Growing Need for Non-Emergency Medical Transportation Boosts Market Growth

About 5.8 million Americans miss or delay their healthcare appointments due to the lack of transportation facilities. According to a study published in the American Journal of Public Health in 2019, ~16,000 individuals in the US miss their doctor’s appointments every day due to this reason, and several of these individuals have chronic conditions that can adversely affect their health. A 2019 survey by Kaiser Permanente found that one-third of Americans frequently or occasionally experience stress due to transportation. Since 1965, Medicaid has had a non-emergency medical transportation (NEMT) benefit and people covered by Medicaid are provided with transportation services as an essential benefit. ~75 million individuals have been enrolled in Medicaid as of 2019. The KFF Medicaid Budget Survey anticipated 8.2% increase in healthcare membership in the US in 2021, which was mostly driven by the COVID-19 outbreak crisis and a high unemployment rate. The need for NEMT services grows further with the rise in healthcare enrolment and eligibility. Shared mobility has undergone proliferation and normalization in recent years. According to a Pew Research Center survey, ~36% of Americans used some form of ride-hailing service in 2018. Most of the NEMT services are delivered through NEMT brokers or managed care organizations (MCOs). In many states, the brokers or MCOs receive a per capita payment to manage the NEMT, while in others, NEMT is delivered on a fee-for-service basis through local service providers. The Children’s Health Insurance Program (CHIP) provides health coverage to eligible children through Medicaid and separate CHIP programs. CHIP is administered by states as per federal requirements, and it is funded jointly by state governments and the federal government. Thus, with an increase in such initiatives by governments, the demand for NEMT is rising, which boosting the market growth in North America.

Market Overview

The non-emergency medical transportation market in North America is segmented into the US, Canada, and Mexico. The increasing prevalence of chronic illnesses (especially among aging populations), disabilities, injuries, and obesity favor the growth of the market growth in the region. Cathay Express Transportation, a non-emergency private shuttle service provider, offers wheelchair-accessible rides to medical appointments for dialysis patients. The population of the US is likely to double from 2000 to 2033, registering a 21% increase in the number of senior citizens during this period. This factor is likely to contribute to a further rise in demand for non-emergency medical transportation (NEMT) and other mediums of transport for the more efficient transportation of elderlies to clinics and hospitals. Senior citizens with health problems can have a difficult time getting from point A to point B, considering that taxi and conveyance services are in high demand. Further, the COVID-19 pandemic has generated an enormous need for reliable car transportation to get to appointments, essential doctor visits, and daily treatments. After forming their health divisions in 2018 and 2016, respectively, Uber and Lyft are now estimating the multi-billion-dollar market for their non-emergency medical transportation services. Similarly, with the increased demand, many new NEMT service businesses are emerging in the US, while the existing ones are undertaking the expansion of their operations in other states/locations.

Strategic insights for the North America Non-Emergency Medical Transportation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Non-Emergency Medical Transportation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Non-Emergency Medical Transportation Strategic Insights

North America Non-Emergency Medical Transportation Report Scope

Report Attribute

Details

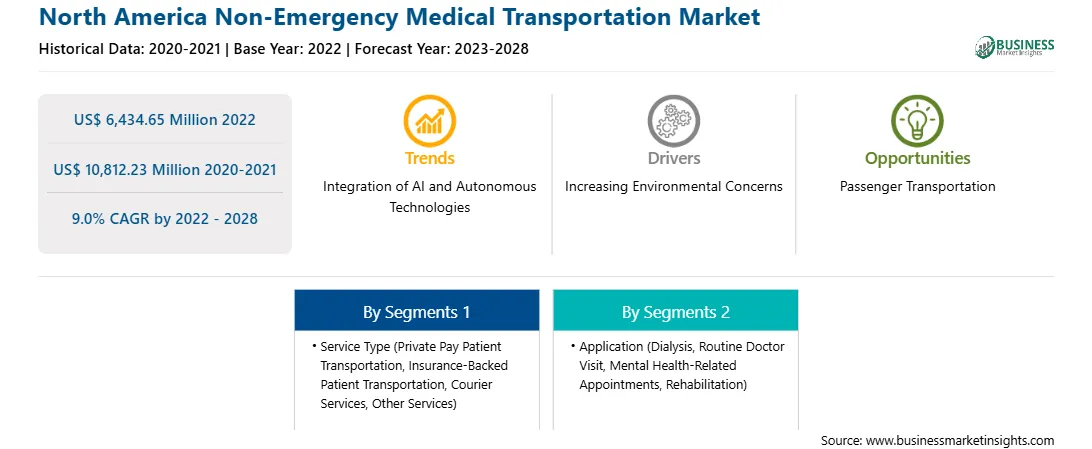

Market size in 2022

US$ 6,434.65 Million

Market Size by 2028

US$ 10,812.23 Million

Global CAGR (2022 - 2028)

9.0%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Service Type

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Non-Emergency Medical Transportation Regional Insights

North America Non-Emergency Medical Transportation Market Segmentation

The North America non-emergency medical transportation market is segmented on the basis of service type, application, and country.

In terms of application, the market is segmented into dialysis, routine doctor visits, mental health-related appointments, rehabilitation, and others. The mental health-related appointments segment held the largest market share in 2022.

ABC Non-Emergency Medical Transportation, LLC; MTM, Inc.; AMR; Xpress Transportation; CJ Medical Transportation; Southeastrans; ModivCare; Crothall Healthcare; Elite Medical Transport; Acadian Ambulance Service; GLOBAL RESCUE LLC.; London Medical Transportation Systems; and FirstGroup plc. are the leading companies operating in the non-emergency medical transportation market in North America.

The North America Non-Emergency Medical Transportation Market is valued at US$ 6,434.65 Million in 2022, it is projected to reach US$ 10,812.23 Million by 2028.

As per our report North America Non-Emergency Medical Transportation Market, the market size is valued at US$ 6,434.65 Million in 2022, projecting it to reach US$ 10,812.23 Million by 2028. This translates to a CAGR of approximately 9.0% during the forecast period.

The North America Non-Emergency Medical Transportation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Non-Emergency Medical Transportation Market report:

The North America Non-Emergency Medical Transportation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Non-Emergency Medical Transportation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Non-Emergency Medical Transportation Market value chain can benefit from the information contained in a comprehensive market report.