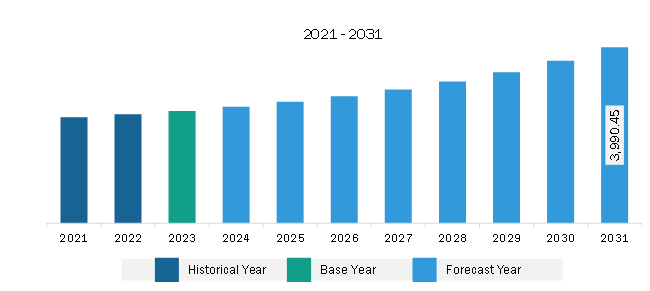

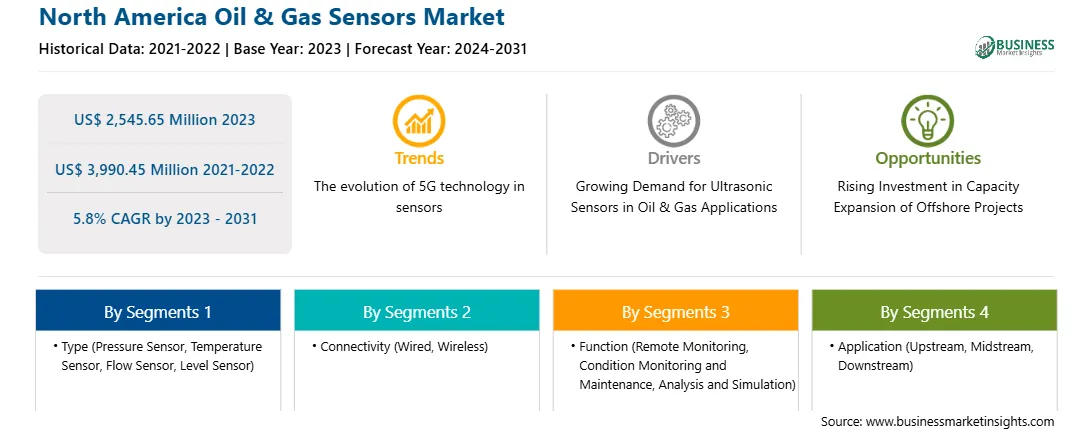

The North America oil & gas sensors market was valued at US$ 2,545.65 million in 2023 and is expected to reach US$ 3,990.45 million by 2031; it is estimated to register a CAGR of 5.8% from 2023 to 2031.

Rising Investment in Capacity Expansion of Offshore Projects Fuels North America Oil & Gas Sensors Market

Offshore renewables, such as offshore wind and ocean energy, have the potential to speed the global energy transition while creating new economic and social opportunities. According to the most recent data published by the International Renewable Energy Agency (IRENA) in June 2023, the capacity of offshore wind accounted to be more than 55 gigawatts (GW) in 2022, while ocean energy installed capacity was 0.535 GW in 2021. Offshore wind and ocean energy are expected to generate 380 GW and 350 GW, respectively, by 2030 due to increasing investment in ocean energy technologies. This increases the adoption of oil & gas sensors among users to monitor water quality, detect oil spills, and assess the impact of offshore drilling activities on oil & gas applications.

Investments in offshore projects are growing worldwide. Such investments increase the demand and adoption of temperature, pressure, flow, and level sensors to monitor the performance and integrity of offshore wind turbines, oil platforms, and underwater pipelines. Thus, rising investment in capacity expansion of offshore projects is expected to generate numerous opportunities for the growth of the oil & gas sensors market during the forecast period.

North America Oil & Gas Sensors Market Overview

The oil & gas sensors market growth in North America is attributed to the growing adoption of oil & gas sensors across upstream, midstream, and downstream applications, among others, for monitoring the working of devices and equipment used in the energy & power sector. Moreover, expansion activities of the oil & gas industries are anticipated to create lucrative opportunities for market growth during the forecast period. According to data published by the US Energy Information Administration in April 2024, the US and Canada respectively rank 1st and 4th among the top oil producers in the world. The US and Canada produced 21.91 and 5.76 million barrels per day in 2023, respectively, accounting for 22% and 6% shares of global oil production. Increasing demand and production of oil results in a greater scale of oil & gas production, resulting in the need for a larger number of sensors at plants for performance monitoring. In June 2023, PetroChem Canada announced its plan to take measures to promote the development of petrochemical industries. Petrochemical refineries require oil & gas sensors such as temperature and flow sensors in numerous applications, including crude oil distillation, catalytic cracking, and hydroprocessing. These sensors are used for maintaining precise temperature profiles within distillation columns, thereby ensuring the proper separation of crude oil into diesel and gasoline.

North America Oil & Gas Sensors Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the North America Oil & Gas Sensors provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,545.65 Million |

| Market Size by 2031 | US$ 3,990.45 Million |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Oil & Gas Sensors refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Oil & Gas Sensors Market Segmentation

The North America oil & gas sensors market is categorized into type, connectivity, function, application, and country.

Based on type, the North America oil & gas sensors market is segmented pressure sensor, temperature sensor, flow sensor, and level sensor. The pressure sensor segment held the largest market share in 2023.

In terms of connectivity, the North America oil & gas sensors market is bifurcated into wired and wireless. The wired segment held a larger market share in 2023.

By function, the North America oil & gas sensors market is segmented into remote monitoring, condition monitoring and maintenance, analysis and simulation, and others. The remote monitoring segment held the largest market share in 2023.

By application, the North America oil & gas sensors market is segmented into upstream, midstream, and downstream. The upstream segment held the largest market share in 2023.

By country, the North America oil & gas sensors market is segmented into the US, Canada, and Mexico. The US dominated the North America oil & gas sensors market share in 2023.

Honeywell International Inc, TE Connectivity Ltd, Robert Bosch GmbH, ABB Ltd, Siemens AG, Rockwell Automation Inc, Analog Devices Inc, Emerson Electric Co, SKF AB, and GE Vernova are some of the leading companies operating in the North America oil & gas sensors market.

The North America Oil & Gas Sensors Market is valued at US$ 2,545.65 Million in 2023, it is projected to reach US$ 3,990.45 Million by 2031.

As per our report North America Oil & Gas Sensors Market, the market size is valued at US$ 2,545.65 Million in 2023, projecting it to reach US$ 3,990.45 Million by 2031. This translates to a CAGR of approximately 5.8% during the forecast period.

The North America Oil & Gas Sensors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Oil & Gas Sensors Market report:

The North America Oil & Gas Sensors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Oil & Gas Sensors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Oil & Gas Sensors Market value chain can benefit from the information contained in a comprehensive market report.