Poor diet is one of the major causes of malnutrition and diseases across the world. Micronutrients and dietary fibers are necessary for health, and fruits and vegetables are loaded with such nutrients, which makes them an essential part of a healthy diet. Thus, their demand is growing with the rising awareness about healthy diets. The World Health Organization (WHO) and the Food and Agriculture Organization (FAO) recommend a minimum consumption of 400 g of fruits and vegetables per person per day. This diet would help to prevent chronic diseases such as heart disease, diabetes, cancer, and obesity. It is also likely to prevent and alleviate several micronutrient deficiencies, especially in people from less developed countries. An insufficient intake of fruits and vegetables is estimated to lead to ~14% of deaths from gastrointestinal cancer worldwide, ~11% of those from ischemic heart disease, and ~9% of those caused by stroke. For instance, in 2014, FAO and WHO announced the Rome Declaration on Nutrition and the Framework for Action. This action plan mainly focused on promoting healthy dietary patterns by providing year-round access to safe and nutritious fruits and vegetables; pulses; whole grains; and animal-source foods such as fish, while limiting the consumption of processed foods that negatively affect nutrition and health. According to the US Department of Agriculture, the overall quantity of vegetables available for consumption in the US increased from 371.6 pounds per capita in 2019 to 382.5 pounds per capita in 2020. In addition, global fruit production went up by 54% (i.e., 342.8 million tons) from 2000 to 2019 to reach 973.3 million tons by 2019. Thus, the growing fruit and vegetable consumption due to consumers' shift toward healthy diets is bolstering demand for chemicals applied for the protection of crops from pests. Miticides protects fruits & vegetables form mites and ticks. Thus, the growing demand for crop protection chemicals is also bolstering the demand for miticides.

The North America miticides market is growing due to increased population and government subsidies, strong economies, and robust food safety nets. As per the reports of the US Department of Agriculture (USDA), North America ranks highest in food affordability. The agricultural sector in the US adds value to the economy of the country. In 2020, the contribution of agriculture to the US gross domestic product (GDP) was more than 0.6% . Hence, the demand for miticides is increasing in the sector in North America.

North America promotes the use of miticides to balance the growth of the agricultural sector with other sectors of the economy. The growth is mainly achieved using chemical fertilizers and pesticides required to sustain large-scale production. According to the Food and Agriculture Organization of the United Nations, the US is the largest producer of corn, accounting for ~32.9% of global production. Spider mites such as banks grass mites (BGM) and two-spotted spider mites (TSSM) mainly affect the production of corn in North America. The injury by the mites, in conjunction with drought stress, increases the stress on the plant and negatively impacts photosynthesis. Early plant injury can result in lost yield potential, which can have grain losses ranging from 6 to 48% and as high as 40% yield loss for corn harvested as silage. If predatory insects are controlled, and a miticide is not used, the mite population can increase rapidly. These factors are promoting the usage of miticides in North America. Market players in North America are focusing on manufacturing agricultural miticides to produce oilseeds and pulses, cereals and grains, and fruits and vegetables, among others. Companies are formulating mid and long-term business strategies to adapt to potential trends in North America.

Strategic insights for the North America Miticides provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Miticides refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Miticides Strategic Insights

North America Miticides Report Scope

Report Attribute

Details

Market size in 2022

US$ 135.02 Million

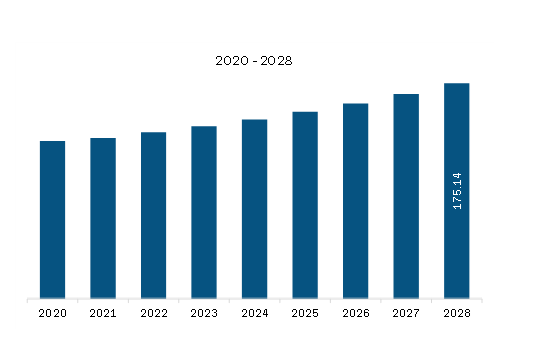

Market Size by 2028

US$ 175.14 Million

Global CAGR (2022 - 2028)

4.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Source

By Form

By Crop Type

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Miticides Regional Insights

North America Miticides Market Segmentation

The North America Miticides market is segmented into source, form, crop type, and country.

Based on source, the North America miticides market is bifurcated into bio-based and synthetic. In 2022, the synthetic segment registered a larger share in the North America miticides market.

Based on form, the North America miticides market is segmented into dry and liquid. In 2022, the liquid segment registered a larger share in the North America miticides market.

Based on crop type, the North America miticides market is segmented into fruits and vegetables, cereals and grains, oilseeds and pulses, and others. In 2022, the fruits and vegetables segment registered a largest share in the North America miticides market.

Based on country, the North America miticides market is segmented into the US, Canada, Mexico. In 2022, the US segment registered a largest share in the North America miticides market.

BASF SE; Bayer AG; Certis USA LLC; FMC Corp, Gowan Co; Kemin Industries Inc.; Nihon Nohyaku Co. Ltd.; Oro Agri International BV; Syngenta AG; and UPL Ltd are the leading companies operating in the North America miticides market.

The North America Miticides Market is valued at US$ 135.02 Million in 2022, it is projected to reach US$ 175.14 Million by 2028.

As per our report North America Miticides Market, the market size is valued at US$ 135.02 Million in 2022, projecting it to reach US$ 175.14 Million by 2028. This translates to a CAGR of approximately 4.4% during the forecast period.

The North America Miticides Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Miticides Market report:

The North America Miticides Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Miticides Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Miticides Market value chain can benefit from the information contained in a comprehensive market report.