North America is characterized by high disposable individual incomes, higher standards of living, and rapid technological advancements in the arena of motors. The region witnesses the maximum application of electric motors for various utilities, such as electric vehicles, elevators, flight control systems, blowers, fans, machine tools, pumps, turbines, power tools, alternators, compressors, rolling mills, ships, movers, and paper mills. In August 2020, Hitachi Automotive Electric motor Systems Ltd. established Hitachi Automotive Electric Motor Systems America, Inc. in Kentucky, US, for the development, manufacture, and sale of electric vehicle motors. The new company’s full production is expected to start in 2022. Further, in 2019, Ford Motor Co. committed to make electric motors at its Van Dyke Transmission plant in suburban Detroit. The company is planning to spend nearly US$ 11.5 billion on electric and hybrid vehicles through 2022. The investment is expected to deliver 40 electrified vehicles, of which 16 are pure electric. Therefore, the ongoing proposed investments in the region on electric vehicle development is expected to bolster the demand for motor controller devices and show a prominent scope for growth in the upcoming years.

Furthermore, in case of COVID-19, in North America, especially the US, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of automation manufacturing activities; other household appliances manufacturing sector has subsequently impacted the demand for motor controller during the early months of 2020. Moreover, decline in the overall manufacturing activities has led to discontinuation of automotive equipment manufacturing projects, thereby reducing the demand for motor controllers. Similar trend was witnessed in other North American countries, i.e., Canada and Mexico. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Strategic insights for the North America Motor Controller provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

