The North America mouthwash market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. The high incidence of dental caries has also majorly driven the market. According to 2015 statistics by the Centers for Disease Control and Prevention (CDC), 91% of the US population aged 20–64 years had dental caries, among them 27% remained untreated. This result in a growing need for oral care products; thereby, boosting the market growth. Oral ulceration is a common condition among population; it has estimated 4%-point prevalence in the US, and 25% of the North America population is thought to be affected by aphthous ulcers, one of the common causes of oral ulcerate. Moreover, increasing recommendation from dental physicians worldwide for the treatment of plague and gingivitis fuels the growth of the mouthwash market. Besides, mouthwash when used in mouthwashes, antimicrobial ingredients such as cetylpyridinium, chlorhexidine, and essential oils have been shown to reduce plaque and gingivitis when combined with daily brushing and flossing. Further, mouthwash boosts oral health and gives breathe a makeover as it contains fluoride, which can help reduce cavities and demineralization of teeth. Fluoride rinse mouthwash contains 0.05% of sodium fluoride, which is enough to avoid tooth decay. Also, herbal mouthwashes have potential benefits in plaque and inflammation control as supplements to patients' daily oral hygiene with gingivitis. The increasing prevalence of dental problems, such as dental caries, gingivitis, and plaques is one of the significant factors expected to propel the market growth over the coming years.

While the ongoing COVID-19 pandemic don’t have much of an impact on the oral care market, the mouthwash market is also not expected to be significantly impacted by the pandemic. However, there could be possible disruptions in the distribution channel due to the lockdown and restricted movements, which are imposed to control the virus spread and flatten the curve. Social distancing protocols and quarantine measures have led to a shift in consumer purchasing patterns from in-store to online, which would be reflected in oral care/oral hygiene product sales. Major players in the market have continued their production activities during this period, which, in turn, has maintained the growth of the market.

Strategic insights for the North America Mouthwash provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 2,702.73 Million |

