The US, Canada, and Mexico are the key contributors to the North America online recruitment market. The US and Canada are developed countries in terms of modern technologies, standard of living, and infrastructure. North America is one of the frontrunners in terms of developing and accepting new, advanced technologies. The significant adoption of technologies in the last five years has fueled the adoption of various recruitment software, thereby promoting online recruitment processes across the region. The high internet penetration among the North American countries, coupled with the high digitalization rate among companies, is a major driver for the online recruitment market across the region. For instance, the US, had 288.1 million internet users in January 2020. Between 2019 and 2020, the number of internet users in the US increased by 1.8 million (+0.6%). In January 2020, the US had an Internet penetration rate of 87%. Additionally, in January 2020, the country had 230.0 million social media members. Between April 2019 and January 2020, the number of social media users in the US increased by 6.9 million (+3.1%). In January 2020, social media penetration in the US was at 70%. This rises in internet and social media adoption by the North American population encouraged the adoption of online recruitment across the region to attract more candidates for specific job roles posted by companies.

It is becoming apparent with the COVID-19 pandemic spreading across the United States significant challenges are faced by all industries. Thus, any impact on industries directly affects the economic development of North America. The US is the world's worst-affected country by the COVID-19 outbreak. The consequent economic downturn has led to the rise in number of jobless candidates by more than 14 million in the country, which reached 20.5 million in May 2020 from 6.2 million in February 2020. As a result, in 2020, the rate of unemployment increased from 3.8% in February to 13.0% in May in the US; the rise in unemployment rate continued in April as well with 14.4%. This also led to a standstill in recruitment process across the region thereby impacting the online recruitment market. However, post Q3 2020, the number of COVID-19 cases in the US started declining, thus triggering gradual normalization of economic activities in the country. This resulted in rise in demand of products and services across the region. Moreover, with the improved vaccine distribution and administration drives, the US witnessed a more than expected increase in job openings in February 2021. According to data released by the Job Openings and Labor Turnover Survey (JOLTS), in 2021, the number of job openings rose to 7.4 million in March 2021 from 7.1 million in February 2021. Nonetheless, the labor market has a long way to go before resuming its late-2019 status. The US hiring rate increased to 4% in February 2021 from 3.8% in February 2020. To hire people easily and rapidly while maintaining social distancing, the demand for online recruitment rapidly increased across the region

Strategic insights for the North America Online Recruitment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 12,009.85 Million |

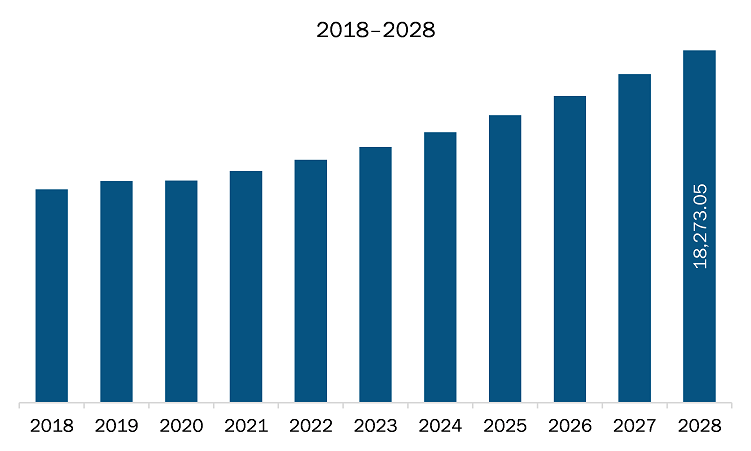

| Market Size by 2028 | US$ 18,273.05 Million |

| Global CAGR (2021 - 2028) | 6.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Job Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Online Recruitment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The online recruitment market in North America is expected to grow from US$ 12,009.85 million in 2021 to US$ 18,273.05 million by 2028; it is estimated to grow at a CAGR of 6.2% from 2021 to 2028. Integration of Artificial Intelligence (AI) in recruitment; Several businesses use artificial intelligence in the HR, some way or another. AI is expected to be used in the recruiting process by businesses. AI for hiring refers to the use of artificial intelligence to solve problems in the same way that a machine does. The use of technology is assisting in the streamlining of high-volume activities in the recruitment process. Online application management is one of the ways AI is assisting businesses with the recruiting process. Applicant monitoring from recruiter databases involves many keywords and other data points that AI can easily filter and analyze. To speed up the hiring process, AI assists recruiters in sorting through thousands of resumes. This is bolstering the growth of the online recruitment market.

In terms of job type, the permanent segment accounted for the largest share of the North America online recruitment market in 2020. In terms of application, the IT segment held a larger market share of the online recruitment market in 2020. Further, the energy & power segment held a larger share of the market based on end user in 2020.

A few major primary and secondary sources referred to for preparing this report on the online recruitment market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Glassdoor, Inc.

The North America Online Recruitment Market is valued at US$ 12,009.85 Million in 2021, it is projected to reach US$ 18,273.05 Million by 2028.

As per our report North America Online Recruitment Market, the market size is valued at US$ 12,009.85 Million in 2021, projecting it to reach US$ 18,273.05 Million by 2028. This translates to a CAGR of approximately 6.2% during the forecast period.

The North America Online Recruitment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Online Recruitment Market report:

The North America Online Recruitment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Online Recruitment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Online Recruitment Market value chain can benefit from the information contained in a comprehensive market report.