Market Introduction

Oats is a cereal crop widely consumed in the form of flakes, oatmeal, and groats in various application industries. The growth of the North America oats market growth is fueled by determinants such as the wide application scope of oats and health benefits associated with the consumption of oats. The market is expected to grow in the upcoming years owing to the surging demand for gluten-free and organic oats and the rising requirement for oats in the personal care industry. However, the availability of substitutes for oat is hampering the market's growth.

Based on form, the flakes segment held the largest market share in 2022, whereas the flour segment is expected to register the highest CAGR during the forecast period. Oat flakes are a type of oats that are specifically processed to cook quickly. They are incredibly versatile and can be found in a variety of recipes or food products. In addition, oat flakes can be used in cereals, baked goods, and muesli. They can also be consumed cold as muesli, heated as oat porridge, or used as an ingredient in baked goods. Further, there are various types of oat flakes based on the manufacturing procedure. For instance, large leaf flakes, such as those seen in muesli, are produced from whole grains, whereas small leaf flakes are made from crushed oats, and they swell faster if soaked. Thus, the growing use of flakes in various food items and beverages would boost the oats market growth for the flakes segment during the forecast period.

Strategic insights for the North America Oats provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Oats refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Oats Strategic Insights

North America Oats Report Scope

Report Attribute

Details

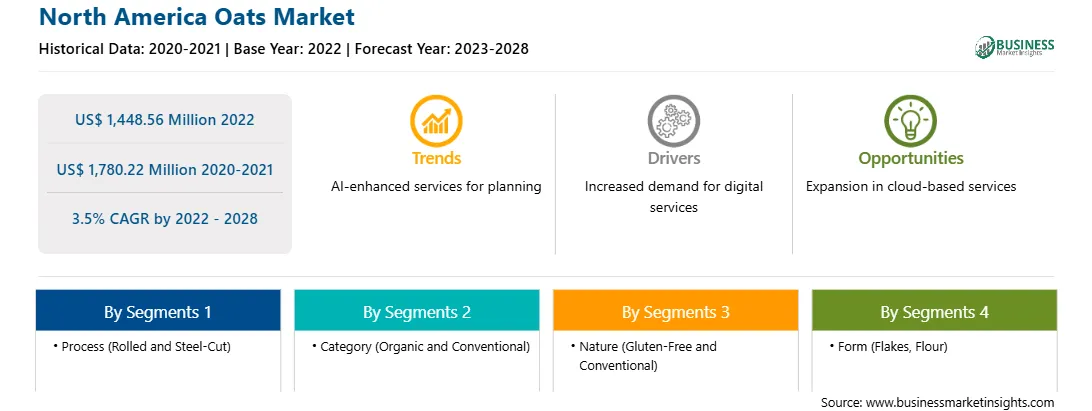

Market size in 2022

US$ 1,448.56 Million

Market Size by 2028

US$ 1,780.22 Million

Global CAGR (2022 - 2028)

3.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Process

By Category

By Nature

By Form

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Oats Regional Insights

Market Overview and Dynamics

The changing consumer preference has always been a significant factor in influencing the food & beverages industry. Continuous shifts in consumer preferences are propelling food manufacturers to introduce dairy-free, gluten-free, organic, and vegan diets products that meet the dietary needs of various consumers. The rising trend of gluten-free and organic food products, especially in western countries, is boosting the North America oats market growth significantly. With the rise in heart disease, diabetes, and obesity, people across the North America have become more health and fitness concerned, providing organic and gluten-free oats a promising growth.

Furthermore, key companies in the oats industry are launching gluten-free and natural oats and focusing more on advertising and product packaging. They are highly concerned about meeting the demand from potential customers all over the North America. For instance, in January 2021, Glanbia Ireland expanded its oat portfolio to include OatStanding Hydrolysed Oat Flour to help producers meet the demand for gluten-free, natural, and functional oat products.

Key Market Segments

Based on nature, the North America oats market is segmented into gluten-free and conventional. In 2022, the conventional segment held a larger market share, whereas the gluten-free segment is projected to register a higher CAGR during the forecast period. Oats are naturally gluten-free, and their consumption can be safe for people who have celiac disease or gluten intolerance. Increasing incidence of celiac disease and surging sensitivity to gluten among consumers have produced a strong demand for gluten-free products. As gluten-free oats are high in critical vitamins, fiber, minerals, and antioxidant plant components, they are used in breakfast cereals, baked goods, and snack foods. These uses boost the oats market growth for the gluten-free segment. Furthermore, gluten-free oats have a low calorific content and a low glycemic index, making them a popular choice among dieters. Oats are an excellent choice for people who want to minimize their gluten intake while also ingesting fewer calories.

Major Sources and Companies Listed

A few major primary and secondary sources referred to while preparing the report on the North America oats market are paid databases (Factiva), publications, Hoovers, investor presentations, newsletters, sec archives, annual reports, and other information available on the public domain. Avena Foods, Ltd.; Glanbia plc; Grain Millers, Inc.; Lantmännen; Richardson International Limited; American International Foods, Inc.; Small Valley Milling; Emerson Milling Ltd.; Buffalo Creek Mills; and Highland Milling, LLC. are among the major players operating in the market.

Reasons to Buy Report

The "North America Oats Market Forecast to 2028" is a specialized and in-depth study of the food & beverages industry, focusing on the North America oats market trend analysis. The report aims to provide an overview of the market with detailed market segmentation. The North America oats market is segmented based on process, category, nature, form, and application. Based on category, the market is segmented into organic and conventional. In 2022, the conventional segment held a larger market share, whereas the organic segment is expected to register a higher CAGR during the forecast period. By process, the North America oats market is segmented into rolled and steel-cut. Based on nature, the North America oats market is bifurcated into gluten-free and conventional. By form, the market is divided into flakes, flour, and others. Based on application, the North America oats market is segmented into food and beverages, animal feed, personal care, and others.

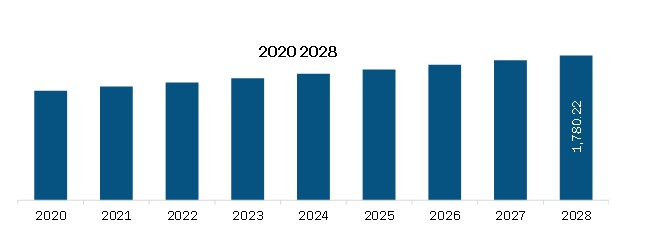

The North America Oats Market is valued at US$ 1,448.56 Million in 2022, it is projected to reach US$ 1,780.22 Million by 2028.

As per our report North America Oats Market, the market size is valued at US$ 1,448.56 Million in 2022, projecting it to reach US$ 1,780.22 Million by 2028. This translates to a CAGR of approximately 3.5% during the forecast period.

The North America Oats Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Oats Market report:

The North America Oats Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Oats Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Oats Market value chain can benefit from the information contained in a comprehensive market report.