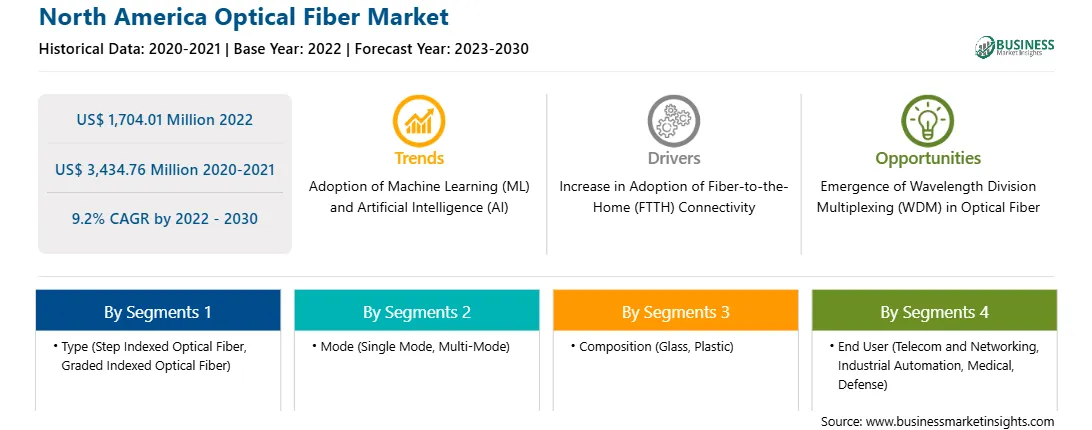

The North America optical fiber market was valued at US$ 1,704.01 million in 2022 and is expected to reach US$ 3,434.76 million by 2030; it is estimated to record a CAGR of 9.2% from 2022 to 2030.

Increase in Adoption of Fiber-to-the-(FTTH) Connectivity Fuels North America Optical Fiber Market

The internet has become an indispensable element of daily life. Consumers rely on technology for everything, including communication, entertainment, and work. However, as the reliance on the internet has risen, so has the demand for more dependable and quicker access. Fiber-to-the-home (FTTH) broadband is a broadband technology that employs optical fibers to offer high-speed internet to residences. Unlike typical copper or coaxial cables, which are susceptible to signal loss and interference, optical fibers are constructed of glass or plastic. They can transfer data over considerably greater distances without signal degradation.

Traditional internet technologies cannot compete with quicker speeds and more dependable connections of FTTH. According to the study conducted by the Fiber Broadband Association (FBA), the number of residences in the US served by fiber internet has surpassed 60 million in 2021, an increase of 12% from roughly 54 million in 2020. Moreover, the study also revealed that fiber internet is already available to 43% of American households and 60% of Canadian households. According to the survey, large providers such as Verizon, AT&T, and Lumen, are the top five cable Management Services Organizations (MSOs) formed 72% of all fiber internet connectivity, while Tier 2 regional operators such as Frontier, Windstream, TDS, and Consolidated accounted for 10% of the expansion.

In a very short period, FTTH broadband has come a long way. It was first utilized exclusively in a few industries, particularly for high-end corporate and government applications. However, as the need for faster and more dependable internet connections has increased, so has the use of FTTH broadband. Today, it is becoming more common in residential areas, and many internet service providers now provide FTTH broadband as a basic offering. Therefore, the increase in the adoption of FTTH connectivity drives the market.

North America Optical Fiber Market Overview

The North America optical fiber market is segmented into the US, Canada, and Mexico. Fiber optical cables have gained higher popularity in North America, providing more flexibility and simplicity of installation. Advanced testing and monitoring technologies, such as optical time-domain reflectometers (OTDRs) and optical spectrum analyzers, are in great demand to match the expanding sophistication of fiber optic networks. The North America optical fiber cable industry is expanding rapidly, owing to the rising demand for high-speed internet access. The region's booming IT and telecommunications sectors, together with optical fiber cable innovation, are driving market expansion even further. Optical fiber connections have become important in North America as bandwidth needs and the demand for dependable and high-capacity networks have increased.

The continuous need for high-speed internet across numerous industries is one of the primary factors for market development. Optical fiber cables are perfect for gigabit transmission due to their large bandwidth expansion and low attenuation, which is critical for enterprises demanding high-speed data transfer. North America's communication infrastructure is significantly reliant on optical cabling, particularly with the expansion of data centers around the continent. Fiber optics are widely utilized in intra and inter-data center connections, allowing enormous amounts of data to be sent across great distances. In North America, there has been a considerable push for fiber-to-the-home (FTTH) deployment in response to the rising demand for higher internet speeds and enhanced network performance. Telecommunications and internet service providers are investing in expanding their fiber optic networks to residential areas, allowing for seamless access and improved broadband experiences for customers.

Furthermore, investments from the key players have boosted the demand for optical fiber networks in the region. For instance, in October 2023, Prysmian Group committed to spending US$85 million on North American plant equipment and technological improvements. The majority of these modifications will take place at Prysmian Group's Claremont, North Carolina site to boost optical product manufacturing to satisfy the expanding demands of telecommunications clients. Its Claremont site is co-located in a combined optical fiber and optical fiber cable manufacturing facility. This is also set to grow to 620 personnel in the next 18 months, with up to 70 additional positions added.

North America Optical Fiber Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Optical Fiber provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,704.01 Million |

| Market Size by 2030 | US$ 3,434.76 Million |

| Global CAGR (2022 - 2030) | 9.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Optical Fiber refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Corning Inc

2. Prysmian Spa

3. Jiangsu Zhogtian Technology Co Ltd

4. Yangtze Optical Fiber and Cable Joint Stock Ltd

5. Fiberhome Telecommunication Technologies Co Ltd

6. CommScope Holding Co Inc

7. Nexans SA

8. Furukawa Electric Co Ltd

9. Sumitomo Electric Industries Ltd

10. Coherent Corp

The North America Optical Fiber Market is valued at US$ 1,704.01 Million in 2022, it is projected to reach US$ 3,434.76 Million by 2030.

As per our report North America Optical Fiber Market, the market size is valued at US$ 1,704.01 Million in 2022, projecting it to reach US$ 3,434.76 Million by 2030. This translates to a CAGR of approximately 9.2% during the forecast period.

The North America Optical Fiber Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Optical Fiber Market report:

The North America Optical Fiber Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Optical Fiber Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Optical Fiber Market value chain can benefit from the information contained in a comprehensive market report.