North America Ophthalmology Devices Market

No. of Pages: 114 | Report Code: BMIRE00030930 | Category: Life Sciences

No. of Pages: 114 | Report Code: BMIRE00030930 | Category: Life Sciences

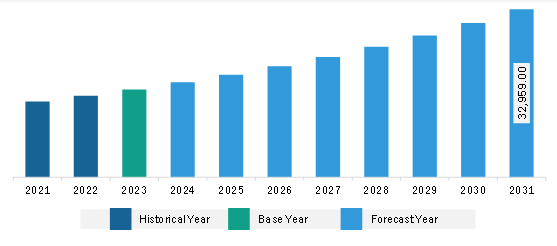

The North America ophthalmology devices market was valued at US$ 17,221.21 million in 2023 and is expected to reach US$ 32,959.00 million by 2031; it is estimated to register at a CAGR of 8.5% from 2023 to 2031.

With technological advancements in image capturing and data transmission, ophthalmology is strongly embracing telehealth integration. The adoption of technology in delivering remote eye care, known as teleophthalmology, has evolved rapidly with the rapid usage of smartphones and 5th generation (G) wireless communications. Teleophthalmology can be used both asynchronously (store-and-forward) and synchronously (real-time) in the diagnosis, screening, monitoring, and treatment of eye diseases such as age-related macular degeneration, diabetic retinopathy, glaucoma, neuro-ophthalmic disorders, and pediatric ocular diseases, including the retinopathy of prematurity. Moreover, the integration of telehealth in ophthalmology presents strong potential to improve access to screening procedures and treatments. Remote patient monitoring, enabled by this approach, enhances the overall quality of eye care services. Telemedicine and teleophthalmology are already in place since many years, but the practices gained significant importance during the COVID-19 pandemic. Hence, the adoption of teleophthalmology, in both developed and developing countries is expected to bring significant growth trends in the ophthalmology devices market in the coming years.

The North America Ophthalmology Devices market was valued at US$ 17,221.21 million in 2023 and is projected to reach US$ 32,959.00 million by 2031; it is expected to register a CAGR of 8.4% during 2023-2031. The ophthalmology devices market growth in North America is attributed to the rising aging population and the increasing prevalence of eye diseases.

As per the Population Reference Bureau 2019, the number of individuals in the US aged 65 and older is estimated to double from 52 million (16% of the total population) in 2018 to nearly 95 million (23% of the total population) by 2060. As per the American Academy of Ophthalmology's 2019 study, an estimated 7.32 million people aged 70-75 would be affected by primary open-angle glaucoma (POAG) in the US by 2050.

Eye conditions such as vision impairment and poor vision are the prominent causes of a surging number of eye surgeries in the US. According to the 2023 investors' presentation of Starsurgical, nearly 3000,000 refractive procedures are performed in the US every year. Companies in the ophthalmology devices market are adopting various organic and inorganic growth strategies; a few of the recent instances are mentioned below.

In September 2023, OCULUS, Inc. partnered with LUVO to introduce two new patient treatment devices-the DARWIN and LUCENT-in the US optometry and ophthalmology market. The LUCENT IPL, and DARWIN IPL and RF devices are intended to offer eye care practitioners effective and comfortable treatment modalities that can target the root causes of patient symptoms.

Furthermore, according to the Statistics Canada estimates, seniors are expected to comprise ~23-25% of the Canadian population by 2036 and ~24-28% of the population by 2061. The rising geriatric population is expected to propel the adoption of ophthalmology devices as the aging population is highly prone to eye diseases.

Strategic insights for the North America Ophthalmology Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Ophthalmology Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Ophthalmology Devices Strategic Insights

North America Ophthalmology Devices Report Scope

Report Attribute

Details

Market size in 2023

US$ 17,221.21 Million

Market Size by 2031

US$ 32,959.00 Million

Global CAGR (2023 - 2031)

8.5%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Product

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Ophthalmology Devices Regional Insights

The North America ophthalmology devices market is segmented based on product, application, end user, and country.

Based on product, the North America ophthalmology devices market is segmented into vision care products, surgical devices, and diagnostics and monitoring devices. The vision care products segment held the largest share in 2023.

In terms of application, the North America ophthalmology devices market is segmented into cataract, glaucoma, refractory disorders, vitreoretinal disorders, and other applications. The glaucoma segment held the largest share in 2023.

By end user, the North America ophthalmology devices market is segmented into hospital and eye clinics, academic and research laboratories, and other end users. The hospital and eye clinics segment held the largest share in 2023.

Based on country, the North America ophthalmology devices market is categorized into US, Canada, and Mexico. The US dominated the North America ophthalmology devices market in 2023.

Key players operating in the North America ophthalmology devices market are Johnson & Johnson Vision Care Inc, Alcon AG, Carl Zeiss Meditec, Bausch & Lomb Inc, Essilor Intonational SAS, Nidek Co Ltd, Topcon Corp, Haag-Streit AG, Ziemer Ophthalmic Systems AG, and Hoya Corp are some of the leading companies operating in the North America ophthalmology devices market.

The North America Ophthalmology Devices Market is valued at US$ 17,221.21 Million in 2023, it is projected to reach US$ 32,959.00 Million by 2031.

As per our report North America Ophthalmology Devices Market, the market size is valued at US$ 17,221.21 Million in 2023, projecting it to reach US$ 32,959.00 Million by 2031. This translates to a CAGR of approximately 8.5% during the forecast period.

The North America Ophthalmology Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Ophthalmology Devices Market report:

The North America Ophthalmology Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Ophthalmology Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Ophthalmology Devices Market value chain can benefit from the information contained in a comprehensive market report.