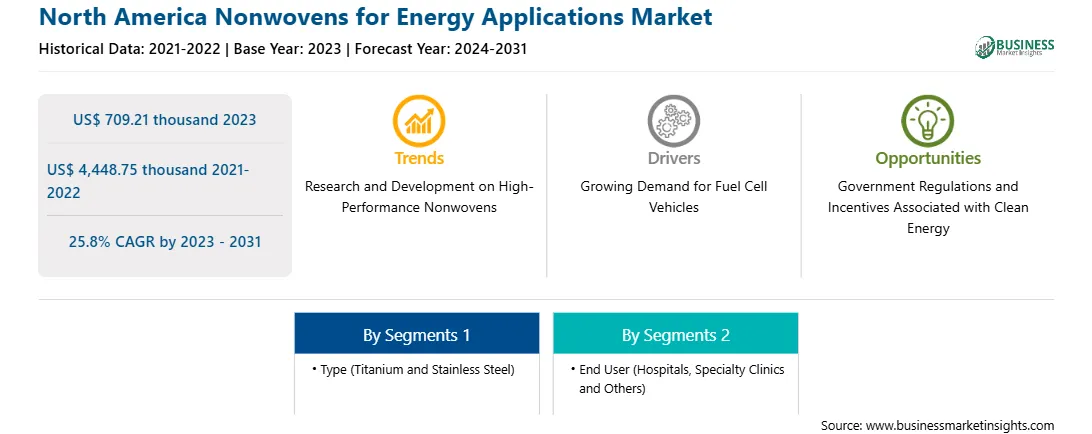

The North America nonwovens for energy applications market was valued at US$ 709.21 thousand in 2023 and is expected to reach US$ 4,448.75 thousand by 2031; it is estimated to register a CAGR of 25.8% from 2023 to 2031.

The renewable energy sector is experiencing rapid growth due to widespread efforts to combat climate change and enhance energy security. According to the International Energy Agency 2023 report, the global renewable power capacity is expected to increase in the next five years, of which solar PV and wind energy accounted for 96% of power capacity, as their power generation costs are lower than fossil and non-fossil alternatives. Solar PV and wind energy capacity are forecasted to double by 2028 compared to 2022. The continuous growth in the economic attractiveness of renewable energy industry coupled with increasing government policy support, especially in the US expected to accelerate capacity growth in the coming years. As per the Global Wind Energy Council, in 2022, a new wind power capacity of 77.6 GW was connected to power grids worldwide, recording a total installed wind capacity of 906 GW and registering growth of 9% compared with 2021. Nonwoven separators are crucial in advanced battery technologies, as these separators improve safety, performance, and longevity for integrating renewable energy into the grid. Thus, the increasing demand from the renewable energy sector drives the North America nonwovens for energy applications market.

The US marks the presence of several institutions and companies exploring nonwoven applications in the energy sector. Nonwovens are used in battery separators, as this material offers excellent mechanical strength, thermal stability, and chemical resistance. Nonwovens are used in fuel cells and supercapacitors. In October 2023, Florida Power & Light Company (FPL) announced the construction milestone for the clean hydrogen pilot project in Florida. NextGen Hydrogen Hub will help the company explore using clean hydrogen to offset the use of natural gas to run a conventional power plant. In June 2024, Honda advances its hydrogen strategy with the production launch of fuel cell electric vehicles in the US.

The emphasis on renewable energy has also spurred the utilization of nonwovens in wind energy components and fuel cell applications. As per the US Department of Clean Energy, the US National Clean Hydrogen Strategy and Roadmap explores opportunities for clean hydrogen to contribute to national decarbonization goals and provides highlights of hydrogen production, transport, storage, and utilization in the US. It offers a strategic framework for achieving large-scale production and utilization of clean hydrogen, examining scenarios for 2030, 2040, and 2050. Thus, the development in the electric vehicles industry, as well as green hydrogen technology, is expected to boost the demand for nonwovens for energy applications during the forecast period.

Strategic insights for the North America Nonwovens for Energy Applications provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Nonwovens for Energy Applications refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Nonwovens for Energy Applications Strategic Insights

North America Nonwovens for Energy Applications Report Scope

Report Attribute

Details

Market size in 2023

US$ 709.21 thousand

Market Size by 2031

US$ 4,448.75 thousand

Global CAGR (2023 - 2031)

25.8%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Nonwovens for Energy Applications Regional Insights

The North America nonwovens for energy applications market is categorized into type, application, and country.

Based on type, the North America nonwovens for energy applications market is categorized into carbon fiber, titanium fiber, and others. The titanium fiber segment held the largest market share in 2023.

In terms of application, the North America nonwovens for energy applications market is segmented into battery, Fuel Cell Gas Diffusion Layer (GDL), PTL fuel, and wind energy. The Fuel Cell Gas Diffusion Layer (GDL)segment held the largest market share in 2023.

By country, the North America nonwovens for energy applications market is segmented into the US, Canada, and Mexico. The US dominated the North America nonwovens for energy applications market share in 2023.

Technical Fibers Products, Tex Tech Industries Inc, Freudenberg Group, SGL Carbon SE, Lydall Inc, AstenJohnson Inc, Hoftex Group AG, and Sandler AG are some of the leading companies operating in the North America nonwovens for energy applications market.

The North America Nonwovens for Energy Applications Market is valued at US$ 709.21 thousand in 2023, it is projected to reach US$ 4,448.75 thousand by 2031.

As per our report North America Nonwovens for Energy Applications Market, the market size is valued at US$ 709.21 thousand in 2023, projecting it to reach US$ 4,448.75 thousand by 2031. This translates to a CAGR of approximately 25.8% during the forecast period.

The North America Nonwovens for Energy Applications Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Nonwovens for Energy Applications Market report:

The North America Nonwovens for Energy Applications Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Nonwovens for Energy Applications Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Nonwovens for Energy Applications Market value chain can benefit from the information contained in a comprehensive market report.