North America Monoclonal Antibodies Market

No. of Pages: 169 | Report Code: TIPRE00027987 | Category: Life Sciences

No. of Pages: 169 | Report Code: TIPRE00027987 | Category: Life Sciences

Favorable government regulations in North America regional market authorizes monoclonal antibodies during the onset of the pandemic. For instance, in December 2021, The US Food and Drug Administration (FDA) announced Emergency Use Authorization (EUA) for AstraZeneca’s Evusheld (tixagevimab co-packaged with cilgavimab and administered together) intended for pre-exposure prophylaxis of COVID-19 for certain adults and pediatric individuals. As monoclonal antibodies are laboratory manufactured proteins involved in mimicking the immune system's ability to fight off harmful pathogens such as viruses. Therefore, "Tixagevimab" and "cilgavimab" are long-acting monoclonal antibodies particularly directed for spike protein of SARS-CoV-2. Apart from that, favorable funding for development of biologics further enhanced the market growth for monoclonal antibodies during the onset of pandemic in North America regional market. For example, the US International Development Finance Corporation (DFC) announced furnishing of US$50 million to Biological E Limited for increasing COVID-19 vaccine manufacturing capacity. Also, favorable policy relating to product approvals for biologics by the FDA positively impacts the market growth.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the monoclonal antibodies market. The North America monoclonal antibodies market is expected to grow at a good CAGR during the forecast period.

Strategic insights for the North America Monoclonal Antibodies provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

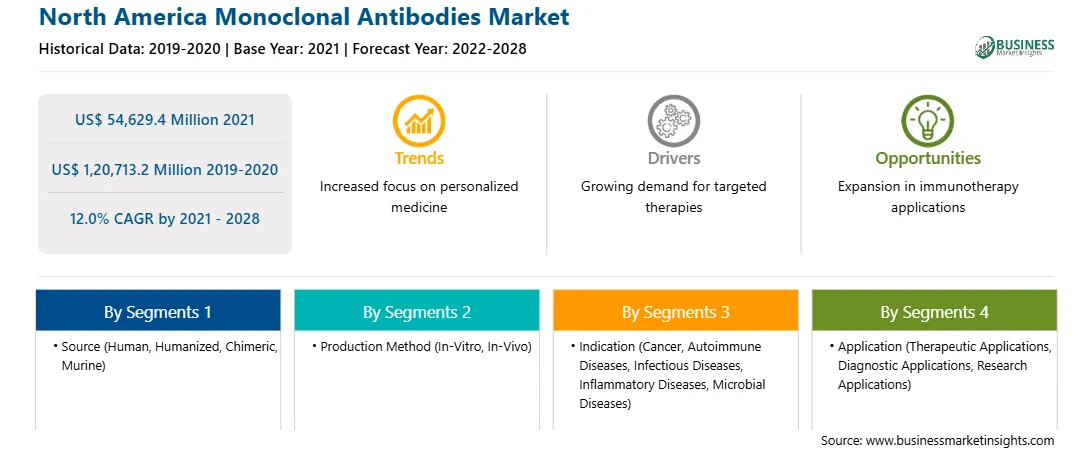

| Market size in 2021 | US$ 54,629.4 Million |

| Market Size by 2028 | US$ 1,20,713.2 Million |

| Global CAGR (2021 - 2028) | 12.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Source

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Monoclonal Antibodies refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

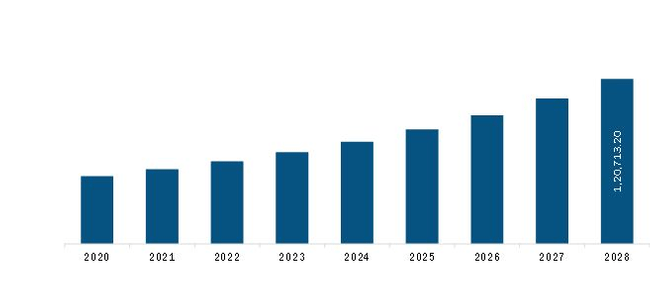

The North America Monoclonal Antibodies Market is valued at US$ 54,629.4 Million in 2021, it is projected to reach US$ 1,20,713.2 Million by 2028.

As per our report North America Monoclonal Antibodies Market, the market size is valued at US$ 54,629.4 Million in 2021, projecting it to reach US$ 1,20,713.2 Million by 2028. This translates to a CAGR of approximately 12.0% during the forecast period.

The North America Monoclonal Antibodies Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Monoclonal Antibodies Market report:

The North America Monoclonal Antibodies Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Monoclonal Antibodies Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Monoclonal Antibodies Market value chain can benefit from the information contained in a comprehensive market report.