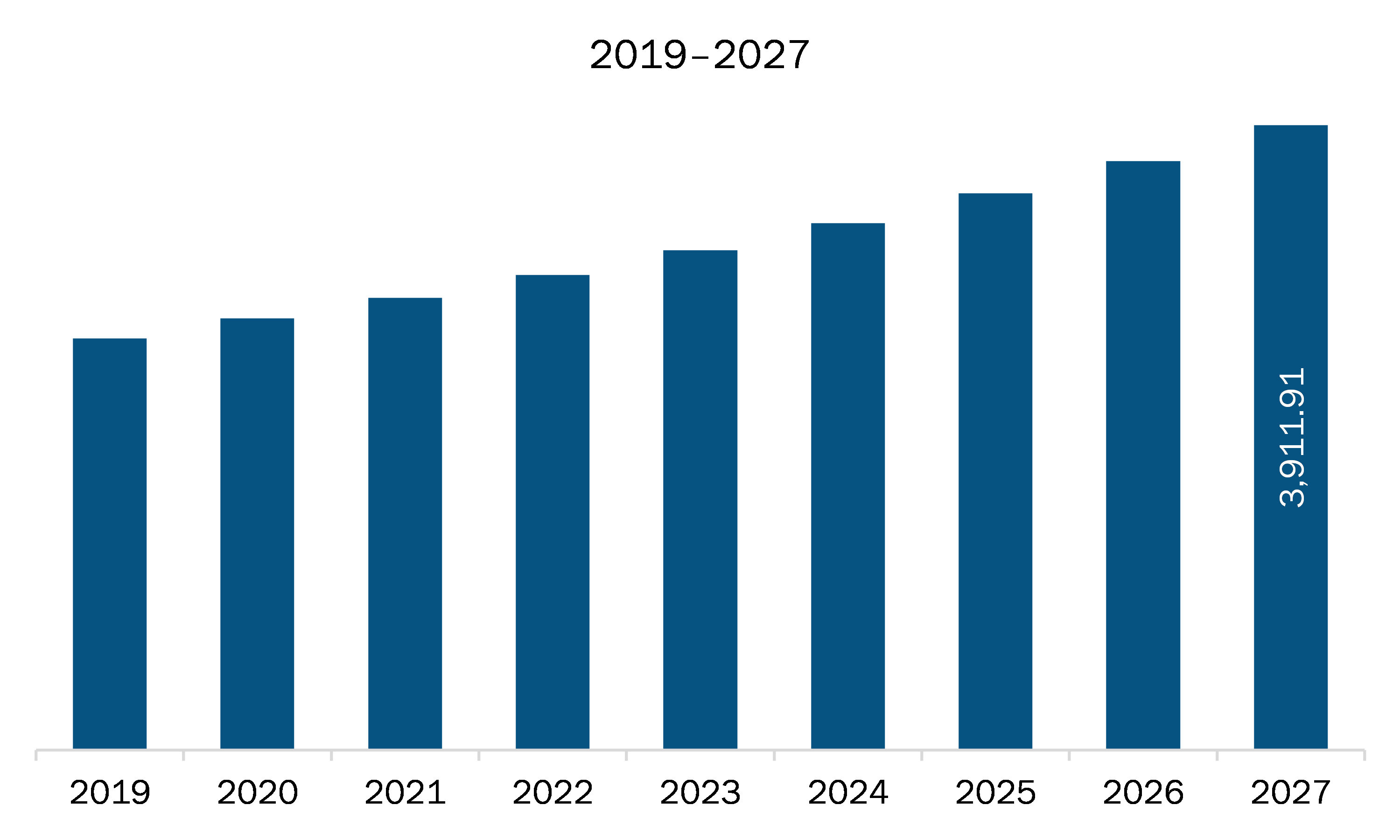

| Market Size by 2027 | US$ 3,911.91 Million |

| Global CAGR (2020 - 2027) | 5.4% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Mouthwash refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The mouthwash market in North America is expected to grow from US$ 2,702.73 million in 2020 to US$ 3,911.91 million by 2027; it is estimated to grow at a CAGR of 5.4% from 2020 to 2027. There has been a remarkable shift in the retailing of oral care products in North America in recent years. Online retailers are gradually being preferred over traditional distributors, retailers, and pharmacies. Purchasing oral care products through e-commerce portals offers several advantages, such as the availability of multi-brand oral care products at relatively lower prices, ease of purchasing, and free shipping. The successful sales of oral care products through e-commerce have prompted increasing investment toward these channels by major market players. Moreover, large merchants who sell their products in stores also sell them online. For instance, Hello sells its products via ecommerce merchants such as Amazon.com Inc., iHerb.com, Thrive Market, and Grove Collective, as well as via its own direct-to-consumer site Hello-Products.com, along with retail sales. These sites cumulatively account for ~15% of its overall sales. Additionally, Hello-Products.com launched ecommerce functionality in 2017.

Based on product type, the cosmetics segment accounted for the largest share of the North America mouthwash market in 2020. Based on flavour, the mint fresh tea segment accounted for the largest share of the North America mouthwash market in 2020. As per indication, the chronic bad breath segment accounted for the largest share of the North America mouthwash market in 2020. On the basis of distribution channel, the hypermarkets segment accounted for the largest share of the North America mouthwash market in 2020. Based on end user, the adult segment accounted for the largest share of the North America mouthwash market in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America mouthwash market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Colgate-Palmolive Company, Procter & Gamble, GlaxoSmithKline plc., Unilever, Johnson and Johnson Services, Inc., The Himalaya Drug Company, Lion Corporation, Amway, Church & Dwight, Inc., and SmartMouth Oral Health Laboratories.

The North America Mouthwash Market is valued at US$ 2,702.73 Million in 2020, it is projected to reach US$ 3,911.91 Million by 2027.

As per our report North America Mouthwash Market, the market size is valued at US$ 2,702.73 Million in 2020, projecting it to reach US$ 3,911.91 Million by 2027. This translates to a CAGR of approximately 5.4% during the forecast period.

The North America Mouthwash Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Mouthwash Market report:

The North America Mouthwash Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Mouthwash Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Mouthwash Market value chain can benefit from the information contained in a comprehensive market report.