The North America ocular drug delivery market has been segmented into the US, Canada, and Mexico. The US holds the largest share of the North America ocular drug delivery market. In North America, the US holds a significant share of the ocular drug delivery market. The growth of the market in the US is primarily driven by product awareness and the increasing prevalence of eye diseases. Further, the aging population in the US is likely to increase the incidence of eye diseases, which will eventually drive the adoption of ocular drug delivery products in the country. For instance, as per the Population Reference Bureau 2019, the number of individuals in the US aged 65 and older is estimated to double from 52 million in 2018 to around 95 million by 2060, and the 65 and more age group’s share of the total population will increase from 16% to 23%. This aged population is highly vulnerable to eye conditions. For instance, as per the American Academy of Ophthalmology 2019 study, an estimated 7.32 million people aged 70-75 are affected by primary open-angle glaucoma (POAG) by 2050 in the US.

Amidst the COVID-19 crisis, the healthcare institutions have witnessed decrees in inpatient visits to clinics to prevent the spread of the COVID-19 in the first and second quarters of 2020. As per the recent study by CDC, the number of medical emergency department (ED) visits has declined 42% during the early COVID-19. As a result, the number of elective eye procedures performed per week in hospitals and clinics has decreased over time. According to an article in Ophthalmology Times, elective procedures have decreased in countries such as the United States. The number of patient visits to examination facilities has reduced by 15%. During the COVID-19 pandemic, ophthalmology lost a considerable share of patient volume; the volume of ophthalmic practice is predicted to have decreased by 81%, owing to a decline in patients seeking care for glaucoma and cataracts surgery.

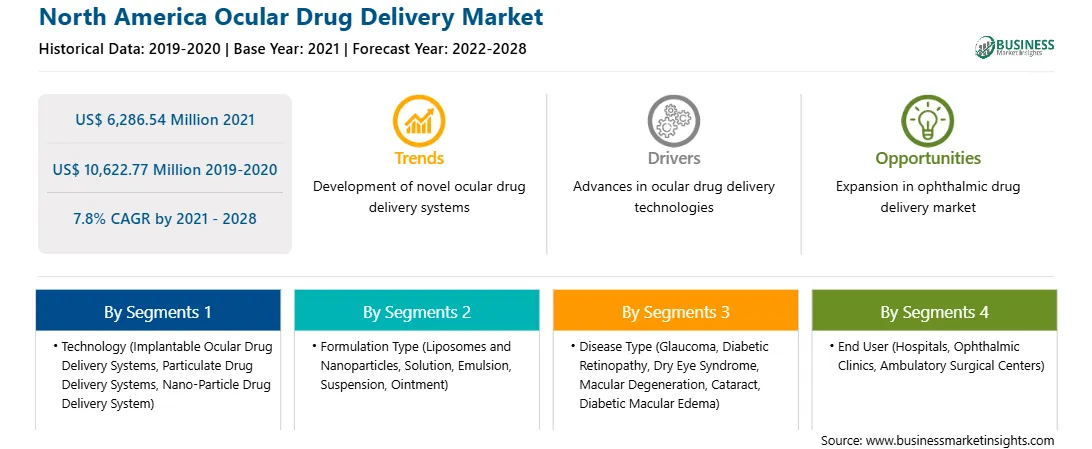

Strategic insights for the North America Ocular Drug Delivery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 6,286.54 Million |

| Market Size by 2028 | US$ 10,622.77 Million |

| Global CAGR (2021 - 2028) | 7.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Ocular Drug Delivery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The ocular drug delivery market in North America is expected to grow US$ 10,622.77 million by 2028 from US$ 6,286.54 million in 2021. The market is estimated to grow at a CAGR of 7.8% from 2021 to 2028. Several players operating in the ocular drug delivery market are developing and launching innovative products. The strategy of development and launch of new products helps companies to cater to a broad customer base. For instance, in June 2020, Senju Pharmaceutical Co., Ltd. and Otsuka Pharmaceutical Co., Ltd. announced the launch of a new combination ophthalmic solution, AILAMIDE Combination Ophthalmic Suspension, for the treatment of glaucoma and ocular hypertension. Similarly, in October 2019, Sun Pharmaceutical Industries launched the ophthalmic solution Cequa in the US, which is used to treat dry-eye disease. Additionally, in May 2019, Menicon Co., Ltd launched Menicon Bloom Myopia Control Management System. Menicon Bloom Night therapy includes the overnight wearing of a specifically designed reverse geometry orthokeratology contact lens—manufactured in hyper oxygen-permeable Menicon Z rigid material that guarantees ideal corneal oxygenation for comfortable contact lens wear. Additionally, in January 2019, Ocular Therapeutix launched Dextenza (dexamethasone ophthalmic insert) 0.4 mg in the US to treat ocular inflammation and pain following ophthalmic surgery. Dextenza received FDA approval in November 2018 for the treatment of ocular pain following ophthalmic surgery. Such developments and launches of new products are emerging as a key trend in the ocular drug delivery market.

North America ocular drug delivery market is segmented based on technology, formulation type, disease type, end user. Based on technology, implantable ocular drug delivery systems segment accounted for the highest share in 2021. Based on formulation type, solution segment accounted for the highest share in 2021. Based on disease type, cataract segment accounted for the highest share in 2021. Based on end user hospitals segment accounted for the highest share in 2021.

A few major primary and secondary sources referred to for preparing this report on ocular drug delivery market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AbbVie Inc.; Bausch Health Companies Inc.; Novartis AG; Clearside Biomedical, Inc.; Ocular Therapeutix, Inc.; Envisia Therapeutics; Alimera Sciences, Inc.; EYEGATE PHARMACEUTICALS, INC. among others.

The North America Ocular Drug Delivery Market is valued at US$ 6,286.54 Million in 2021, it is projected to reach US$ 10,622.77 Million by 2028.

As per our report North America Ocular Drug Delivery Market, the market size is valued at US$ 6,286.54 Million in 2021, projecting it to reach US$ 10,622.77 Million by 2028. This translates to a CAGR of approximately 7.8% during the forecast period.

The North America Ocular Drug Delivery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Ocular Drug Delivery Market report:

The North America Ocular Drug Delivery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Ocular Drug Delivery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Ocular Drug Delivery Market value chain can benefit from the information contained in a comprehensive market report.