry. The US is one of the major compound feed markets in North America. This country's animal food manufacturing industry largely relies on the free-trade agreement with Canada and Mexico. In addition to this agreement, the expanding livestock industry is favoring the animal feed market progress in the US. The increasing popularity of pet ownership among people relates to love, companionship, and stress relief. The rising humanization of pets and awareness of the high nutritional benefits of pet food influence consumers’ purchasing decisions. According to the National Pet Owners Survey (2021–2022) conducted by the American Pet Food Association, pet ownership increased from ~67% of US households in 2021 to 70% in 2022. Moreover, millennials were revealed to be the largest cohort of pet owners, with a share of 32%, followed closely by baby boomers (27%) and generation X (24%). Increasing awareness about the nutritional requirements of pets among pet owners is making them spend more on healthy pet food products. Key market players in North America are adopting strategic initiatives such as product launches, acquisitions, and partnerships to sustain themselves in the growing market. For instance, in June 2019, Kemin Industries Inc. launched a new line of palatants—PALTEVA Natural Palatants—to address the growing consumer demand for naturally flavoured and safe meat-based palatants. Thus, flourishing animal feed production businesses, increasing demand for pet food with growing pet humanization, and various development strategies adopted by market players are fueling the North America palatants market.

Strategic insights for the North America Palatants provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

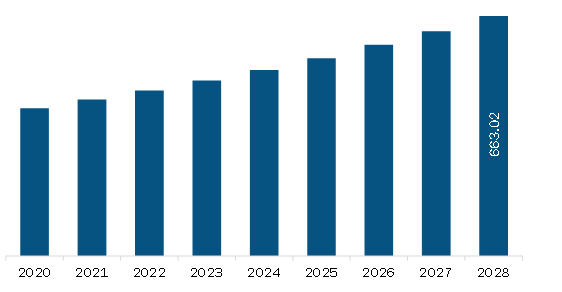

| Market size in 2022 | US$ 457.99 Million |

| Market Size by 2028 | US$ 663.02 Million |

| Global CAGR (2022 - 2028) | 6.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Form

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Palatants refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Palatants Market Segmentation

The North America palatants market is segmented into form, category, source, and country.

Based on form, the North America palatants market is bifurcated into dry and liquid. The dry segment held the larger market share in 2022.

Based on category, the North America palatants market is bifurcated into organic and conventional. The conventional segment held the larger market share in 2022.

Based on source, the North America palatants market is segmented into plant derived palatants, meat derived palatants, insect derived palatants, and others. The meat derived palatants segment held the larger market share in 2022.

Based on country, the North America palatants market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

AFB International Inc; Archer-Daniels-Midland Co; BHJ AS; Innov Ad NV/SA; Kemin Industries Inc; Kerry Group Plc; Ohly GmbH; Symrise AG; and Trilogy Essential Ingredients Inc are the leading companies operating in the North America palatants market.

The North America Palatants Market is valued at US$ 457.99 Million in 2022, it is projected to reach US$ 663.02 Million by 2028.

As per our report North America Palatants Market, the market size is valued at US$ 457.99 Million in 2022, projecting it to reach US$ 663.02 Million by 2028. This translates to a CAGR of approximately 6.4% during the forecast period.

The North America Palatants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Palatants Market report:

The North America Palatants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Palatants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Palatants Market value chain can benefit from the information contained in a comprehensive market report.