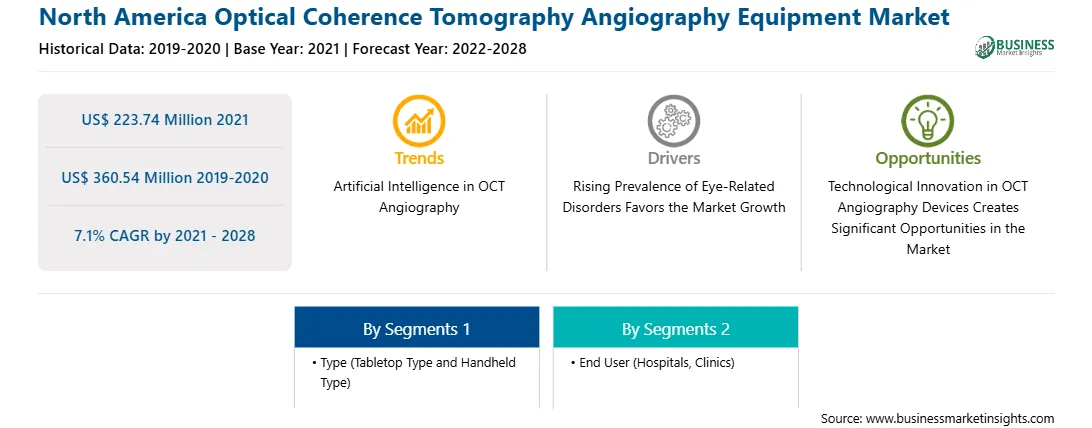

North America Optical Coherence Tomography Angiography Equipment Market

No. of Pages: 114 | Report Code: BMIRE00025109 | Category: Life Sciences

No. of Pages: 114 | Report Code: BMIRE00025109 | Category: Life Sciences

The market growth in this region is attributed to the increasing prevalence of eye-related disorders and a rise in the geriatric population. However, the lack of skilled professionals and technical challenges associated with the equipment restrict the market growth.

Eye-related conditions and disorders include diabetic retinopathy, glaucoma, age-related macular degeneration, ocular histoplasmosis, retinal vein occlusion, and retinal breaks and detachment. Diabetic retinopathy (DR) is caused due to high blood sugar levels that damage blood vessels of the retina or cause changes to them. These changes may include swelling, leakage, or closing, thus stopping the passage of the blood. In some people, abnormal new blood vessels grow on the surface of the retina. Such changes to the retina can hamper the vision of a person. According to the NCBI article, the number of adults with DR is expected to grow from ~103.12 million in 2020 to ~160.50 million by 2045 in the world. In addition, the DR is the most common diabetic eye disease and a leading cause of blindness among US adults. As per the National Eye Institute data, the number of Americans with DR is expected to double, from 7.7 million in 2010 to 14.6 million by 2050. With more than 150 million people estimated to be living with diabetes by 2040, the number of people suffering from diabetic retinopathy and vision impairment is also expected to rise in the future.

Glaucoma, ranked as the second-leading cause of blindness globally, damages the eye’s optic nerve. According to the National Glaucoma Research data, the number of people suffering from glaucoma is projected to grow from ~80 million in 2020 to ~111 million by 2040 in United States. It is also the leading cause of irreversible blindness in the US as more than 3 million Americans are likely to be suffering from glaucoma. Among various causes of total blindness in adults, glaucoma caused 11.0% of blindness across the world in 2020, followed by diabetic retinopathy with 2.5% cases.

The optical coherence tomography (OCT) angiography helps in the evaluation of various ophthalmologic diseases, such as diabetic retinopathy, age-related macular degeneration (AMD), and retinal vascular occlusions, by providing a detailed view of the retinal vasculature that allows accurate delineation of abnormalities in diabetic eyes and vascular occlusions. It helps quantify vascular compromise depending on the severity of diabetic retinopathy. The OCT angiography can aid visibility in microaneurysms and retinal nonperfusion areas, enabling closer observation of each layer of retinal capillaries. It also evaluates the microvascular status and effectiveness of DR treatments. Hence, a rise in the prevalence of eye-related diseases boosts the adoption of OCT devices in hospitals and imaging centers, thereby driving the optical coherence tomography angiography equipment market growth.

NORTH AMERICA OPTICAL COHERENCE TOMOGRAPHY ANGIOGRAPHY EQUIPMENT MARKET SEGMENTATION

The North America optical coherence tomography angiography equipment market, based on type, has been bifurcated into handheld type and tabletop type. The market, based on end user, is segmented into hospitals, clinics, and others. In terms of country, the North America optical coherence tomography angiography equipment market is segmented into the US, Canada, and Mexico.

NIDEK CO.; LTD, Carl Zeiss AG’; Optovue Incorporated; Canon Inc.; OPTOPOL Technology Sp. z o.o; Michelson Diagnostics Ltd.; SANTEC CORPORATION; Alcon Inc.; Topcon Corporation; and Heidelberg Engineering GmbH are among the leading companies operating in the

North America optical coherence tomography angiography equipment market.

Strategic insights for the North America Optical Coherence Tomography Angiography Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 223.74 Million |

| Market Size by 2028 | US$ 360.54 Million |

| Global CAGR (2021 - 2028) | 7.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Optical Coherence Tomography Angiography Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Optical Coherence Tomography Angiography Equipment Market is valued at US$ 223.74 Million in 2021, it is projected to reach US$ 360.54 Million by 2028.

As per our report North America Optical Coherence Tomography Angiography Equipment Market, the market size is valued at US$ 223.74 Million in 2021, projecting it to reach US$ 360.54 Million by 2028. This translates to a CAGR of approximately 7.1% during the forecast period.

The North America Optical Coherence Tomography Angiography Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Optical Coherence Tomography Angiography Equipment Market report:

The North America Optical Coherence Tomography Angiography Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Optical Coherence Tomography Angiography Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Optical Coherence Tomography Angiography Equipment Market value chain can benefit from the information contained in a comprehensive market report.