The offshore pipeline, often known as, submarine or subsea pipeline is used for the transportation of oil, gas, and refined products. The North America offshore pipeline market is increasingly gaining traction on account of higher efficiency and large capacity. In addition to this, the offshore pipeline provides faster, safer, and more reliable connectivity for oil and gas transportation. The North America offshore pipeline market is expected to witness considerable growth during the forecast period owing to the growing number of natural gas projects as well as the identification of new oil fields, particularly in remote locations. Additionally, the depletion of existing oil & gas reserves in various countries across North America have created a demand for cross-border pipelines for the supply of oil & gas related products, which is boosting the growth of the North America offshore pipeline market. The increasing demand for cost-effective transportation method for oil and gas is one of the major factors that is expected to boost the demand for offshore pipeline in the oversea oil & gas sector across North America region. There are growing number of on-going and upcoming offshore oil & gas projects in North America which is anticipated to create huge opportunity in the North America offshore pipeline market during the forecast period.

Moreover, in case of COVID-19, The North America especially the US region witnessed an unprecedented rise in number of COVID cases, which disrupted its construction activities in the oil & gas sector and subsequently impacted the demand for offshore pipeline during the early months of 2020. Moreover, the considerable decline in overall global oil prices further restricted the oil & gas related projects and other activities that negatively influenced the demand for offshore pipelines. Similar trend was also witnessed in other North American countries i.e., Canada and Mexico. However, the countries are expected to overcome the swift drop in demand as the countries continue to open their economic activities especially in the recent months for revival of business activities which will escalate the North America offshore pipeline market.

Strategic insights for the North America Offshore Pipeline provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

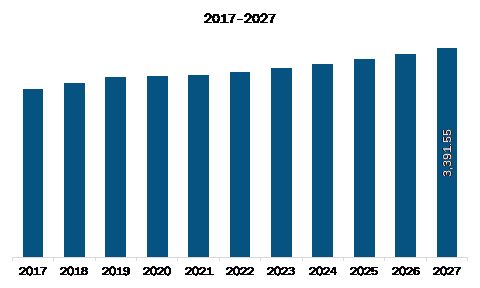

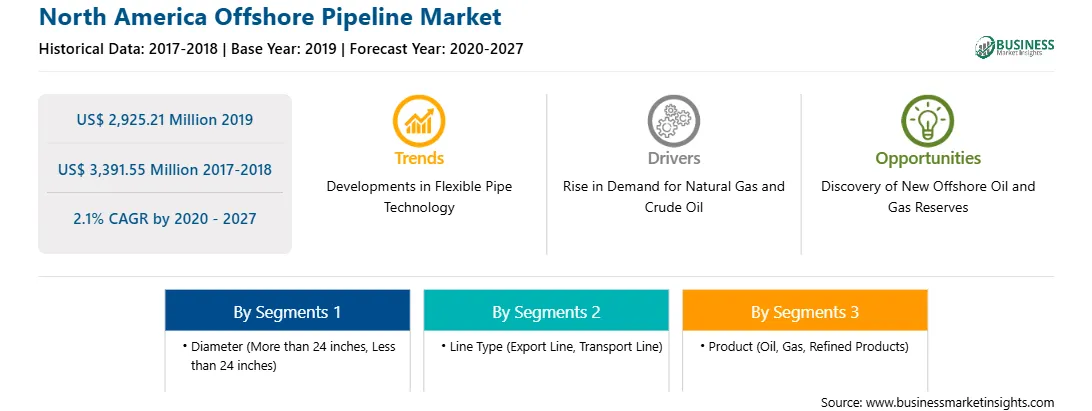

| Market size in 2019 | US$ 2,925.21 Million |

| Market Size by 2027 | US$ 3,391.55 Million |

| Global CAGR (2020 - 2027) | 2.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Diameter

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Offshore Pipeline refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America offshore pipeline market is expected to grow from US$ 2,925.21 million in 2019 to US$ 3,391.55 million by 2027; it is estimated to grow at a CAGR of 2.1% from 2020 to 2027. Advancements in flexible pipe technology is expected to accelerate the North America offshore pipeline market. The offshore oil & gas industry across North America has been using flexible pipes since 1972. Since then, the demand for flexible pipes has steadily increased and diversified. There is an increase in demand for flexible pipe technology in the oil & gas industry in recent years owing to operators seeking operational efficiencies. Deeper water, higher pressure, higher temperatures, and aging infrastructure as well as complex chemistry build increasingly intense environments for the flexible pipe to resist. Also, more and more fields are insisting on the limitations of existing technology. Recently, in 2020, a North American company, Baker Hughes developed novel designs for flexible pipes used in the oil & gas industry. The new designs use carbon fiber composite materials. These pipes are lighter in weight and easy to install, requiring less equipment for installation purposes. Such advancements to boost productivity with increased flexibility, speed, and performance are expected to increase the demand of offshore pipelines in coming years, which will drive the North America offshore pipeline market.

In terms of diameter, the less than 24 inches’ segment accounted for the largest share of the North America offshore pipeline market in 2019. In terms of line type, the transport line segment held a larger market share of the North America offshore pipeline market in 2019. Further, the refined products segment held a larger share of the North America offshore pipeline market based on product in 2019.

A few major primary and secondary sources referred to for preparing this report on the North America offshore pipeline market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bechtel Corporation; Fugro; John Wood Group PLC; Larsen & Toubro Limited; McDermott International, Inc.; Petrofac Limited; Saipem S.p.A; Sapura Energy Berhad; Subsea 7 S.A.; TechnipFMC plc.

Some of the leading companies are:

The North America Offshore Pipeline Market is valued at US$ 2,925.21 Million in 2019, it is projected to reach US$ 3,391.55 Million by 2027.

As per our report North America Offshore Pipeline Market, the market size is valued at US$ 2,925.21 Million in 2019, projecting it to reach US$ 3,391.55 Million by 2027. This translates to a CAGR of approximately 2.1% during the forecast period.

The North America Offshore Pipeline Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Offshore Pipeline Market report:

The North America Offshore Pipeline Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Offshore Pipeline Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Offshore Pipeline Market value chain can benefit from the information contained in a comprehensive market report.