The growth of the market is due to are increasing prevalence of cancer and growing demand for next-generation antibody therapeutics. However, complications associated with the manufacturing and approvals of next-generation antibodies is expected to restrict the market growth during the forecast period.

Cancer has emerged as a leading cause of death worldwide. According to the World Health Organization (WHO), cancer was the first leading cause of death in people below 70 years in 183 countries and the fourth leading cause of death in 123 countries worldwide in 2019. The rising prevalence of cancer has created a burden on the healthcare systems across the world. According to the International Agency for Research on Cancer (IARC), the global burden of new cancer cases is estimated to reach ~27.5 million by 2040. The disease is likely to cause ~163 million deaths by that year. Factors, such as lifestyle changes, smoking, reduced physical activities, and uncertain health and climatic conditions, are expected to increase the burden of cancer patients in several parts of the world in the coming years. Therefore, it is essential to control the increasing number of cancer patients worldwide.

Various governments have initiated programs and initiatives to increase the preventive measures and treatment for cancers. For instance, in 2017, World Health Assembly approved the Resolution Cancer (WHA70.12)—an integrated approach to prevent and control cancer. The program has been appealing to the WHO and various governments to accelerate their efforts to achieve the targets that are specified in the Global Action Plan (2013–2020) for the prevention and control of noncommunicable diseases (NCDs) and the 2030 UN Agenda for Sustainable Development to reduce early deaths from cancer. In addition, various private organizations have joined the action plans to prevent the increasing burden of cancer, creating a demand for better preventive measures against the disease. Thus, the rising prevalence of cancer has accelerated the need for new and effective therapeutic approaches, such as next-generation antibodies, boosting the market.

North America is highly affected due to the outbreak of the COVID-19 pandemic. The US-registered highest number of deaths due to the COVID-19 pandemic. The outbreak has put an immense burden on healthcare infrastructure in the US, Canada, and Mexico. Most pharmaceutical and biotechnological companies and research institutes are involved in developing COVID-19 vaccines and drugs.

Both established pharmaceutical companies and small startups have come forward to advance treatments and vaccines that target the infection created by the novel coronavirus. As a result, vaccine-related research activities in pharmaceutical and biotechnology companies, research centers, and educational research institutes are acknowledged essential and have been primarily unaffected in operations and output. However, due to the rise in research activities, the accessibility of funding for analysis and the need for antibodies, including next-generation antibodies, is anticipated to grow over the next few years.

Many researchers worldwide are involved in the viral examination of SARS-CoV-2, which develops COVID-19. Antibodies generated for both vaccines and therapeutics are examined to counterbalance the target virus for their functional efficiency.

The approval of monoclonal antibody services has increased for the development of COVID-19 vaccines. Companies engaging in the next-generation antibody market witnessed a negative impact on their services in early 2020 due to the temporary shutdown of their laboratories. However, as lockdown limitations were gradually lifted, research laboratories worldwide started reopening. As a result, most service providers prioritized actions to promote the critical work, such as giving a range of high-quality COVID-19-related research tools, reassigning R&D resources for producing essential products for SARS-Cov-2, expanding the supply chain, and supporting the augmented demand for long-term products required for SARS-CoV-2/COVID-19 research. They also focused on entering into discussions and collaborations concentrated on SARS-CoV-2 diagnostics, drugs, and vaccines development across the UK, the US, and China. Considering these factors, it can be declared that the impact of COVID-19 on the next-generation antibody market has been positive. Therefore, the COVID-19 pandemic is expected to aid the North America next-generation antibody market during the forecast period.

Strategic insights for the North America Next-generation Antibody provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2,457.09 Million |

| Market Size by 2028 | US$ 5,428.80 Million |

| Global CAGR (2021 - 2028) | 12.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Therapeutic Area

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Next-generation Antibody refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

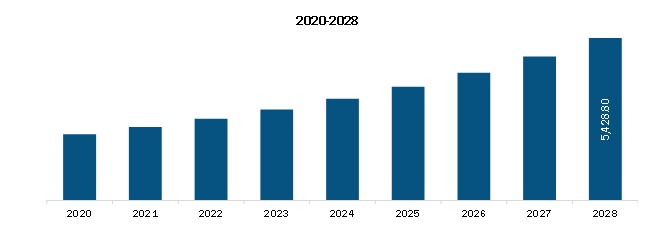

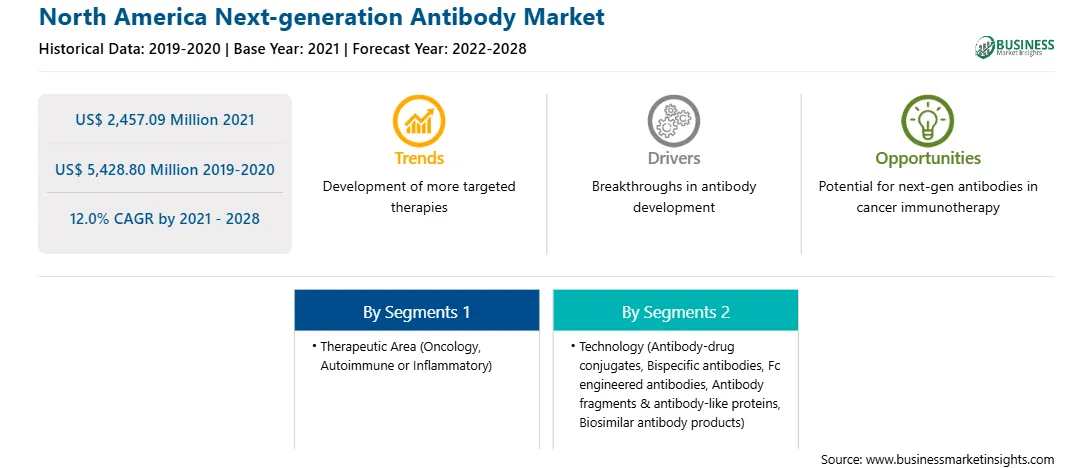

The North America Next-generation Antibody Market is valued at US$ 2,457.09 Million in 2021, it is projected to reach US$ 5,428.80 Million by 2028.

As per our report North America Next-generation Antibody Market, the market size is valued at US$ 2,457.09 Million in 2021, projecting it to reach US$ 5,428.80 Million by 2028. This translates to a CAGR of approximately 12.0% during the forecast period.

The North America Next-generation Antibody Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Next-generation Antibody Market report:

The North America Next-generation Antibody Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Next-generation Antibody Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Next-generation Antibody Market value chain can benefit from the information contained in a comprehensive market report.