Conventional construction materials are highly resource- and energy-intensive. Hence, owing to the rising concerns and awareness about the social and environmental impacts of conventional building materials, composite manufacturers are shifting toward environment-friendly raw materials such as natural fibers. Moreover, stringent regulations, legislation, and policies concerning environment protection, energy efficiency, and economic quality in the construction industry in the region create a shift toward green construction and propel demand for sustainable building materials. The demand for construction materials is increasing with the rising use of technologically advanced processes in construction activities. Several governments are spending generously on infrastructure development in developed and developing countries. Also, construction spending is expected to increase by 5.5% by 2023. Such initiatives generate demand for construction services, equipment, and materials. However, the growing construction sector; rising government emphasis on environmental regulations; and increasing ecological, social, and economic awareness prompted an optimal use of natural resources. This has encouraged the utilization of natural fiber-reinforced composite materials for diverse applications in the construction sector. Natural fiber composites have several advantages such as renewability, biodegradability, high strength, low cost, noncorrosive nature, nonhazardous, and manufacturing flexibility, over other composite alternatives. Thus, rising awareness of green building materials and government support for sustainable solutions fuel the natural fiber composites market growth.

North America offers an extensive growth opportunity for the natural fiber composites market players due to the growing utilization of natural fiber composites within its end-use industries, including automotive, construction, aerospace, consumer goods, and electronics. Natural fiber composites are utilized in various interior and exterior applications of automobiles and infrastructural applications. According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2021, North America registered a production of 13.42 million vehicles. Natural fiber composites are used in automotive interior linings due to their properties, such as lightweight, prefabrication capabilities, and design flexibility. The construction sector in North America is witnessing growth due to increased federal and state financing for the construction of commercial and institutional structures in the region. According to a report released by the US Census Bureau, the value of total construction (private and public) investment in 2022 was US$ 1,792.9 billion, a 10.2% increase from investments in 2021. The expansion of the construction sector and the imposition of building regulations requiring the utilization of green materials are expected to fuel the regional natural fiber composites market during the forecast period.

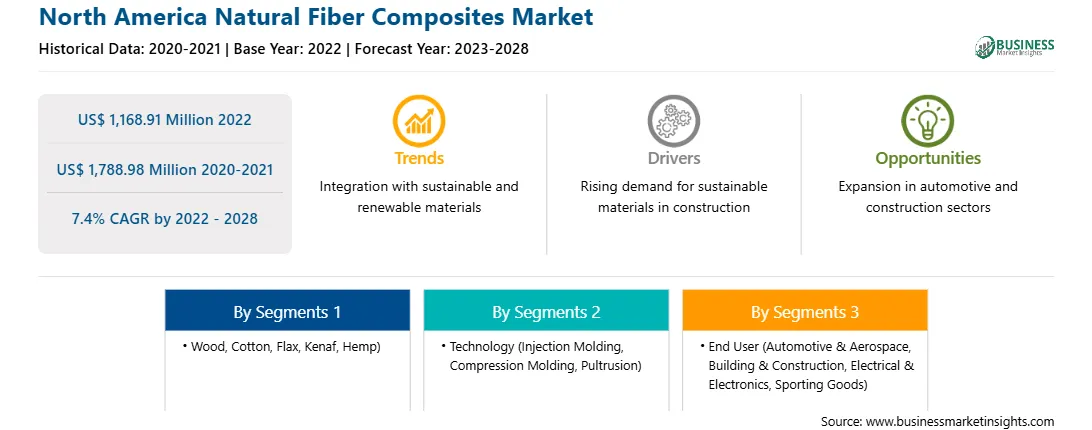

Strategic insights for the North America Natural Fiber Composites provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Natural Fiber Composites refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Natural Fiber Composites Strategic Insights

North America Natural Fiber Composites Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,168.91 Million

Market Size by 2028

US$ 1,788.98 Million

Global CAGR (2022 - 2028)

7.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Wood, Cotton, Flax, Kenaf, Hemp)

By Technology

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Natural Fiber Composites Regional Insights

The North America natural fiber composites market is segmented on the basis of raw material, technology, and end user. On the basis of raw material, the North America natural fiber composites market is segmented into wood, cotton, flax, kenaf, hemp, and others. The wood segment registered a larger market share in 2022.

Based on technology, the North America natural fiber composites market is further segmented into injection molding, compression molding, pultrusion, and others. The injection molding segment registered a larger market share in 2022.

Based on end user, the North America natural fiber composites market is segmented into automotive & aerospace, building & construction, electrical & electronics, sporting goods, and others. The automotive & aerospace registered the largest market share in 2022.

Based on country, the North America natural fiber composites market is segmented into US, Canada, and Mexico. US dominated the market share in 2022.

Amorim Cork Composites SA, Flexform Technologies LLC, Lanxess AG, Lingrove Inc, Polyvlies Franz Beyer GmbH, and UPM-Kymmene Corp are the leading companies operating in the North America natural fiber composites market.

The North America Natural Fiber Composites Market is valued at US$ 1,168.91 Million in 2022, it is projected to reach US$ 1,788.98 Million by 2028.

As per our report North America Natural Fiber Composites Market, the market size is valued at US$ 1,168.91 Million in 2022, projecting it to reach US$ 1,788.98 Million by 2028. This translates to a CAGR of approximately 7.4% during the forecast period.

The North America Natural Fiber Composites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Natural Fiber Composites Market report:

The North America Natural Fiber Composites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Natural Fiber Composites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Natural Fiber Composites Market value chain can benefit from the information contained in a comprehensive market report.