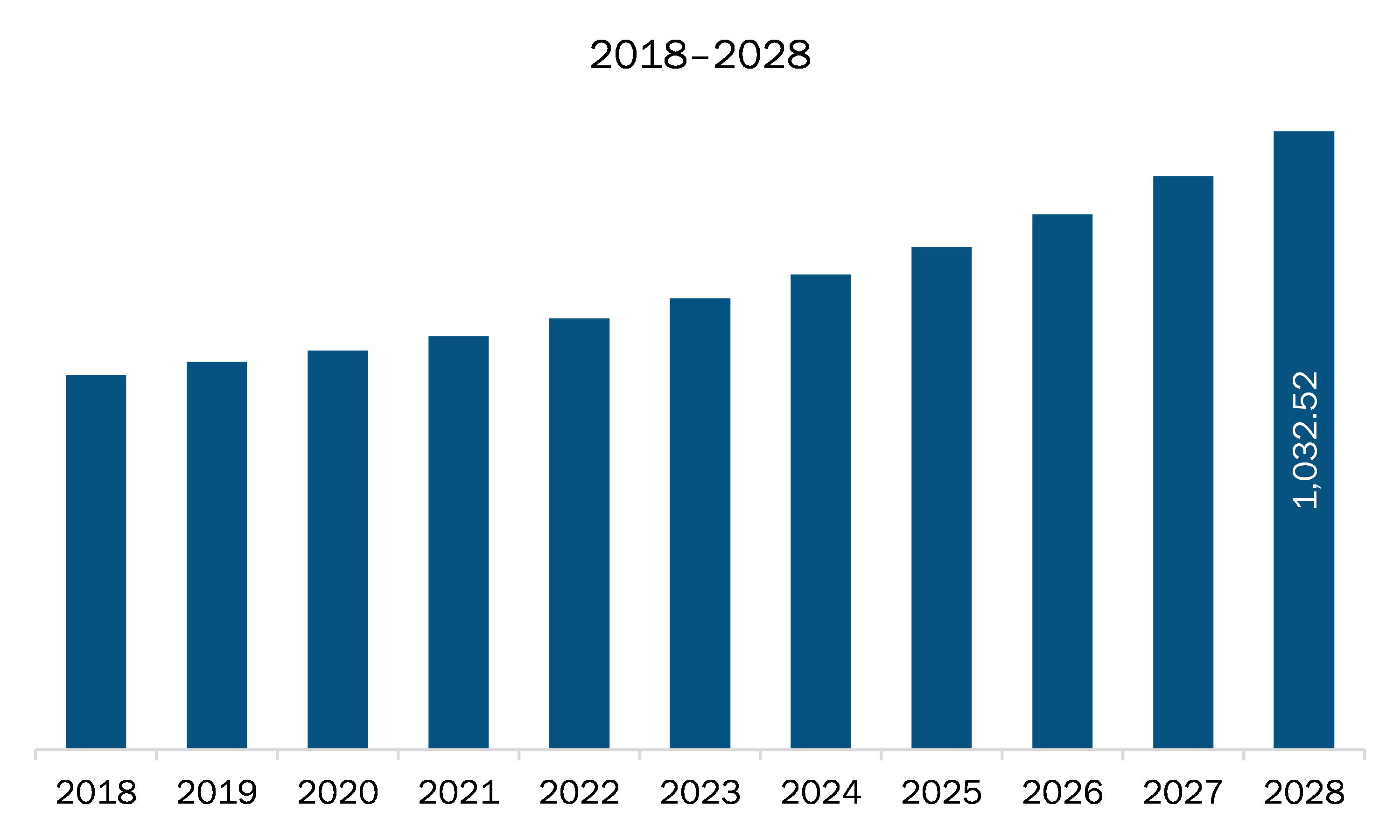

| Market size in 2020 | US$ 666.68 Million |

| Market Size by 2028 | US$ 1,032.52 Million |

| Global CAGR (2021 - 2028) | 5.9 % |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Motor Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Motor Controller refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America motor controller market is expected to grow from US$ 666.68 million in 2020 to US$ 1,032.52 million by 2028; it is estimated to grow at a CAGR of 5.9 % from 2021 to 2028. Growing adoption of industrial internet of things (IIoTs) in plants & factories is expected to escalate the North America motor controller market. The rising adoption of the Industrial Internet of Things (IIoT) in the manufacturing sector is providing noteworthy opportunities to the North America motor controller market players. The widespread use of robotics, sensors, centralized tracking, and quality inspection to form a smart manufacturing plant is triggering the adoption of IIoT. Technological advancements in the field of IoT, for designing ecosystem plants to reduce the power consumptions and increase factory’s safety is expected to increase the demand for motor controller in the upcoming years. Further, with the advent of artificial intelligence (AI) usage in IIoTs for advancing the automation of plants and machines are expected to boost the demand for AI enabled motor controller devices in upcoming year. The demand for motor controllers is set to increase in residential applications as the IoT facilitates the integration of residential spaces with connected devices. Further, IIoT-powered industrial control systems (ICS) facilitate productivity and safety at work; these systems manage temperature and sensory equipment, manufacturing lines, and security devices, among others. So IIoTs will drive the demand of motor controller, which will escalate the North America motor controller market.

In terms of motor type, the AC motor segment accounted for the largest share of the North America motor controller market in 2020. In terms of output power range, the 0.6 - 1.0 HP segment held a larger market share of the North America motor controller market in 2020. In terms of voltage type, the below 1 kV motors segment held a larger market share of the North America motor controller market in 2020. Further, the industrial segment held a larger share of the North America motor controller market based on end-user in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America motor controller market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ABB Ltd., AMETEK Inc., Anaheim Automation, Inc, ARC Systems Inc, Eaton Corporation plc, ErieTec Inc, General Electric Company, Microchip Technology Inc., Nidec Corporation, and Parker-Hannifin Corporation.

The North America Motor Controller Market is valued at US$ 666.68 Million in 2020, it is projected to reach US$ 1,032.52 Million by 2028.

As per our report North America Motor Controller Market, the market size is valued at US$ 666.68 Million in 2020, projecting it to reach US$ 1,032.52 Million by 2028. This translates to a CAGR of approximately 5.9 % during the forecast period.

The North America Motor Controller Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Motor Controller Market report:

The North America Motor Controller Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Motor Controller Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Motor Controller Market value chain can benefit from the information contained in a comprehensive market report.