North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market

No. of Pages: 65 | Report Code: BMIRE00030513 | Category: Energy and Power

No. of Pages: 65 | Report Code: BMIRE00030513 | Category: Energy and Power

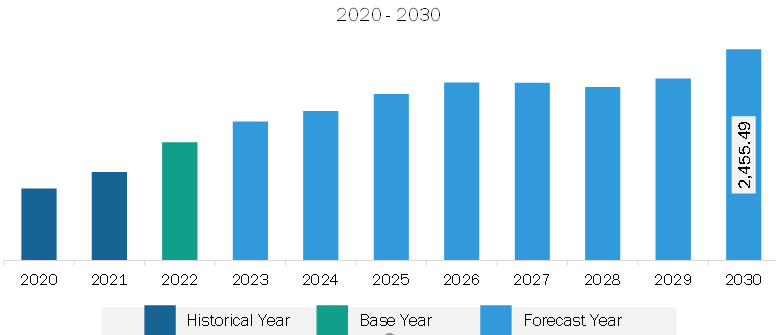

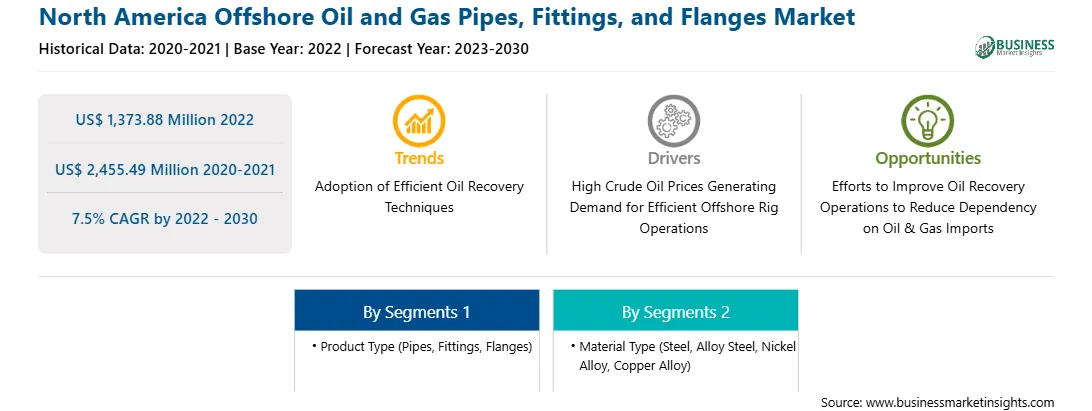

The North America offshore oil and gas pipes, fittings, and flanges market is expected to grow from US$ 1,373.88 million in 2022 to US$ 2,455.49 million by 2030. It is estimated to record a CAGR of 7.5% from 2022 to 2030. Adoption of Efficient Oil Recovery Techniques Fuels North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market

The crude oil extraction process involves three phases-primary, secondary, and tertiary [enhanced oil recovery (EOR)] recovery. As several oil fields have already been used up excessively for oil production, operators of these projects are focusing on tertiary or EOR stages that help extract 30-60% or more of a reservoir's original oil output. Thermal EOR techniques have gained considerable traction in recent years. According to the Global CCS Institute database, around 220 commercial-scale CCS facilities are reportedly in the development stages worldwide. About 15 of them explicitly intend to use CO2 for enhanced oxygen recovery (EOR), with the remaining ones driven by decarbonization. Thus, the oil & gas industry is witnessing a trend toward efficient oil extraction techniques, which is expected to support the growth of the offshore oil & gas pipes, fittings, and flanges market in the coming years.North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market Overview

North America is one of the major oils & gas exporters across the world. The US accounts for more than 18% of global oil production, which shows the presence of many onshore and offshore oil fields across the region. Oil & gas fields require a lot of pipelines for different applications, including upstream, midstream, and downstream operations. Moreover, oil & gas are also processed with various chemicals that generate a lot of slag and corrosion in the pipelines and fittings. For such issues, the pipelines, fittings, and flanges are maintained or replaced (if required) periodically. One of the major factors driving the growth of the oil & gas pipes, fittings, and flanges market includes the rising number of oil & gas rigs across different countries of North America. For instance, below are the number of overall rigs for the North American countries. Such an increasing number of oil rigs is one of the major factors driving the integration of large volumes of pipes, fittings, and flanges across the respective countries of the region. In addition, increasing crude oil production is another major factor expected to generate new demand for the installation of pipelines, flanges, and fittings in the coming years.

North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Offshore Oil and Gas Pipes, Fittings, and Flanges provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Offshore Oil and Gas Pipes, Fittings, and Flanges refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Offshore Oil and Gas Pipes, Fittings, and Flanges Strategic Insights

North America Offshore Oil and Gas Pipes, Fittings, and Flanges Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,373.88 Million

Market Size by 2030

US$ 2,455.49 Million

Global CAGR (2022 - 2030)

7.5%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product Type

By Material Type

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Offshore Oil and Gas Pipes, Fittings, and Flanges Regional Insights

North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market Segmentation

The North America offshore oil and gas pipes, fittings, and flanges market is segmented into product type, material type, and country.

Based on product type, the North America offshore oil and gas pipes, fittings, and flanges market is segmented into pipes, fittings, and flanges. The pipes segment held the largest share of the North America offshore oil and gas pipes, fittings, and flanges market in 2022.

In terms of material type, the North America offshore oil and gas pipes, fittings, and flanges market is segmented into steel, alloy steel, nickel alloys, and copper alloys. The steel segment held the largest share of the North America offshore oil and gas pipes, fittings, and flanges market in 2022.

Based on country, the North America offshore oil and gas pipes, fittings, and flanges market is segmented into the US, Canada, and Mexico. The US dominated the North America offshore oil and gas pipes, fittings, and flanges market in 2022.

Sumitomo Corp, US Metals Inc, London Fittings & Flanges Ltd, American Piping Products Inc, AFG Holdings Inc, Flanschenwerk Bebitz GmbH, and Kerkau Manufacturing Inc are some of the leading companies operating in the North America offshore oil and gas pipes, fittings, and flanges market.

1. Sumitomo Corp

2. US Metals Inc

3. London Fittings & Flanges Ltd

4. American Piping Products Inc

5. AFG Holdings Inc

6. Flanschenwerk Bebitz GmbH

7. Kerkau Manufacturing Inc

The North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market is valued at US$ 1,373.88 Million in 2022, it is projected to reach US$ 2,455.49 Million by 2030.

As per our report North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market, the market size is valued at US$ 1,373.88 Million in 2022, projecting it to reach US$ 2,455.49 Million by 2030. This translates to a CAGR of approximately 7.5% during the forecast period.

The North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market report:

The North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Offshore Oil and Gas Pipes, Fittings, and Flanges Market value chain can benefit from the information contained in a comprehensive market report.